Time to stress test your portfolio

Written By:

|

Stephen Leh |

Now may be the ideal time for local authority investors to prepare for the next period of financial stress by testing their portfolios against a wide range of potential outcomes. Stephen Leh from J.P. Morgan Asset Management’s Infrastructure Research team look at the potential resilience that can be provided when private core infrastructure is part of a portfolio

Favourable markets have made many investors complacent about the risks of a downturn, even as listed equity and fixed income portfolios show signs of pressure.

Traditional investments are expensive relative to historical averages across an array of financial metrics. However, greater risk is often apparent only during market downturns – correlations were much higher during the global financial crisis than more recent averages would suggest. Investors should assess their portfolios’ ability to weather downturns by testing their resilience in the event of recession, higher inflation and interest rates, or technological disruption.

Private core infrastructure’s resilience

Core infrastructure’s resilience to financial stress has strong theoretical underpinnings. The asset class is characterised by stable and forecastable cash flows, with yield making up the majority of total return. These stable cash flows typically derive from some combination of monopolistic market positions, transparent and consistent regulatory environments, long-term contracts with credible counterparties, mature demand profiles and prudent leverage strategies.

Unlisted core infrastructure is a relatively young asset class, and data is by definition private. Consequently, there are no reliable, comprehensive third-party return indices that cover multiple economic cycles.

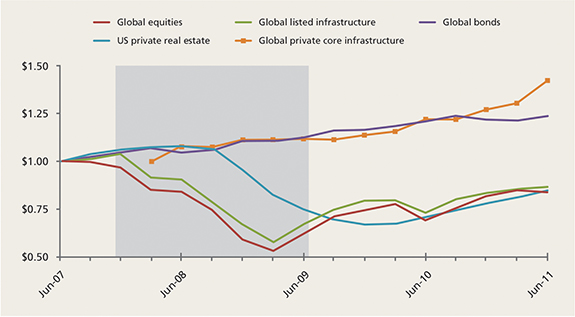

However, the MSCI Global Quarterly Infrastructure Asset Index, the first third-party private infrastructure return index, is a relatively good performance indicator (Figure 1). Over the life of the index, private core infrastructure has demonstrated relatively low correlations with other asset classes, including both equities (0.3) and fixed income (-0.2).

Figure 1: Value of $1 investment through the global financial crisis

Source: Source: Bloomberg, National Council of Real Estate Investment Fiduciaries (NCREIF), MSCI World Index, Barclays Global Aggregate Bond Index, NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE), S&P Global Infrastructure Index, MSCI Global Quarterly Infrastructure Asset Index*; J.P. Morgan Asset Management; data as of January 2018.

Time series are quarterly, based on gross of fees total return indices, and denominated in local currency. Returns are levered to reflect how institutional investors typically access the representative asset classes.

*The MSCI infrastructure returns are available only from Q2 2008 and so do not cover the beginning of the recession. However, private infrastructure investments would likely have been relatively unaffected at the outset of the crisis, when its full economic impact was not yet clear. The index has a relatively small sample and a bias toward Australian assets, but it continues to evolve and has successfully captured broader trends in core infrastructure.

Stress testing private core infrastructure

No two downturns are the same, and underlying investments can evolve over time – especially when allocations are susceptible to style drift. Investors should not rely exclusively on historical correlations and mean-variance frameworks to assess whether a given portfolio will be resilient in the next downturn. Bottom-up scenario analysis offers a way to test portfolios against a range of outcomes, including those that have never occurred before.

To that end, we applied a scenario analysis tool to an illustrative private core infrastructure portfolio comprising 40% regulated utilities, 30% contracted power generation and 30% transportation. We tested how that portfolio’s cash flows – as measured by its yield on cost – would perform in the event of (1) a global recession, (2) higher inflation and interest rates, and (3) lower power prices.

Observing cash flows directly eliminates the impact of fluctuating discount rates during a market downturn, which can distort returns and is of reduced importance for long-term investors. Cash yield is also valuable in its own right and allows for a more direct comparison with fixed income instruments for liability-focused investors.

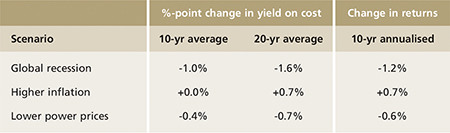

Yield on cost is a more useful metric than yield on net asset value (NAV): it would be little consolation if an investment registered a strong yield on NAV because the investment’s underlying value had atrophied. Figure 2 summarises the impact of these downside scenarios.

Figure 2: Impact of downside scenarios

Stress test scenario 1: Global recession

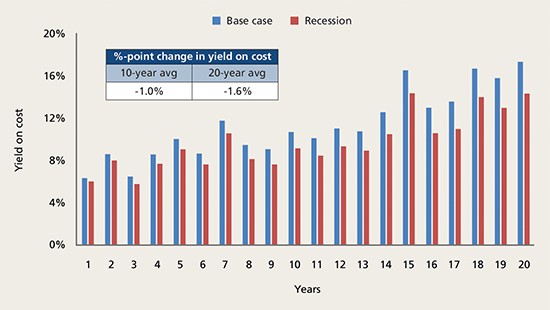

Our analysis finds a synchronised global recession has a muted impact on a private core infrastructure portfolio (Figure 3). This downside case models a fairly conservative 10% decrease in demand for electricity, heat and transportation; a 5% decrease in oil prices; and a 20 basis point parallel shift downward of inflation expectations and real interest rates – with concomitant decreases in power prices and utilities’ allowed returns.

Figure 3: Infrastructure portfolio’s yield on cost: Base case vs Recession

Source: J.P. Morgan Asset Management; data and estimates as of January 2018. For illustrative purposes only.

Power contracts anchor the long-term yield, and regulated utilities are relatively less susceptible to declining consumer spending. Transportation seems to have a disproportionately negative impact. Over 10 years, we would expect the average yield on cost to fall by one percentage point (ppt), from 9.0% to 8.0%.

Stress test scenario 2: Higher inflation

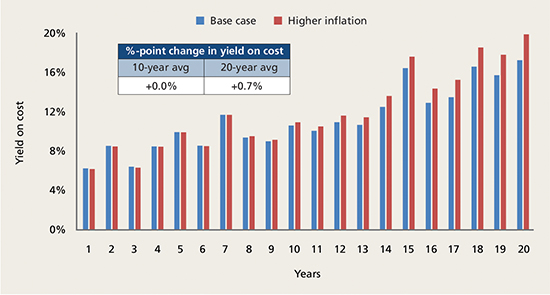

Higher inflation can raise companies’ expenses and increase their cost of debt. While the probability of runaway inflation is very low in the near term, there remains a possibility that low and negative interest rates, combined with massive injections of liquidity by central banks worldwide, could ultimately trigger a period of higher inflation.

We considered a scenario in which inflation and inflation expectations are perpetually 1pt higher than the base case forecasts. Other inflation-driven variables – such as the cost of debt, commodity prices including energy, costs of maintenance and operations, and capital expenditures – would rise in line.

As Figure 4 shows, the impact on yield is slight in spite of the higher expenses. The 10-year average is unchanged, and back-end yields are higher, as fixed price contracts roll off and utilities receive approval to raise rates. Quasi-monopolistic transportation investments and certain inflation-linked power contracts and regulatory regimes provide inflation protection from the outset.

Figure 4: Infrastructure portfolio’s yield on cost: Base case vs Higher Inflation

Source: J.P. Morgan Asset Management; data and estimates as of January 2018. For illustrative purposes only.

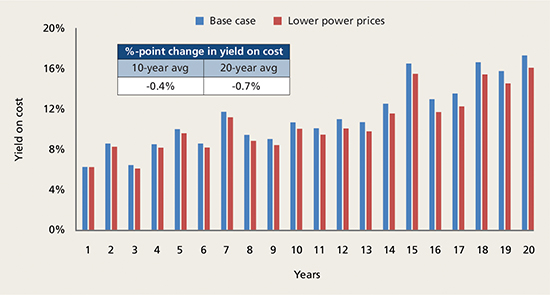

Stress test scenario 3: Power price weakness

Because core infrastructure assets are physical assets, we believe they are less vulnerable to technological disruption than other sectors. No app can replace water mains or container ports.

Nevertheless, we sought to understand how resilient infrastructure may be in the face of transformational developments.

We considered a scenario in which renewable energy sources and cheap battery storage advance more quickly than expected, lowering power prices and reducing demand for traditional baseload energy sources. This would also accelerate the transition to electric cars and reduce demand for oil.

In our model, spot power prices fall 30% and oil prices 15%. However, illustrative short-term yields are relatively stable because of long-term power contracts, while longer-term yields are only slightly lower (Figure 5).

Figure 5: Infrastructure portfolio’s yield on cost: Base case vs Lower Power Prices

Source: J.P. Morgan Asset Management; data and estimates as of January 2018. For illustrative purposes only.

Investment implications

Local authority investors should continuously assess their portfolios’ ability to weather downturns, and today’s relatively expensive asset valuations reinforce the importance of portfolio construction and downside protection.

As a fairly young asset class, infrastructure has limited performance data, but what data exists points to robust performance through the global financial crisis. Our study supplements that finding, and illustrates how a diversified core infrastructure portfolio can be expected to withstand recessions, higher inflation and interest rates, and power price disruption.

Consequently, core infrastructure – in addition to providing institutional portfolios with high and stable yields – may help investors to mitigate negative economic and market surprises.

More Related Content...

|

|

|