The role of absolute return bonds in LGPS investment strategies

Written By:

|

Paul Myles |

Paul Myles of BMO Global Asset Management looks at the different roles which absolute return bonds can play in the fixed income portfolios of UK pension funds

Record low bond yields, concerns about rising inflation and the desire to increase diversification are leading many UK pension funds to look beyond traditional index-based products for their fixed income portfolio. In this article, we describe one approach – Absolute Return Bonds (ARB).

We will discuss the key features of this approach and how it might play a role in an LGPS fund’s fixed income portfolio. In particular, we will discuss how an ARB fund can help LGPS funds achieve better risk adjusted returns by avoiding some of the pitfalls of traditional index approaches, improve diversification and how they can complement a Liability Driven Investment (LDI) or cashflow driven investment strategy.

What is an Absolute Return Bond fund?

The universe of ARB funds is varied, however most will share the following features:

1) A high degree of active management. ARB funds may include strategies which cover:

- Currencies (e.g. buying cheap currencies and selling expensive ones in the expectation that the exchange rate will narrow)

- Global rates (e.g. buying government bonds with high yields and selling bonds with low yields; taking positions in bonds with different maturities)

- Style/issue (investing in corporate bonds of companies or sectors expected to outperform)

In addition, the fund manager may take an overall position on the amount of interest rate and credit exposure in the portfolio. In some cases, the manager may take a negative duration position – meaning that the fund will outperform if interest rates rise.

2) Credit. Most ARB funds will include an element of credit market exposure. This may include UK and overseas corporate bonds and in some cases, emerging market debt and high yield (i.e. lower credit quality) debt.

3) Cash benchmark. This gives the fund manager a great deal of freedom and means that the manager is not tied to a benchmark of government or corporate bonds, which may have undesirable characteristics.

When might LGPS funds consider an ARB investment?

A typical local government pension scheme has around 16% of its assets allocated to fixed income.1 This has tended to be invested in government bonds, corporate bonds or, increasingly, in aggregate funds which invest in both. There are a number of differences between ARB funds and these strategies which can be attractive to LGPS investors.

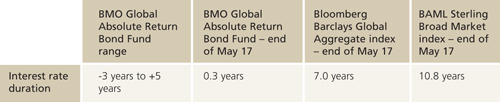

Duration: A typical global aggregate fund will have a duration of seven years.2 This means that a 1% rise in the yields of its constituents will result broadly in a 7% fall in the fund’s value. Whether this is a desirable characteristic will depend partly on whether pension fund panel members are seeking to manage interest rate risk in their LGPS fund’s liabilities and partly on their view on the direction of yields in the future.

Some LGPS funds will value their liabilities using a discount rate based in part on Gilt yields. For these schemes, interest rate duration in their fixed income portfolio may be desirable as this will partially offset the interest rate risk in their liabilities (although potentially this can be addressed more effectively using a dedicated LDI strategy, which we elaborate on later).

However if, as is becoming increasingly common, the fund’s actuary is using an “inflation plus” discount rate, the case for duration in the portfolio may diminish and rest largely on a view on the likely future direction of interest rates.

We are facing a shift towards a higher yield environment as central banks start to normalise monetary policy. Traditional benchmark-based fixed income strategies that have benefited from the last 30-year bull market in fixed income are ill suited to the new market environment, as they lack the flexibility to make meaningful changes to duration. Unconstrained bond funds (such as ARB funds) in contrast, have the scope to implement short as well as long duration positions. The ability to implement negative duration positions is a valuable tool in an environment in which yields start to rise – an important differentiator of ARB funds. Although unconstrained by benchmark, the risk of ARB funds is managed to a specific risk target, providing investors with the level of clarity with which they need to invest.

Unlike an index-based approach, the duration of an ARB fund will not be tied to a benchmark and will generally be lower than a typical index-based fund’s duration. This makes the fund potentially less vulnerable to rising interest rates.

Figure 1: Duration comparison between BMO Global Absolute Return Bond Fund and leading market indices

Source: BMO Global Asset Management and Bloomberg, as at 31 May 2017

An increase in transaction costs in corporate bonds has meant even passive index-based strategies have significant implementation transaction costs. Our approach to absolute return seeks to harvest an attractive credit premium but at the same time, limiting turnover.

Similarly, a non-index approach avoids undue concentration to certain issuers or sectors. At BMO Global Asset Management, we focus on where market anomalies exist to identify a “sweet spot” due to rigidities of index-based and passive management styles.

Diversification: The primary drivers of returns in traditional index-based fixed income funds will usually be interest rates and/or credit spreads. Active funds will have the potential to earn returns from “manager skill”, however rates and credit will usually still dominate the total risk and return profile of index-based active strategies.

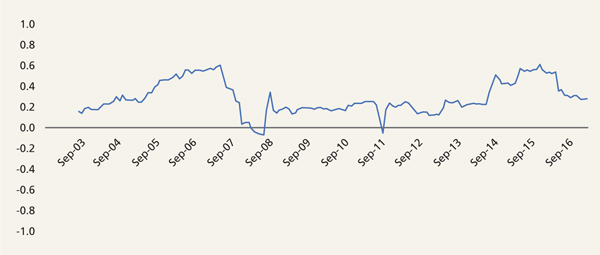

Although rates and credit will form an important part of an ARB strategy, active management is usually a much larger component than with index-based funds. As shown below, the returns from independently run active fixed income strategies can have a very low correlation with each other and with market sources of return such as equities. Accessing a range of uncorrelated return drivers in a single fund is a straightforward way for members to increase the diversification of their investment strategy.

Figure 2 shows how our unconstrained fixed income strategy has achieved a low level of correlation with the broader market, represented by the Bloomberg Barclays Global Aggregate index, over the medium term. The relatively low correlation of the unconstrained fixed income strategy to global fixed income markets highlights the diversification benefit that this strategy can offer when combined with benchmarked fixed income allocations.

Figure 2: Correlation between unconstrained fixed income strategy and global fixed income

Source: BMO Global Asset Management and Bloomberg, as at 31 March 2017. Correlation is shown between our unconstrained fixed income strategy and the Bloomberg Barclays Global Aggregate Index and calculated using 3 month rolling averages

Investing in an ARB fund alongside an LDI strategy

LDI is an efficient and flexible way for pension funds to manage the interest rate and inflation risk in their liabilities. Broadly speaking, it enables funds to offset more than £1 of liability risk per £1 invested (usually up to £3 is possible). If an LGPS fund invests a proportion of its fixed income portfolio in an LDI strategy, pension fund panel members then have a number of options:

1) Keep the cash as an additional buffer to meet future cashflow needs, for example to support rebalancing of the LDI solution or to pay member benefits

2) Use the cash to support more LDI coverage to offset more liability risk

3) Invest the cash in a strategy to increase expected return (illustrated right)

For option 3, the strategy selected to enhance returns should meet two criteria: firstly, it should offer an attractive return over cash. Secondly, and crucially, the strategy selected should not compromise the main objective of the matching strategy – to manage funding level risk. This means not introducing unwanted funding level volatility in the search for additional returns. The strategy will also need to be a suitable source of cash for when the LDI strategy requires rebalancing. This means it should be sufficiently liquid and, ideally, have a low correlation with the LDI strategy to avoid the risk of buying high or selling low.

Pension funds are increasingly using ARB funds for return enhancement alongside LDI. However trustees should check that the strategy selected is consistent with the risk management objectives of their LDI strategy. This is likely to favour a fund with a low duration, and with diversified and tightly risk controlled active fixed income strategies.

Figure 3

Meeting a fund’s cashflow needs

Some LGPS funds are facing the prospect of becoming cashflow negative in the near future (or perhaps already are) as their contribution income falls and/or benefit payments increase.

This means that benefit payments will need to be paid in part from the fund’s investments. Some funds will choose to invest in higher income generating assets such as a buy-and-maintain corporate bond portfolio. Whilst this may help to meet the fund’s cashflow needs, these strategies may not always offer the best risk/return payoff, particularly in an environment where investors are increasingly willing to “pay for yield”.

As an alternative, a liquid ARB fund can also help a pension scheme address a negative cashflow position. A daily dealt, cheap to transact fund can act as a ready source of capital if required. Furthermore, the diversified strategies in an ARB fund help to reduce the risk of selling low or buying high.

Conclusion

ARB funds can fulfil a number of rolls in an LGPS fund’s fixed income portfolio. They can help funds achieve better risk adjusted returns by avoiding some of the pitfalls of traditional index approaches, improve diversification, and can form part of a cashflow driven investment strategy, or complement an LDI strategy.

Important information

For professional investors only. The value of investments and income derived from them can go down as well as up as a result of market or currency movements and investors may not get back the original amount invested. Past performance should not be seen as an indication of future performance.

Views and opinions have been arrived at by BMO Global Asset Management and should not be considered to be a recommendation or solicitation to buy or sell any products that may be mentioned.

© 2017 BMO Global Asset Management. All rights reserved. BMO Global Asset Management is a trading name of F&C Management Limited, which is authorised and regulated by the Financial Conduct Authority. F&C Management Limited accepts no liability for any loss arising from the use of, nor make any representation as to the accuracy or completeness.

1. Source: WM Performance Services 2016 report

2. Duration of the Barclays Global Aggregate index as at 25 May 2017

More Related Content...

|

|

|