The residential real estate opportunity

Written By:

|

Alex Greaves |

Alex Greaves of M&G Real Estate explains how investment in the private rented sector can help pension funds support long-term income-driven returns while improving diversification

The residential housing sector is a familiar topic of discussion for local government with the growing population in the UK outpacing the supply of homes, especially in urban areas. But local government pension schemes are also recognising the investment opportunity represented by residential property through its ability to add diversification, offer strong risk-adjusted returns and generate a growing, sustainable income to match their liabilities.

The structural undersupply of homes has been an ongoing issue for decades and looks set to continue. The UK population growth, at 0.6% per annum, is currently growing at a rate almost double that of the EU average, and forecasts suggest that the UK population will continue to expand faster than most of Western Europe on a per capita basis.¹ However housebuilding, which has been on a downward trend since the 1970s, has failed to keep pace with demand for housing. Population growth has, therefore, outstripped the delivery of new homes and due to constrained supply and rising new demand, the housing shortfall is worsening. Coupled with significant affordability constraints for home ownership and changing social mobility trends, especially in London where renting is becoming more accepted (particularly by “millennials” and “Generation Y”), this scenario is fuelling demand for rented residential property.

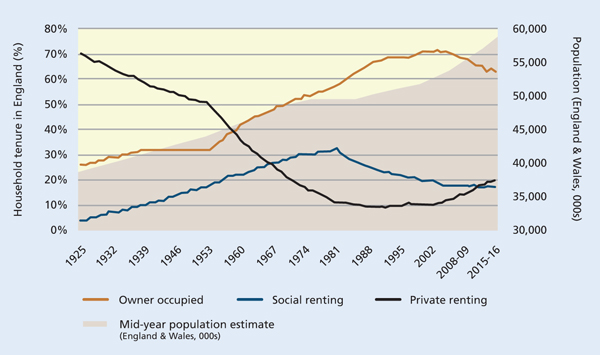

Against this backdrop, the UK private rented sector (PRS) is growing steadily and now represents 20% of the English market, up from 10% in 2001, according to data from the Department for Communities and Local Government (DCLG). Commentators suggest that the number of households in the PRS will grow to more than seven million households, a quarter of all tenures, by 2025. The PRS represents a highly credible and efficient exit route for housebuilders, as buy-to-let investors are affected by additional Stamp Duty Land Tax and changes in mortgage interest rate relief.

Figure 1: Tenure over time (England)

Source: English Housing Survey (2017), Office of Statistics (2017)

Growth in the PRS is backed by the UK government with cross party support for private renting and institutional build-to-rent schemes. More accommodative policy is one of the reasons behind more institutional investors rediscovering the advantages of PRS.

Strong track records of income-driven returns, resilience in economic downturns, diversification benefits and the backing of robust fundamentals are all attractions of the PRS sector for pension schemes. Residential property is a good diversifier against other UK asset classes as well as commercial property, showing a low correlation of 0.7 to this real estate sub-sector.² Also, and unlike commercial property, residential real estate is not purely an investment play and meets a fundamental need: people will always need a roof over their heads. Therefore, in the event of an economic downturn, the rental market is likely to remain resilient, as more people are obliged to rent in a difficult environment. This helps mitigate capital value falls for such assets, which has been reflected in the two recent economic downturns where residential property capital values fell less steeply and recovered more quickly than commercial property, highlighting the asset class’s defensive characteristics, which are key for pension scheme investors.

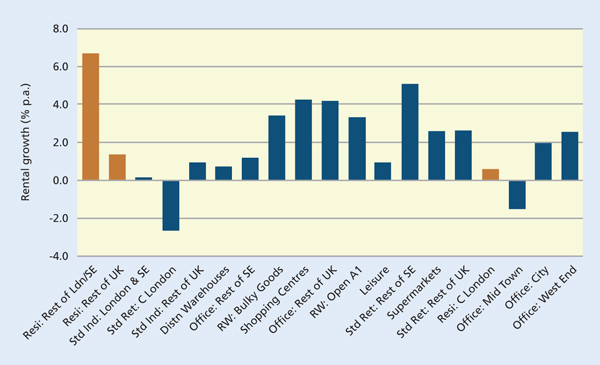

Demand for residential housing is increasing across the UK, with the exception of Central London where it remains relatively weak. The quantum of rentable product remains limited, placing upward pressure on rents. Rental growth for the rest of London (outside Central) and the South East was 6.7% per annum in 2016. Such favourable dynamics have supported rental growth in the residential sector outstripping comparable figures for the commercial property sectors. The reliable nature of rising income, with contracted predictable payments, is a key attraction for local authority pension funds.

Figure 2: Rental growth across the property market, 2016

Source: IPD Annual Digest (Mar 2017)

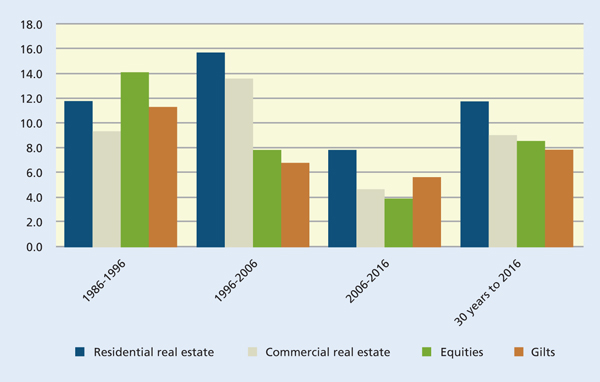

Limited available stock, particularly in urban areas, and stable demand means that house prices are expected to keep rising in the short-term, albeit at a modest pace. Furthermore, house price growth is becoming more balanced across the different regions, although London, the East, and the South East continue to see stronger rates of annual growth. The combination of strong capital growth and increasing rents has culminated in residential property outpacing other asset classes, including commercial property, equities and Gilts.

Figure 3: Total returns by asset class (% per annum)

Source: IPD Annual Property Digest 2016, IPD Residential Property Digest 2016, Bloomberg (March 2017). N.B. Residential total returns from 1984-2000 taken from IPD Annual Property Digest, 2001+ from IPD Residential Property Digest.

When evaluating particular sites, critical factors such as access to employment, transport, affordability, local service and housing supply amongst others are assessed in terms of their impact upon rental growth. City centre locations with good local employment, and areas close to transport nodes, are attractive to occupiers and investors alike thanks to their solid long-term fundamentals. Some local authorities may feel that investing in residential property through their pension schemes creates a conflict of interest given their own work on social housing and planning. Such issues can be minimised by investing beyond the scheme’s locality, which, encouragingly, a number already do.

Turning to development, uplifts to rents are easier to implement when residential property is built for purpose, offering customers more than a “space” to live in. Private renting accounts for 46% of all households in the 25-34 year old bracket,³ driven by the lack of affordability of home ownership, and this Generation Y is the demographic cohort who are likely to favour onsite amenities that meet their needs, facilitating their busy lifestyles. Offering such services improves occupancy rates and drives rental growth. It is also appealing for pension schemes that are keen to build sustainability into their investment approach as daily essentials can be easily accessed by occupiers without the need to rely on a car, encouraging eco-friendly and low-carbon living.

Forward-funded development creates the opportunity to control the design and build of high quality assets and enables the introduction of sustainable design features, reducing ongoing operating costs and overall management costs. In turn, these benefits filter down to occupiers by cutting their utility bills, driving high occupancy levels and maximising income for investors.

Facilities for residents might include electric car sharing schemes, garden allotments and outdoor gyms – all of which encourage a community feel. Greener living and sustainable design features that improve energy efficiency are also key. Combined heating and power systems, low-energy LED lighting and lighting controls, low energy motors in pumps and fans, and hydro taps all contribute to more efficient buildings, whilst brown roof systems provide a home for wildlife where habitats have been destroyed due to urbanisation. A responsible approach to construction and the creation of high-quality sustainable communities make for good places to live, which in turn improve occupier retention and decreases depreciation and obsolescence of assets.

Local government pension schemes have already embraced real estate as part of their portfolios, and many believe that adding UK residential alongside domestic and international commercial property can further improve diversification and support long-term income-driven returns.

This article presents the author’s present opinions reflecting current market conditions. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product.

1. Source: ONS, Eurostat and https:www.populationmatters.org

2. IPD Annual Property Digest 2016, IPD Residential Property Digest 2016, Bloomberg

3. English housing survey 2015-2016

More Related Content...

|

|

|