The real return portfolio of the future for real estate

Written By:

|

Julian Agnew |

Julian Agnew of LaSalle Investment Management looks at the composition of a real return portfolio, arguing that while retail will remain dominant, such a portfolio should in future be more balanced in terms of sector weighting than it has been in the past

Many investors of core real estate choose to assemble a portfolio which targets a real return that outpaces inflation by 3-5% each year. Given its inflation-tracking characteristics and strong overall performance in the past, the retail real estate sector has traditionally formed the bedrock of this approach. Indeed, an unconstrained model real return portfolio shows that the optimal portfolio to maximise real returns over the last 35 years would have been entirely comprised of retail. Yet with mounting concerns over the changing landscape of retail, we are revisiting the accepted notion that real return portfolios should be strongly overweight to this sector.

Acquiring assets with a yield of a minimum 5% goes some way to achieving a target real return of 5%. However, one must also ensure that the asset can subsequently generate positive real net income growth over the long term. Since the year 2000, there have been very few occasions where the average asset in the MSCI IPD universe has been able to meet both of these criteria at the point of acquisition. Only two clear acquisition opportunities stand out in recent years; supermarkets in 2009-10 and retail parks in 2012-14. Superior stock selection is therefore key to meeting target real returns in the current climate.

Revising the historic real return portfolio and constraining the model’s weightings to ensure no single property type dominates results in a more balanced portfolio. Most significantly, the industrial sector plays a more important role in the portfolio. However, the model is partly capturing the high returns achieved prior to 1986, when this maturing sector benefited from strong yield compression which is unlikely to be repeated. In a third iteration of the model, now reconfigured to minimise volatility rather than maximise real returns, a large element of alternatives (i.e. student housing, hotels, healthcare, and leisure) is introduced. This sector has been shown to be very stable in the past.

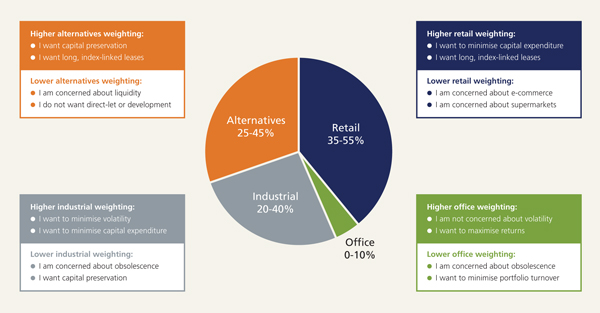

However, the past is only a guide to the future, particularly given both the headwinds facing the retail sector and the rapid maturity of the alternatives sector. Yet, looking ahead, retail should still form the majority of the real return portfolio of the future (35- 55%). Whilst this sector’s performance has lagged since the global financial crisis, certain economic indicators are now pointing to the return of modest rental growth. Retail tenants that invest in their shops, are less likely to exercise a lease break and still sign longer leases than tenants in other sectors. Nonetheless, it is prudent to assume that retail will be less dominant in real return portfolios than in the past. For example, the oversupply of large, out-of-town supermarkets will limit the market rental growth of this sector. More fundamental and widespread than this, e-commerce competes directly with physical retail which can be categorised as neither destination nor convenience. Stores on turnover leases are highly exposed. The impact of e-commerce may plateau in due course but will have a detrimental effect on secondary high streets and out-of-date retail parks for many years to come. Retail in the south east of the UK will continue to feature given the strength and wealth of the local economy, alongside certain strong national retail parks which can demonstrate e-resilience – for example, those embracing click & collect, or incorporating leisure elements.

The alternatives sector will form a major part of a future portfolio (25-45%). Investors intent on maximising lease length will focus on long-lease student housing, hotels and leisure. Others will opt for direct-let student housing and funding development in the emerging residential build-to-rent sector in regional hotspots nationally. Healthcare may also feature, but less prominently. With the exception of hotels, all of these alternative sectors face significant undersupply in many UK markets, supporting strong rental growth prospects for many years to come. Concentrating a portfolio on assets which are driven by the long-term themes of demographics, technology, urbanisation and environmental change (DTU+E) will provide comfort when considering capital preservation – another key element of a real return portfolio. There is also an inherent London/South East bias in these themes, as well as emphasising the importance of the underlying land/residential value of an asset.

Figure 1: Retail return portfolio weightings

Source: LaSalle Investment Management

The industrial sector will feature heavily in the real return portfolio of the future (20-40%). Rather than traditional industrial properties which have contributed to outperformance in the past, the future portfolio will include a greater degree of logistics. E-commerce is closely linked to rise in demand for distribution units. These need to be modern to accommodate latest technology, and these are currently in short supply. In order to execute next/same-day/food delivery sites need to be closer to or deep within their markets. These reflect the long-term trends in DTU+E and are therefore important to securing a real return over the long term.

Offices will form the smallest part of the real return portfolio of the future (0-10%). Within this, Greater London and South East offices will feature heavily, particularly during the growth part of the economic cycle. Investors seeking longer-term stability will carefully select a few assets in other important cities around the country. However, those willing to trade some stability for additional return will favour Central London offices. The long-term holding of office assets in a real return portfolio will be possible but only in specific circumstances.

In summary, the conclusions of the study point to a more balanced real return portfolio in the future in terms of sector weightings than has been typical of the past. Whilst retail will remain the dominant sector, emerging trends suggest a much larger contribution from alternatives, as well as an industrial component. Within predefined ranges, investors should vary these weightings according to themes, and their tolerance for risk and return.

More Related Content...

|

|

|