Why has making an impact been made so difficult?

Written By:

|

Ian Mason |

|

Will Fox-Robinson |

Today’s trustees are expected to assess the financial cost of climate change without an accepted definition of how this can be achieved and the same is now expected for impact investing, which seems a tad unfair, say AEW’s Ian Mason and Natixis Investment Managers’ Will Fox-Robinson

When ESG (Environmental, Social and Governance) arrived on the investment scene it seemed to perfectly encapsulate a broad agenda of risks and opportunities in a simple acronym that:

- Started a long-overdue debate on social good and corporate responsibility

- Recognised that good governance was the ideal way to safeguard investor assets

- Allowed investors to take into account the effects of climate change as well as many other extra-financial issues

However, experience teaches us that as soon as an investment bandwagon starts to roll in the financial services community, a new set of measurement standards, performance benchmarks, detailed reporting and regulations will inevitably follow. Why? Because as an industry we are somewhat obsessed with SMART1 objectives.

ESG has found its way into the Department of Work and Pensions regulations and The Pensions Regulator Codes of Practice as a mandatory consideration in all investment strategies. Therefore, trustees of the UK’s local government pension funds, already overburdened by a raft of regulatory requirements, now have an additional responsibility bestowed upon them.

Understandably, they have begun to look towards the concept of “impact investing”. It’s seen as a way of escaping both the vagaries of ESG and the onus of constant negative screening. If they are forced to own the responsibility, impact investing seems, on the face of it, a much more explicit method for their investment powers to make a positive impact on the community.

But impact investment is not without its own challenges. The Global Impact Investing Network (GIIN), the non-profit organisation dedicated to increasing the scale and effectiveness of impact investing, requires clear intentionality and impact measurement. One can only presume that if these two criteria are not met, in the eyes of GIIN, it doesn’t count.

One of the attractions of social impact investing (SII) is that it is currently less defined, less restrictive and more philosophical in its approach. However, it might not stay that way for long. The Society of Pension Professionals in June prescribed a need for a new “universally agreed” set of standards for measurement, reporting and monitoring to “help boost growth in the £91 billion market for SII globally2”. They claim that this will subsequently give more funds the sufficient scale, and ultimately provide trustees greater choice.

We can only think that if we were UK pension fund trustees, we’d be wondering why the burden of governance around something so simple, has made it all so hard.

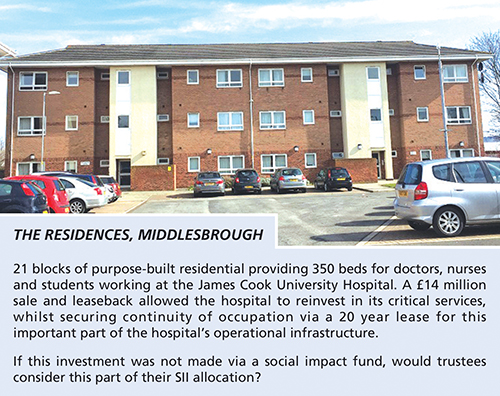

Take UK real estate as an example, it is likely that many schemes invested in this asset class will already have significant exposure to social sectors – and for several years. After all, NHS accommodation, care homes, supported living and nursery education are all areas that increasingly rely on the private sector and often offer attractive and stable returns for portfolios. But this exposure will not necessarily be via “designated” social impact funds.

Purists would argue that these existing allocations are unworthy of being considered as a form of social impact investment if it is not branded a social impact fund, and if there is no clear demonstration of “intentionality”, nor any impact reporting. They would also likely baulk at the fact that the investments in social sectors sit alongside investments in pubs. Though others have argued that pubs are often at the heart of a community and should also form part of our social impact allocation.

We believe that if trustees want to consider all or part of these existing allocations to social sectors as part of their scheme’s own definition of social impact investing, they should have the freedom to do so.

Instead, if they wait for a universally agreed set of standards, not only do they risk being funnelled into a small niche and further overburdened with rules and regulations, but in the emerging climate of local authority-led, community-focused investment initiatives targeting pension funding, may find themselves on the wrong side of the universally-agreed definition of what counts as SII.

One glimmer of hope from the SPP white paper is the recommendation that, even with a SMART framework in place, investment consultant buy-in is essential. We would not disagree, but now is the time for advisers to suggest, as we have tried to do here, that the emphasis should be on enabling and not labelling and that for once, the KISS3 principle might be a far better and simpler solution.

An investment in a fund involves risk, including the possible loss of principal. Such investment may not be suitable for all investors. Before determining if such investment is an appropriate investment, prospective investors must carefully consider the fund’s investment objectives, risk factors, charges and expenses as described in the fund’s legal documentation.

This material is provided by Natixis Investment Managers UK Limited (the ‘Firm’) which is authorised and regulated by the UK Financial Conduct Authority (register no. 190258). Registered Office: Natixis Investment Managers UK Limited, One Carter Lane, London, EC4V 5ER. In the United Kingdom: this material is intended to be communicated to and/or directed at investment professionals and professional investors only. This material is provided to the intended recipients for information purposes only, and does not constitute an offer to the public, or a recommendation or an offer to buy or to sell any security, or an offer of services. Although the Firm believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy, or completeness of such information. Such information are subject to change. This material may not be distributed, published, or reproduced, in whole or in part.

1. Specific. Measurable. Achievable. Relevant. Time-bound

2. Source: How to unleash the power of social impact investing, The Society of Pensions Professionals, 2019

3. Keep It Simple, Stupid

More Related Content...

|

|

|