The real assets evolution

Written By:

|

Andrea Echberg |

Andrea Echberg of Pantheon looks at the drivers of the growth in demand for global infrastructure and real assets, and outlines the investment potential for institutional investors such as local authority pension funds

Real assets is fast emerging as a mainstream asset class; a recent poll of institutional investors found that 75% plan to increase their allocation to real assets in the next five years1. The key catalyst for interest and capital flow into the asset class is the urgent search for yield. The very low interest-rate environment has persisted for multiple years, and investors need other sources for income generation. There is also a heavy requirement for capital investment in the development of infrastructure, energy production, transportation and agriculture to keep pace with rapid global population growth, which is currently at 7 billion and forecast to reach 9.6 billion by 20502. Capital investment requirements for infrastructure alone have been estimated at approximately US$57 trillion for the period up to 20303. These underlying drivers are the principal fuel for institutional appetite for these asset classes.

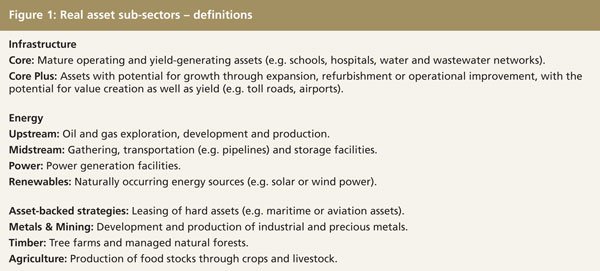

This is further supported by the investment characteristics that real assets can exhibit, principally strong downside protection, an attractive yield profile and the potential for capital growth. Core infrastructure assets, asset-backed leasing strategies, producing upstream and midstream energy assets (see Figure 1) can offer reliable income streams governed by regulation or long-term contracts with reputable counterparties. Core plus infrastructure and growth-orientated upstream energy assets have higher return profiles and can benefit from intensive value creation strategies, such as increasing reserves or production and improving cost structures. Real assets can also be a valuable portfolio diversifier; market studies show a low correlation between real asset returns and equity/fixed income returns. Furthermore, the various sub-sectors tend not to be correlated to each other.

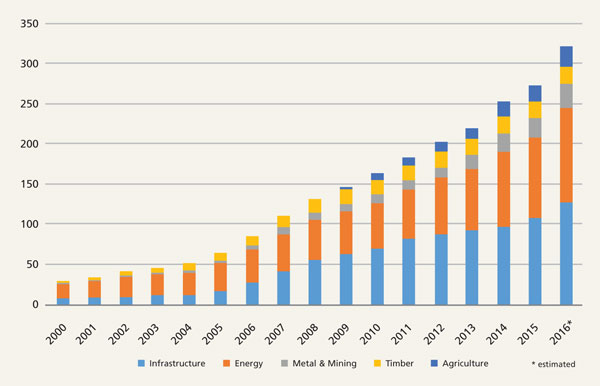

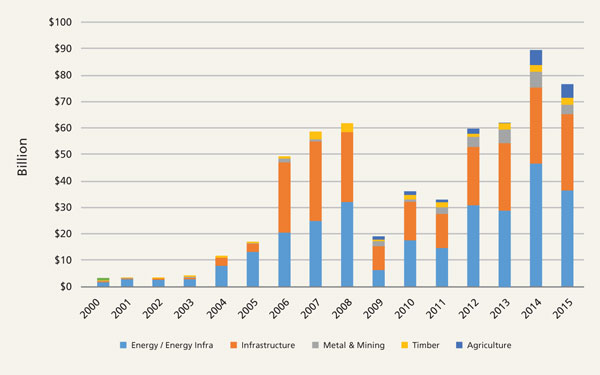

The underlying manager universe has grown considerably; there are now over 250 third party managers who we consider to be of institutional quality. Fundraising has also surged with nearly US$300 billion raised by dedicated real asset funds in the period 2012-2015. The growth and evolution of the manager landscape is providing investors with many opportunities and access to the asset class. There remain clear risks and serious challenges to executing a successful investment strategy however. Selecting and accessing the best managers in an evolving and increasingly complex universe requires significant expertise, and navigating commodity price volatility and potential asset price bubbles requires a disciplined and differentiated investment approach.

Figure 2: Number of institutional-quality managers, by year

Source: Pantheon data / internal Pantheon estimates. Institutional-quality managers is defined as funds that are actively tracked by Pantheon with more than $100 million in assets under management

Figure 3: Amount of capital raised by institutional-quality managers, by vintage year

Source: Pantheon data / internal Pantheon estimates. Institutional-quality managers is defined as funds that are actively tracked by Pantheon with more than $100 million in assets under management

Infrastructure has seen a large inflow of investor capital as central bank policy boosts liquidity and investors hunt for yield in low/zero interest rate environments. In contrast, the supply of infrastructure assets has remained subdued compared to historic levels. The impact of this is amplified by the fact that there has been an investment bias towards core, brownfield (operating) assets in stable developed economies. We call this the “crowded core”, where the large amount of capital chasing relatively few deals has continued to drive up valuations. In our view, successful strategies have avoided the crowded core by targeting managers that have proven, credible and differentiated strategies, and have industry connections or specialisations that enable them to source deals directly without the need to compete in the very competitive auction processes.

Through the secondary market (where second-hand assets are traded), we believe there is the opportunity to access infrastructure cash flows, of the same types being fought over so heavily in the primary direct market, in a much more advantageous supply and demand position. Over the past six years the market has grown considerably as illustrated by ballooning deal flow – deals we have screened during that period have risen nearly tenfold. There are also a limited number of buyers creating a supply and demand imbalance. For investors with in-depth asset knowledge, broad market coverage and transaction expertise, it is possible to be very selective and acquire exposure to assets at what we consider to be attractive entry prices.

We believe that the asset-backed sub-sector provides another compelling real assets opportunity for institutional investors. This strategy pursues the acquisition of capital-intensive assets such as tanker ships and aircraft, and leases them to end users such as shipping companies or commercial airlines. Asset-backed strategies continue to play on the broader global deleveraging theme, and we anticipate growth in this sector as companies move towards more “asset light” balance sheets. Similar to core infrastructure, these assets can provide attractive cash yields and can exhibit strong downside protection. The market is much less developed however, with fewer participants and less capital competing for deals. The emergence in recent years of dedicated and specialist third party funds in this space has facilitated access to these investment opportunities. In the energy market our view is that successful strategies are likely to be those that seek to invest with very high quality and specialist managers, and build diversification across sub-sectors (e.g. upstream, midstream, power and renewables), resource type, location/basin exposure and region. The significant dislocation of commodity prices has, in our view, created an emerging opportunity for skilled investors to acquire high quality upstream and midstream assets at attractive valuations. Furthermore, we have found that high quality management teams operating in the growth-orientated upstream assets have still been able to drive growth and enhance value by focusing on improvements in drilling economics and efficiencies.

Outside of core investment discipline, certain other considerations play an important role, in our view. One of these is effective ESG risk management. We believe that incorporating ESG considerations across investment activities can have a real impact on value creation while guarding the reputation of investments. We have the same conviction that diverse views can be additive to and enhance the investment process. Four of our investment practices are led by women, including our infrastructure and real assets team, and we strive to provide an open and inclusive investment culture.

In summary, we believe that real assets, with their infrastructure-like characteristics, are very well-suited to long-term investors. The cash yield component should provide a level of interim liquidity to meet funding requirements, while also benefiting from long-term appreciating assets. At the same time, we believe that an appropriate level of sub-sector diversification and the ability to uncover pockets of value as the investment landscape evolves will remain crucial to harnessing the potential rewards.

1. JP Morgan Asset Management.

2. United Nations Department of Economic and Social Affairs, population division.

3. McKinsey Global Institute.

More Related Content...

|

|

|