Why infrastructure secondaries could thrive in a dislocated market

Written By:

|

Dinesh Ramasamy |

|

Molly Plotkin |

|

Andy Bush |

Dinesh Ramasamy, Molly Plotkin and Andy Bush explain why infrastructure assets come into focus during inflationary periods – and how infrastructure secondaries could offer additional benefits to investors in the current market

During periods of elevated inflation such as we are currently seeing, investments in real assets and infrastructure are seen to offer “the opportunity for uncorrelated returns and competitive real return potential”1. This reflects infrastructure assets’ defensive characteristics. Contracted cash flows and the essential nature of services enable lower volatility and higher cash yield compared to investments in other asset classes. Cash flows are often inflation-linked, providing a direct hedge against rising costs and protecting real returns.

Furthermore, infrastructure assets are often capitalised with long-term, fixed rate debt packages and so are less exposed to interest rate risk from refinancing, a valuable attribute in a rising rate environment. Debt providers are able to underwrite longer-term loans based on durable cash flows inherent to infrastructure assets and businesses.

Beyond infrastructure’s inherent defensive characteristics, many investors are keen to play offence and invest behind mega market growth themes such as digitisation, the global energy transition and sustainability, which have accelerated since the start of the Covid pandemic. Investors have increased allocations to digital infrastructure and renewables as two key sub-sectors that stand to benefit from these tailwinds and structural shifts.

This article will explore why investors seeking to capture the benefits of investing in infrastructure should consider doing so via secondary strategies that provide investment opportunities in “not-for-sale” assets alongside existing direct managers, or in portfolios of assets held by established, older vintage infrastructure funds. By their nature, secondary infrastructure investments enable shorter duration exposure to hard-to-access assets within this lower correlation and lower volatility asset class.

Infrastructure during inflationary cycles

Infrastructure investing is generally focused on gaining exposure to monopolistic- or duopolistic-positioned assets that provide essential services, typically have long-term contracts with inflation-linked revenue escalators, and that are supported by contracts or concessions with high-quality corporate/government counterparties. Inflation-linked revenues act as a natural hedge to rising inflation.

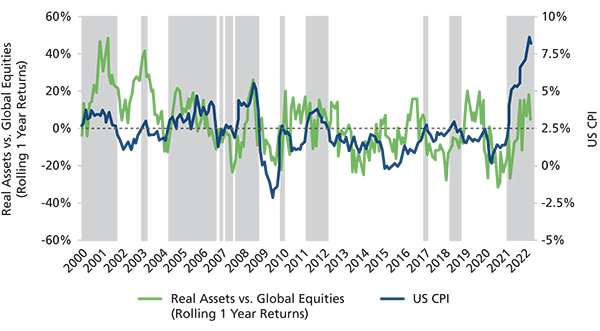

This has resulted in returns for public real asset securities, such as listed infrastructure companies, listed real estate companies (REITs), and commodities, being bolstered compared to global equities during previous periods of heightened volatility.

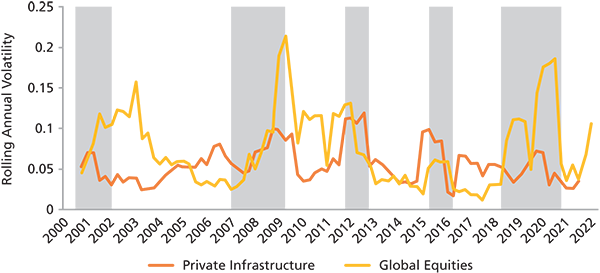

Figure 1 reflects this historic correlation, showing the positive and negative movement of listed real assets returns versus global equities, highlighting periods where the US inflation rate (US CPI) is high, or above 2.5%2. Meanwhile, looking at each asset class separately and with the addition of private infrastructure, Figure 2 takes the quarterly returns (annualised) for real assets relative to global equities and averages these across the same periods of high inflation to showcase the outperformance of the asset class during historical inflationary regimes. While Figure 2 demonstrates that private infrastructure has historically been among the most consistent in return profile, with among the strongest excess returns compared to global equities during inflationary periods, Figure 3 builds on this by highlighting that the volatility of returns from private infrastructure has been noticeably lower than global equities during periods of market uncertainty3 over the more than two decades since 2000.

Figure 1: Positive and negative movement of liquid assets vs. global equities 2000-2033

Source: Bloomberg as of June 30, 2022; Real assets is an average of S&P GSCI (Commodities), FTSE NAREIT, and S&P Global Infra (from 2001 on); Global equities: MSCI World.

Figure 2: Annualised quarterly returns for real assets relative to global equities

Source: EDHEC Infra, Bloomberg as of June 30, 2022; Private Infra: infra300 (EDHEC Infra); Listed Infra: S&P Global Infrastructure; REITs: FTSE NAREIT All Equity; Global Equities: MSCI World; Quarterly returns from 2000 to 2021 are averaged and annualized.

Figure 3: Returns from private infrastructure and global equities 2000-2022

Source: EDHEC Infra, Bloomberg as of June 30, 2022; Unlisted infrastructure: infra300; Global equities: MSCI World. Areas shaded in grey illustrate periods of market uncertainty.

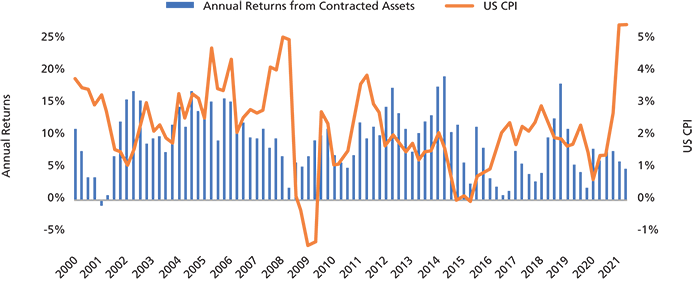

Figure 4: Annual returns from contracted assetrs v US CPI 2000-2021

Source: EDHEC Infra, Refinitiv as of June 30, 2022.

Finally – and in specific reference to the contracted cash flow nature of many infrastructure assets – in Figure 4, we can see that infrastructure assets with contracted cashflows4 have historically continued to generate positive returns during periods of rising inflation, shown on a 1-year lag5. In addition, the availability of longer-term fixed debt for infrastructure potentially shields these investments from interest rate risk that can arise during a refinancing in a rising rate environment.

Secondaries during periods of market strain

Secondary investors invest via two entry points: Limited Partner-stake (LP-stake) and General Partner-led (GP-led) secondaries. LP-stake/portfolio secondary investments enable quick diversification into older vintage investments, while mitigating blind pool risk. The secondary investor steps into an existing LP’s portfolio at a price or valuation that is determined by the underwriting of future cash flows for the fund.

GP-led transactions on the other hand allow secondary investors to access select assets or concentrated portfolios of assets through continuation vehicles, minority investments, preferred equity structures, or strip sales. GP-led transactions typically exclude majority ownership premiums and mitigate operating risks associated with a new investor in a change of control. In some scenarios, secondary buyers can also provide unfunded capital to these assets to be invested into accretive add-ons or de-risked development opportunities.

Potential rationales for investors, such as LGPS funds, allocating via secondaries include:

- Mitigation of the “J-curve” – investments in mature assets can provide earlier distributions to offset the impact of management fees

- Access to “not-for-sale” investments that might not become available on the wider market

- Enhanced diversification across fund manager, asset, geography and investment vintage versus primary fund investments

- Lower volatility in returns due to shorter duration and greater visibility on underlying portfolios

- Ability to buy at discounts to prevailing net asset value (NAV), which in turn has the potential to boost performance

- Having a tool to invest during periods of market dislocations, by providing liquidity to LPs.

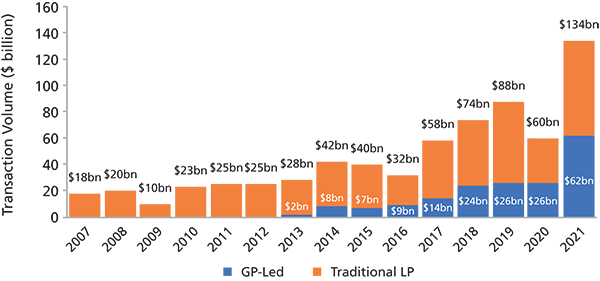

The secondary market for private market fund stakes has expanded very significantly over more than a decade. Since 2009, investors have increased allocations to private markets secondary funds at a 24% CAGR, reaching $282 billion of available dry powder in 2021. These growing allocations have been matched by deal activity, with secondary transaction volume in 2021 reaching $134 billion, setting a new annual record6.

Furthermore, secondary investors can act as the bridge capital during periods of market stress – and have historically stepped in to provide expedited liquidity solutions, as shown in Figure 5. After a slowdown in 2009 in the teeth of the fallout from the global financial crisis, from 2010, secondary market transaction volume grew consistently to a new high of $42 billion in 2014, at a CAGR of 21.8%. Similarly, after a dip in 2020 due to a slowdown in the first half of the year caused by the pandemic, the secondary market rebounded strongly to record a strong H2 2020 – and in 2021 deal volume was 50% up on pre-Covid levels, with GP-led transactions showing an especially strong rise of 2.3x7.

Figure 5: Secondary investors provide expedited liquidity solutions during periods of market stress

Source: Greenhill as of January 2022.

Infrastructure secondaries: A growing opportunity

As we have shown above, secondaries, by definition, are investments in funded assets in older vintage funds – and they therefore have shorter durations relative to primary fund commitments. Secondary investors can invest into either older vintage funds or assets that are being carved out from existing funds and that have shorter exit horizons. Furthermore, secondary funds tend to provide early distributions from the mature portfolio assets through dividend yield and structured GP-led solutions’ rights to early distributions.

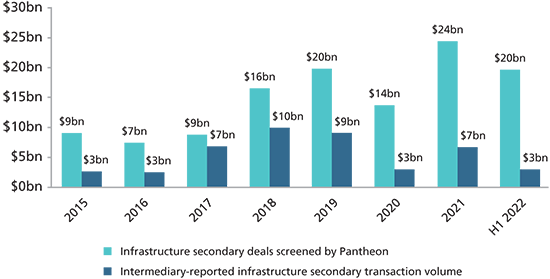

Looking at how the secondary market for infrastructure has developed in recent years, its growth is stark. As shown in Figure 6, over the past 10 year, transactions completed have grown from $1.2 billion in 2011 to $6.7 billion in 20218, a 19% CAGR. Infrastructure accounted for 5% of total secondary market volume and 10% of GP-led secondary volume in H1 2022.9,10

Figure 6: Dollar value of transactions in the secondary market for infrastructure screened by Pantheon v deals reported by intermediaries 2015-H12022

Source: Greenhill as of January 2022.

Figure 6 specifically compares the dollar value of the transactions screened by Pantheon against deals completed in the market as reported by intermediaries. In the two and a half years to H1 2022, Pantheon has reviewed $57.8 billion of secondary opportunities, which is almost in line with the $61.5 billion reviewed in the five years prior.

According to Preqin, 2021 was a record year for fundraising with $128 billion committed to infrastructure funds and 2022 is shaping up to break that record, with Infrastructure Investor’s latest quarterly fundraising report noting the largest ever total for Q1-Q3 fundraising in 2022. This increases the supply of future opportunities for the secondary market. Meanwhile the number of scale secondary infrastructure investors in the space remains limited. While there is substantial dry powder in the infrastructure market – according to Preqin, a little more than $333 billion as at the end of Q2 2022 – largely waiting to be deployed in direct funds, the investment chasing secondary opportunities remains comparatively low, creating potential inefficiencies that can support favorable pricing dynamics. As of Q2 2022, secondary dry powder earmarked for infrastructure investments represented $12.3 billion.

Conclusion

Over the past decade, investors allocating to infrastructure secondaries have done so on the basis of the potential to offer diversification, J-curve mitigation and yielding benefits. Amid the current disruption, infrastructure secondaries could finally be having their “moment”. Gaining exposure to the infrastructure asset class via this short-duration (swift deployment and early cash back) strategy, plus access to off-market transactions and quality assets at potentially attractive entry prices, may offer a differentiated angle, and a safe haven relative to more volatile asset classes.

Furthermore, investors can use infrastructure allocations to further increase their exposure to mega themes such as digitisation, energy transition and sustainability. As today’s markets try to find their footing, we forecast that over the next 6-18 months, similar investment opportunity windows for infrastructure secondaries will begin to emerge as have done in the wake of previous periods of market strain.

This article is based on a Pantheon research paper, “Infrastructure Secondaries in Today’s Market”, published October 2022. To read the full paper, visit https://www.pantheon.com/news-and-media/publications

1. Goldman Sachs, June 2022, “Equity Bear Market: Paradigm Shift?” Goldman Sachs Research Newsletter.

2. The US Fed has a target inflation rate of 2.0%, year over year https://www.federalreserve.gov/newsevents/pressreleases/monetary20120125c.htm.

3. Defined by EDHEC Infra as: July 2000 to April 2003, January 2007 to May 2009, December 2011 to January 2013, July 2015 to July 2016, April 2018 to May 2020.

4. EDHEC Infra defines contracted assets as “availability-payment schemes, by which a public- or private-sector client commits to paying a fixed income over a pre-agreed period, typically in excess of two decades”.

5. Pantheon analysis of EDHEC Infra data.

6. Pantheon analysis of Greenhill data, as of January 2022.

7. Pantheon analysis of Greenhill data, as of January 2022.

8. Pantheon analysis of intermediary-reported transaction data from Campbell Lutyens for 2011 and Greenhill for 2021.

9. Greenhill as of August 2022.

10. Jefferies as of July 2022.

More Related Content...

|

|

|