The infrastructure labyrinth

Written By:

|

Karen Shackleton |

Karen Shackleton of AllenbridgeEpic outlines how a careful alignment of investment aims and expectations can help pension funds benefit from their infrastructure investments

According to Preqin1, in 2014 14% of investors felt their infrastructure investment had fallen short of expectations, twice as many as when Preqin surveyed investors in 2013. How can trustees and pensions committees mitigate against such dissatisfaction?

Step 1: Clarity over the objective

The Preqin survey identified the primary causes of disappointment: concern about too many chasing too few opportunities (49% of respondents), lack of liquidity (33%), performance below expectations (26%) and fees (23%). These concerns could be alleviated if pensions committees were absolutely clear about the objectives underpinning a proposed infrastructure allocation. For example, questions that committees might ask could include:

- Do we need this investment to generate income? If yes, how regular and reliable does that income stream need to be? Does it need to increase with inflation?

- Do we need this investment to deliver growth, in order to reduce our deficit? If yes, what is the implied actuarial rate of return that growth assets must exceed, in order to reduce the deficit? Following on from that, what excess return would we ideally like this investment to deliver?

- Do we need liquidity in the portfolio? If this is not a concern, what is the maximum term that we would be happy to wait before being able to realise funds from our investment?

- When is our next actuarial valuation? What is the likelihood of a change in investment strategy impacting our infrastructure allocation?

- How do the other asset classes in our portfolio already deliver to our needs? Do we need to diversify equity risk? Or do we need to increase the yield being generated on the portfolio in order to meet cash-flow requirements?

- Are there other factors influencing our decision to invest, such as political pressure to support infrastructure investment, or ethical considerations? How important are these in relation to our fiduciary duties?

- How quickly do we want/need to deploy our capital?

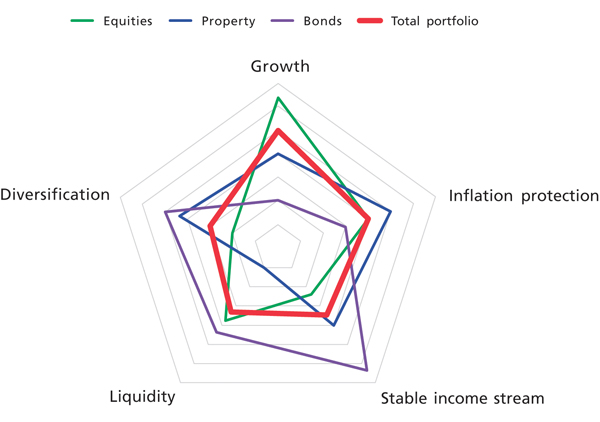

Part of the difficulty is that the pension fund has conflicting needs. Most schemes are running a deficit and need assets to exhibit growth characteristics. At the same time they need a steady return profile from their investments in order to be sure to meet the future pensions’ liabilities. In addition, the scheme will need to consider its short-term cash-flow requirements as and when the tipping point between contributions and pensions’ payments falls into net negative territory. Unfortunately, there is no one asset class that delivers to all needs, but the pensions’ committee could consider drawing a simple “heat map”, such as the one in Figure 1, to identify which objective is most pressing.

Figure 1: Heat map of current portfolio

Source: AllenbridgeEpic

In Figure 1, each asset class is rated based on:

- Growth potential

- Inflation protection characteristics

- Delivering a stable income stream

- Liquidity

- Diversification

Equities, in green, score well on growth, but they fare less well in terms of stability of income stream and diversification. Conventional bonds, in purple, by comparison have low growth yet they do provide a stable and secure income stream.

Combining the characteristics of the three asset classes in this example, into a simple portfolio consisting of 60% equities, 20% bonds and 20% property, the red line in Figure 1 shows the heat map for the whole pension fund. In this case, the scheme is geared towards growth and inflation protection, but scores less well on diversification, liquidity and stable income.

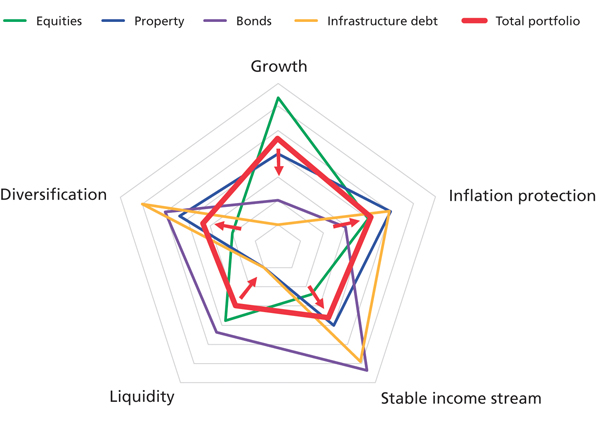

The impact of adding in different infrastructure investments can now be analysed. For example, adding in a 20% allocation to infrastructure debt investment (shown in gold in Figure 2), would result in a more rounded fund, in all dimensions, something the pension fund committee may well find desirable.

Figure 2: Heat map of portfolio with infrastructure added

Source: AllenbridgeEpic

Of course, some pension funds may have a desire to deliberately skew the heat map towards one or two factors, rather than having a rounded profile for the portfolio.

Step 2: Understanding the return/risk profile from different infrastructure investments

Infrastructure private debt involves the financing of infrastructure opportunities (airports, roads, utilities, hospitals, social housing). The underlying companies operate in a regulated environment, and this means that they are less sensitive to the economic cycle and consequently generate long-term, stable cash flows. Infrastructure private debt is attractive to pension fund investors because it offers stable, long-term cash flows which can be used to meet pension liabilities. It is attractive relative to conventional bonds because the illiquidity premium and the credit spread means this investment will generate a higher yield. It provides some inflation-hedging and it diversifies the risk of other asset classes in a portfolio.

Infrastructure private equity involves investment in unlisted equity positions in infrastructure assets such as utilities, transport, renewables and social infrastructure. As an equity investment, the investor has more opportunity to benefit from growth. The flip side of this is that the investment will be more impacted by adverse developments in the underlying asset, as well as by the cost and availability of debt finance. These funds typically involve a level of gearing, which allows the fund to benefit from a more attractive return. Infrastructure private equity is attractive to pension fund investors because it still offers relatively stable cash flows but, compared to infrastructure debt, it does offer some growth opportunity. It is attractive relative to listed infrastructure equity because the illiquidity premium means it is likely to generate a higher yield. It provides diversification benefits as well as inflation-hedging properties.

Listed infrastructure, as its name suggests, involves investment either in listed infrastructure funds, or in the listed companies that operate in the sectors relevant to infrastructure. Listed infrastructure is attractive to pension fund investors because there is greater liquidity compared to private equity or debt, and this may be an important benefit. The regular dividend yield is another attractive feature. Speed of deployment of capital is another key feature which makes listed infrastructure attractive to investors.

Direct investment/co-investment can appeal to larger pension funds. Direct investment in infrastructure is attractive to pension fund investors because the costs (management fees) are lower, resulting in a greater net return to the pension fund. Direct investment also allows the pension fund to target preferred sectors or geography. However, this approach does require significantly increased governance, so it is not the recommended solution for all.

Step 3: Determining your desired geographic and sector mix for your infrastructure allocation

The decision over geography or sector mix may fall out automatically from the steps above. For example, if a secure and regular income stream is required to meet sterling liabilities, then investing in non-sterling infrastructure may not be appropriate. Political pressure to invest is also likely to lead funds towards domestic-only investment.

There are some key benefits associated with moving from a UK-centric infrastructure allocation to a global one:

- Better returns. The UK infrastructure market is attractive to both domestic and international investors, all of whom are competing in a relatively small space. The global market offers a wider opportunity set for growth opportunities

- Better diversification and lower correlation with other asset classes

The sector mix in an infrastructure portfolio is likely to be driven by the desired risk/return characteristics in Step 1. There are, broadly, three types of investment:

- Core infrastructure includes assets such as onshore wind farms, social infrastructure and regulated utilities. These are assets with a high degree of government intervention generating a secure income stream and offering inflation protection.

- Value-added infrastructure includes assets such as transport and power generation. These assets also have long-term income streams, but they are more likely to be affected by the economic cycle.

- Opportunistic infrastructure includes investments in areas such as construction, or services supporting infrastructure assets. These are higher risk/higher return investments.

Step 4: Implementation

The committee can now focus on finding a manager who has:

- A demonstrable track record in the sector/geography being considered

- An alignment in terms of desired characteristics

- Similar investors in the fund (this is important for a less liquid vehicle, where the investment could be impacted if a large group of investors were looking to exit the fund before the end of the term)

- Reasonable fees and charges

- Drawdown expectations that are aligned with the committee’s needs

Time well spent

Taking time – ahead of any infrastructure investment – to think carefully about the role this asset class will play in a pension fund portfolio, is time very well spent. Committees are often encouraged to allocate to infrastructure by consultants, by politicians, by managers and sometimes by individual trustees, all of whom see this as an excellent opportunity, and all of whom are likely to have different views on why this represents such a good investment. An informed, strategic discussion about the potential role that infrastructure will play in your pension fund, debated in a considered and informed way, should be an obligatory precursor to any decisions that you subsequently make about investing in this asset class, and will make the ultimate route to access much easier to navigate.

1. Preqin Investor Outlook: Infrastructure H1 2015

More Related Content...

|

|

|