What every scheme needs: secure income

Written By:

|

Ben Jones |

Ben Jones of M&G Investments outlines why long lease property could be the ideal investment to deliver the secure income streams sought by pension funds

Pension schemes today are innovative, ambitious, long-term investors that put their assets to work in a growing range of markets and asset classes.

In the past decade since the global financial crisis, the low yields all investors have experienced in bond markets have encouraged schemes to diversify into alternative markets, from private debt to real assets, where beneficial outcomes such as an attractive illiquidity premium and security over physical assets can be found.

Today, schemes are increasingly focused on how to deliver the cashflow they need to fulfil their pension commitments for future decades, while also keeping assets as insulated as possible from volatility or loss. Investments that can provide a secure, growing income stream for the long term are highly sought after, but are scarce and often expensive.

However, for investors happy to sacrifice a degree of liquidity, certain attractively-priced opportunities exist. Long lease real estate, where a real estate freehold is sold by its owner-occupier and leased back on a long-dated lease that can run for decades, is one of these. These investments in UK property deliver contracted income that typically rises with inflation, as a result of inflation-linked rent reviews included in the terms of the lease, usually calculated on an annual basis. Additionally, since the leases are secured against the underlying property, the investor has the potential to benefit from growth in the capital value of the real estate.

Cashflows are king

Long lease real estate is an alternative, privately held asset type that can be an extremely good fit to the investment goals of a typical pension scheme.

Long lease transactions – the most common of which is a sale and leaseback – are widely used on all types of commercial real estate in the UK, including offices, hotels, student accommodation, supermarkets and healthcare and leisure assets. For the businesses that occupy these properties, a long lease transaction can be an effective means to release capital tied up in their real estate, whilst retaining long-term occupational security over the premises they operate their business from.

At the outset of deal negotiations, the investor and owner-occupier can negotiate a range of terms, including the length of the lease, the initial rent level, frequency of rent reviews and an appropriate level of rent inflation over time. Setting these parameters at the appropriate level (particularly the initial rent) is key to ensuring that the transaction is both financially sustainable for the tenant and mitigates risk appropriately for the investor.

The terms negotiated between the parties are reflected in the asset’s price. For example, rent reviews can add more value if carried out annually rather than five-yearly. Other features, such as inflation collars, can provide protective benefits. The collar ensures that rent uplifts do not exceed a maximum (protecting the tenant) or fall below a minimum (protecting the investor). For example, a collar of 0% to 5% ensures rent reviews are always upwards, to a limit of 5%.

Long lease features provide protective benefits for a long-term investor:

- Long-dated, contracted cashflows, offering income security and smoother returns

- Bespoke terms allow for mitigation of risk for the investor and suitability for the tenant

- Periodic rent reviews linked to inflation, with collars adding protection for both parties

- Leases are usually “triple-net”, meaning that costs of real estate ownership, such as property taxes and capital expenditure, remain the tenant’s responsibility

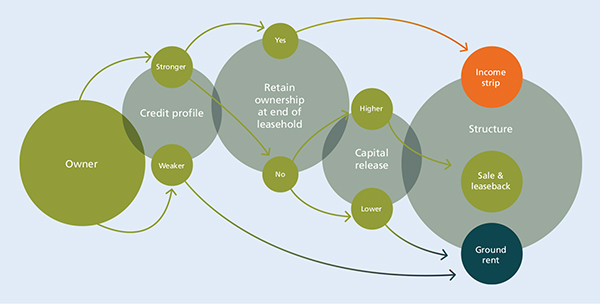

These investments can take several forms, and the choice of arrangement depends on factors such as the prospective tenant’s credit profile, whether they wish to retain ownership at the end of the lease period and how much capital they might wish to release.

Traditional sale and leasebacks

Sale and leasebacks have been a feature of UK corporate life for decades as owner-occupiers have taken advantage of strong demand for UK real estate to release capital.

In a traditional sale and leaseback transaction, an investor buys a real estate freehold interest from a vendor for a capital sum and, at the same time, signs a long-dated lease with the vendor (who becomes the tenant) for its occupancy. Sale and leasebacks typically involve shorter leases than other types of long lease real estate transactions, at around 20 years plus, with the initial rent usually set with reference to current market rent levels.

Income strips

In an income strip, the owner-occupier also sells the asset, but retains the right to repurchase it from the investor at the end of the typically longer (25 to 50 years) lease, for a nominal sum. This makes the transaction particularly attractive for owners of buildings of importance to them, such as university buildings and student accommodation.

Many investors like the income strip structure because it isolates the fixed income-style cashflows to offer just the predictable, inflation-protected income with no exposure to real estate capital values. The removal of exposure to the uncertain real estate value at lease expiry makes it a lot easier for actuaries to model these investments as part of a liability hedging profile for a pension scheme.

Ground rents

Ground rents are the longest-dated form of sale and leaseback arrangement, with lease terms that typically range from 99 to 199 years in length, and consequently, much lower rent payments than other types of long lease transaction. This means they incorporate very low tenant default risk.

Since ground rents are valued based on the discounted value of their expected future cashflows, this means that the expected residual value of the real estate makes up a significantly smaller component of the value of these assets versus a traditional sale and leaseback.

While the attraction for pension schemes is clear, the supply of assets in commercial ground rents can be small and so strong networks of relationships are essential to source such assets. This requires a proactive approach to seeking out opportunities to work with tenants, to structure and create ground rent investments on an individual basis.

Figure 1: The journey through a long lease real estate deal

Source: M&G Investments

Talking directly with property owners can offer the opportunity to shape transactions to both parties’ long-term goals, mitigate risk and negotiate terms that benefit investors.

The importance of mitigating risk

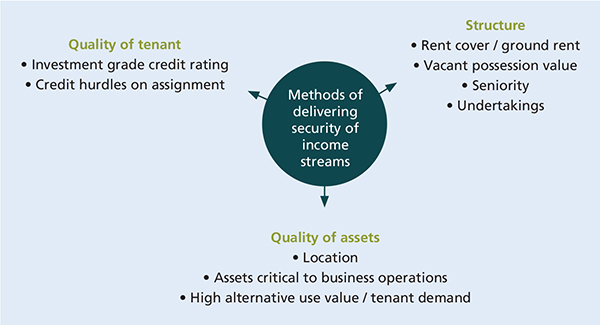

Long lease real estate investment offers investors a yield premium over inflation in return for accepting certain investment risks including credit risk, risks associated with structuring and holding real estate assets and potential illiquidity. Mitigating such risks requires deal structuring expertise, experience and resource.

Perhaps the most important is rigorous credit analysis, to assess the tenant’s ability to pay rent far into the future and to identify any risk factors in its operating business or capital structure that might lead them to default on their contractual lease obligations.

The present value of the expected future cashflows of a long lease usually accounts for at least three quarters of the value of each asset. This effectively means the investor is taking credit risk – the risk that a borrower may be unable to repay the amount borrowed. It’s therefore important to build up a clear picture of the tenant’s business and its creditworthiness as rigorously as would happen in any private long-term loan. Ensuring that the combination of tenant credit quality and transaction structure delivers a strong credit profile materially lowers the risk of default over the life of the lease.

Figure 2: Factors contributing to the quality of long lease assets

Source: M&G Investments

The different types of long lease real estate all require expertise, depth and breadth of resource and analysis to source and structure, but they offer pension schemes valuable, more predictable outcomes. We believe the effort and complexity is compensated for by higher returns, greater flexibility for both the tenant and investor, and a more targeted approach to risk mitigation.

Case study: Supermarket assets

Supermarket long lease assets can deliver long-dated, typically inflation-linked income streams, given a significant proportion of goods sold by supermarkets sit in the inflation basket. Security of these income streams is achieved through consideration of rent affordability, high quality tenants and de-risked leases.

When investing selectively in supermarkets, a focus on the following aspects is important:

- Invest in key operating assets of the tenant, typically in dominant locations with an affluent catchment area

- Assets that have potential for alternative use, such as residential or mixed-use schemes, enabling the recovery of value from the land or property should the retailer ever leave the site

- Large-format stores that can be easily reconfigured due to their large floor plates and flexible planning, thus enabling the effective integration of online and physical channels or sub-division into smaller units if required.

This advertorial reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance. The distribution of this advertorial does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any security, strategy or investment product. Reference in this document to individual companies is included solely for the purpose of illustration and should not be construed as a recommendation to buy or sell the same. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|