Where next to find further improvements and savings?

Written By:

|

David Rae |

As pooling begins in earnest, David Rae of Russell Investments considers how further developments in pooling might deliver more increases in efficiencies and performance

The creation and establishment of the eight pools has required considerable collaborative effort to develop appropriate governance structure, achieve regulatory approval, develop operational infrastructure, and recruit or transfer high quality individuals into new organisational structures. It is unprecedented for multi-billion-pound investment pools to be established in this fashion and the success to date is testament to a collection of well thought out and well executed plans. With assets transferring into the various pools from across the pension funds, many of the pools are now operationally live and beginning to reap some of the benefits associated with pooling.

Consolidation of mandates and portfolios has yielded fee savings, as well as cost savings for asset custody and depository. Almost across the board, the low hanging fruit has been picked off first, with the most liquid and simple asset classes typically being pooled first. Passive equities, for example, where there is a homogenous product set can be pooled in a very straightforward fashion.

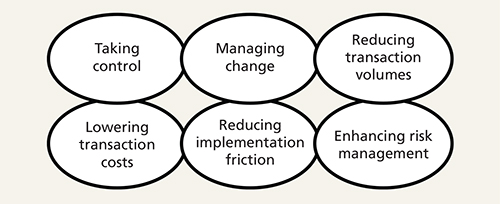

We envisage the next phase of pooling to herald a period of creativity to facilitate more significant improvements. These will come in the form of return enhancements, improvements to the risk profile and further cost reductions. In sum, an overall increase in the risk adjusted returns net of costs.

The UK equity procurement exercise that the Border to Coast Pool launched in July seeks to bring greater efficiency to the UK equity assets by searching for managers each with a distinct style or role to play in contributing to the overall portfolio target.

Opportunities across liquid investments

In addition to the obvious benefits of manager and custody consolidation and the associated fee reductions, we see great opportunity to find additional routes to enhance risk-adjusted returns net of all costs.

Figure 1: Transition efficiencies

Managing change

For many pools, there will be a big-bang change requiring a carefully coordinated and managed transition process. This will be a critical event for the pools and the funds. However, over time, there will be the need to further change the line-up of managers within the fund. This may be a wholesale termination of a manager assignment and appointment of a new manager, or the reweighting of managers. Any manager change presents potential costs and risks which can erode the performance of the fund. Retaining a transition manager on an ongoing basis to manage change, and ensure efficient project management and cost-controlled trading will yield further marginal gains on an ongoing basis.

Reducing transaction costs

A critical focus and area for improvement is in the reduction of overall transaction costs. Portfolio structures with multiple outsourced managers can result in higher aggregate turnover and a longer tail of portfolio positions, because each manger is building the portfolio and trading in isolation. This can occur across the security and currency positions. In the worst case, two separate managers can be active in the market, trading on different sides at the same time. This would result in two sets of transaction costs being incurred unnecessarily. Pooling provides the opportunity to centralise the portfolio implementation and execution removing the siloed portfolio construction and trading. Each manger provides a “paper portfolio” but does not trade positions. The aggregated paper portfolio is then optimised to remove very small holdings, and traded efficiently to reduce transaction costs. There is a huge untapped opportunity for pools to benefit from here.

Taking greater control

The process described above can be taken further allowing the pool to take even greater control of the portfolio. For example, the portfolio could be tilted towards particular securities with certain positive attributes like a lower carbon footprint, or apply some other responsible investment preference.

Reducing friction

As the LGPS funds interact with the pools, there is the potential for trading or other frictions to arise. Where a pool has established an ACS structure with sub-funds, the underlying investors will trade units of the fund periodically as they reallocate between different asset classes. This results in cashflows into or out of the sub-fund. Ordinarily, this cash would be invested or disinvested from the markets as required. Where the management of the sub-fund is outsourced, cash will be transferred to investment managers. Frequently transferring cash to managers introduces potential transaction costs as managers purchase or sell securities. Maintaining a liquidity reserve in cash introduces a different potential drag on portfolio returns. Establishing a liquidity reserve and then employing derivatives or ETFs can help control the transaction costs and risk.

Risk management

Many of the LGPS funds are understandably expressing concern about the current valuations of equities and a number of asset classes. This is particularly pertinent given the timing of the triennial valuation. Derivative overlays can be used to provide downside protection either through options or option replication strategies. If there are common parameters (eg time horizon, levels), these can be included at the pool level, alternatively, they may sit outside the pool.

Either way, pooling should free up capacity to review and consider the potential benefits and implication of any downside protection strategy. The use of options within portfolio management adds a degree of complexity as outcomes and valuations do not necessarily behave linearly.

The benefits an applicability of any structure needs careful consideration and in-depth due diligence, particularly where a provider, with the potential to benefit, is driving any education.

Greater focus on illiquid investments

With the simplification of the liquid portfolios, the pools will be able to devote greater effort to improving the overall portfolio structure with increased portfolio allocations to illiquid and alternative asset classes. These allocations will yield risk management and return benefits and will provide further opportunities to improve the alignment of portfolio with social and other responsible investing objectives.

We’re already seeing this activity happening across the pools and this remains the most exciting area of future development.

In brief

Much has been said about the different approaches being adopted by the pools. However, across the board, significant progress has been made towards establishing fully operative pools. As further time passes, the focus is shifting towards meeting the long-term objectives. On the one hand, the experience the pools gain when operating will be used to gain further efficiencies. We see opportunities to reduce costs, enhance returns and manage risks across liquid asset classes by focusing on innovative techniques around portfolio construction, transition management, and trading. On the other hand, the platform that has been established will enable pools and funds to identify new investment opportunities, particularly across alternative asset classes that can achieve multiple financial and non-financial objectives.

More Related Content...

|

|

|