Uncovering future quality in healthcare

Written By:

|

Greig Bryson |

Greig Bryson of Nikko Asset Management highlights the investment opportunities provided by the firms developing new technologies that would make the lives of nurses, care givers and patients easier

The ongoing public health and economic crises (and the political response to them) have starkly illustrated how intertwined any country’s economic prosperity and health are. Although some of the effects of the current situation are likely temporary (will toilet rolls ever cost more than a barrel of oil again?), some may well prove more enduring. We would certainly hope that we will have a proper conversation about how we are going to adequately provide for ageing societies whilst giving greater support to the people charged with delivering this care. As in every other aspect of life, new technology will have a big role to play but attitudes and some longstanding ways of working will have to change too.

The changing nature of healthcare delivery has been a focus area for our investment research since 2016. At that time, investors were increasingly concerned about the impact of US political pressure on the pharmaceutical and biotech industries. If political consensus could be somehow arrived at and US drug prices were cut substantially (to levels seen in other developed economies), how would the industry respond and what investment opportunities would this response create?

Our view was (and is) that drug developers face a stark choice: keep innovating or die, as only new drugs that confer a meaningful benefit for patients will be able to command a premium price. The problem is that new drug development remains hugely complex and expensive, costing over $1 billion and taking 12 to 15 years to take a new drug from initial discovery to regulatory approval¹. Running the clinical trials needed to prove the safety and efficacy of any new drug is especially cost consuming and remains a focus area for drug-makers. Specialist providers of clinical trial management services have a proven ability to manage these trials faster and up to 30% more cheaply than the equivalent in-house teams of drug companies. Little wonder that the amount of research and development spending outsourced to these companies has been growing in recent years.

Our view however was that focusing solely upon the drug industry was only seeing part of the picture, with drug spending roughly 10% of US healthcare spending. Spending in US hospitals accounted for roughly triple that amount, for instance. What technologies could allow meaningful savings to be made there? And, how could you make sure that cost savings were making lives easier, not worse, for patients and care givers?

Technology has existed for a while that might help (like electronic health records that could give all care givers access to uniform data on patients) but piecemeal adoption and a lack of meaningful incentive for change has limited its effectiveness. All that was needed was a force for change and that force is coming from patients themselves.

Patients are becoming ever more engaged in their own care and are increasingly pushing for more control of their interactions with the medical profession. Data is also emerging that involving patients more can deliver better health outcomes and lower healthcare costs. We remain very confident about the long-term growth in demand for the technologies that enable patients to receive their care where and how they want it.

Healthcare information technology takes many forms, from faster and more accurate diagnosis, to better managing a patient’s health data, to enabling patients to be treated as well in their own homes as they are in hospital. Care givers at companies like LHC Group, for instance, use technology to deliver high quality healthcare in the patient’s own home, rather than medical facilities. With 76% of the (growing) US population aged 50 or over wishing to age at home², they are pushing on an open door.

Other examples of healthcare services being provided more cheaply and more conveniently outside of hospitals include LabCorp’s partnership with Walgreens which allows consumers across the US to get basic blood tests done while they are doing their grocery shopping.

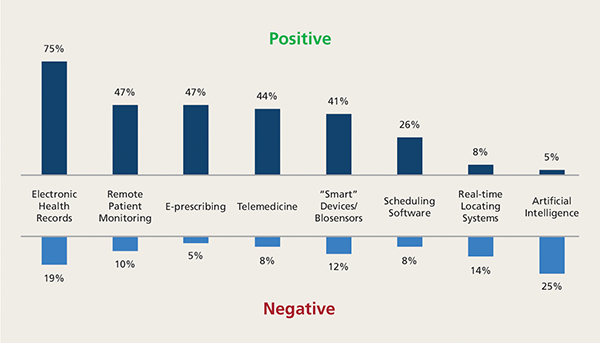

Looking after all of the stakeholders in delivering healthcare will be critical if we are really to meaningfully improve it. Our nurses and doctors have certainly been front and centre of all our minds in recent times. It surprises no one that nurses work extremely hard but a recent survey reported that 15% of them had been subject to burn-out during their careers and 41% felt “unengaged”³ with their roles. No-one knows better than nurses what would help them do their jobs less stressfully. A recent survey of 600 nurses flagged electronic health records, remote patient monitoring, telemedicine and biosensors as amongst the innovations most likely to make their lives easier, and European healthcare company Royal Philips are amongst the world leaders in the provision of all of these.

Figure 1: Results of a survey of nurses indicating how changes may impact their ability to do their day-to-day job

Source: LinkedIn 2018 survey, Nikko Asset Management

As anyone who has ever dieted knows, there is no point in making changes if those changes are not sustainable. The technologies noted above will only deliver their potential if it is in the interests of all stakeholders to use them. That is why focusing on as many of the impacted groups as possible is a prerequisite to our investment analysis. Similarly, a company may have a great new technology but you need to make sure that it has the right management and appropriate funding structure to enable the technology to be adopted. In healthcare, this can take longer than in other industries.

Sustainability also requires strong relationships with other stakeholders in healthcare provision. Delivering strong investment performance is obviously important to us but the real win-win situation is if you can deliver that performance whilst also engaging with the companies that you’re investing in to try and make the world a slightly healthier and more inclusive place.

Industry’s response to the current crises has been instructive in this regard with some companies proving their commitment to corporate value statements more than others. Having a strong relationship with the communities that you serve is a valuable asset at any time. This is even truer now. We firmly believe that companies that enjoy these relationships and are – more importantly – using them to ensure free access to healthcare services at a time of such stress, will be looked upon favourably by customers, politicians and investors in the long run. Good examples of this behaviour in our portfolios would include the US Managed Care Organisation, Anthem.

In conclusion, healthcare is changing and will continue to do so, and this will generate exciting investment opportunities. Public health crises like Covid-19 remind us how indebted we are to the people who look after our health. Surely anything that we can do to make their lives easier in the long term is a worthwhile investment, and we hope that the political will for change will not ebb as new infection rates start to fall. New technologies are enabling caregivers to deliver care in a more effective fashion, and to deliver it where and how patients want it.

1. Ned Pagliarulo / BioPharma Dive, data from “Estimated Research and Development Investment Needed to Bring a New Medicine to Market, 2009-2018,” JAMA

2. American Association for Retired People Survey, published October 2018

3. https://nurse.org/articles/nurse-burnout-statistics/

More Related Content...

|

|

|