Volatility targeting in DGFs – can it work?

Written By:

|

Tristan Hanson |

Tristan Hanson from M&G Investments discusses the pros and cons of diversification and considers a flexible, multi-asset approach to protecting capital without compromising returns

Pension schemes have used diversified growth funds (DGFs) for years for the dual objectives of lowering volatility in portfolios and generating attractive returns in a wide range of market conditions.

However, the past two years have proved a trial, both during the calm conditions of 2017 and the much more turbulent 2018, when US interest rate dynamics and political uncertainty contributed to heightened market volatility and price declines across 90% of asset classes.1

This year has already seen a sharp equity rally that has resulted in a snap-back in performance for many funds. Yet rising markets can create a new dilemma: can volatility targeting in multi-asset funds cause investors to miss out on gains?

In this environment, we see the assumptions behind many diversification models increasingly being challenged. This is arguably to be expected; simply holding a variety of asset classes or strategies does not guarantee diversification. Correlations between asset classes are not static and historical relationships change, as evidenced today between equities and bonds.

We believe it is essential to take a forward-looking view of correlations. Asset valuations, the nature of near term price action, and the prevailing economic regime can all provide information about how much genuine diversification is available, and provide an advantage over simple “set-and-forget” collections of best ideas.

Managing volatility throughout the cycle

DGFs are sometimes perceived as complex and opaque, but these are not intrinsic characteristics – a multi-asset strategy can both manage short-term volatility and deliver on long-term return objectives with great clarity. We believe DGFs remain a useful tool for pension schemes.

Nevertheless, the divergent behaviour of DGFs today reiterates the need for investors to gain a detailed understanding of how each is configured. This includes not only return and volatility objectives, but also strategic assumptions about diversification, portfolio construction methods and risk management processes.

We take the view that asset valuations provide important signals about the prospects for long-term returns and these form the basis of our strategic asset allocation.

Strategically, one of our core observations, which we have noted since mid-2016, is that the negative correlation between equities and core government bonds evident for the past 20 years may no longer consistently hold true today. Many core bond yields have limited scope to decline further, which has reduced their ability to protect against equity volatility. Today, we believe short positions in low-yielding, core government bonds will periodically act as an effective, strategic diversifier against long equity positions.

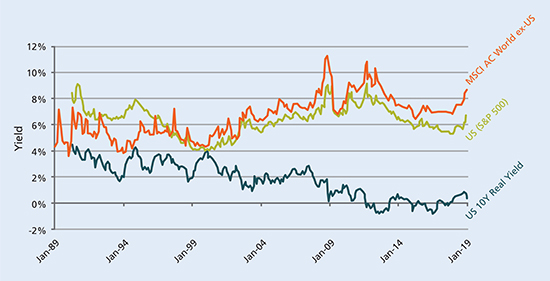

Figure 1: Strategic assessment: equity attractive versus bonds. Equity earnings yield and real US 10-year Treasury yield (%)

Source: Thomson Reuters Datastream, 10 January 2019. *Rebased as at 18 January 2017

Another useful strategy is the avoidance of conventional economic forecasting. For example, we believe that it is impossible to sustainably out-forecast the market on whether US Federal Reserve will increase or decrease its number of planned interest rate rises, or whether the next round of earnings will come in above or below expectations. Moreover, even if one can successfully make these forecasts, this does not automatically lead to strong investment returns.

Dynamic asset allocation can be an imprortant aid to delivering DGF-style objectives throughout market cycles. This is because valuations and correlation patterns can shift materially – and sometimes frequently – in the short term, providing opportunities to both capture potential upside and mitigate downside risk.

Dynamic asset allocation can be primarily achieved by investing in liquid asset classes such as equities, bonds and currencies to enable quick responses to changing market conditions. Position sizing and scaling can be an effective means of providing downside protection, and our overall equity exposure is scaled quite significantly up and down over time.

We believe appropriate use of alternative assets, such as ABS, infrastructure, and private loans, can provide effective diversification – especially given today’s correlated weakness among major asset classes. However, it is also important to recognise their limitations. Investors need to distinguish between assets that are genuinely less volatile and those that are simply illiquid or undiversified. Often illiquidity or concentration of positions can mask the fact that apparently alternative assets are still sensitive to broad factors like growth, interest rates and inflation.

What can schemes expect from DGFs in 2019?

It is hard to believe now, but at the start of 2018, the consensus economic view was one of “synchronised global growth”. Today, it is easier to articulate risks to the global economy stemming from China, trade wars, interest rates and problems in Europe. The realisation that consensus views are repeatedly and profoundly surprised in this way is the reason we believe it’s important to avoid forecasting and exploit market overconfidence in either direction.

Global equity valuations started the year at more attractive levels than they reached in the first quarter of 2016 – the last time such pessimism over global growth was evident, and also a level from which global equities provided strong returns over the subsequent two years. Indeed, today’s opportunity set appears highly compelling.

A DGF that is positioned to take advantage of today’s compelling valuations in global equities and emerging market assets (via higher carry and depressed exchange rates) should therefore be well-placed to deliver positive returns over the medium term. For investors who wish to minimise the associated downside risks, a DGF can provide the flexibility to adjust short-term asset allocation, which can offer greater potential to help pension schemes protect capital and meet liabilities throughout the market cycle.

The DGF investment universe is so broad that we believe each fund should be assessed individually and carefully. We expect continued divergence in realised outcomes should market volatility persist, and potentially fewer strategies being able to deliver DGF-style outcomes. Nevertheless, for investors looking to manage volatility in 2019, we believe a flexible, multi-asset approach still offers the widest range of tools to protect capital without excessively compromising potential returns.

For Investment Professionals only.

This article reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance. The distribution of this article does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any security, strategy or investment product. Reference in this document to individual companies is included solely for the purpose of illustration and should not be construed as a recommendation to buy or sell the same. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at 10 Fenchurch Avenue, London, EC3M 5AG. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

1. Deutsche Bank, January 2019

More Related Content...

|

|

|