The global emerging markets opportunity

Written By:

|

Marcello Siniscalchi |

Emerging markets may have struggled over the last couple of years, but the case for long-term investment still remains. Marcello Siniscalchi of Itaú outlines where opportunities may exist for equity investors

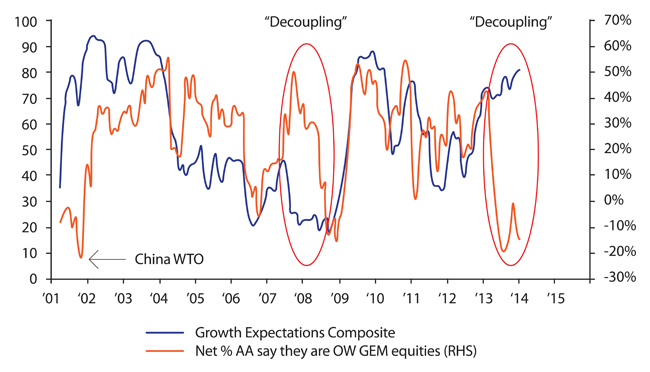

The performance of emerging markets (EM) relative to developed markets (DM) was particularly poor last year. Historically, EM performance is positively correlated with global growth expectations, which have risen to multi-year highs. This correlation seems to have broken down as investors have continued to reduce allocations to EM, now at multi-year lows (Figure 1).

One reason is that we have yet to see an improvement in global trade, which usually accompanies an improvement in global growth – leading to speculation that the traditional growth drivers for EM are no longer in effect. Historically, developed economies like the US enjoyed large consumption booms that led to rising demand for goods from emerging countries. Also, rapid Chinese economic growth, mainly driven by urbanisation and industrialisation, fuelled a commodity boom that benefited resource-rich economies like Brazil’s, Chile’s and Colombia’s. Today’s growth has a different profile. Economic improvement in the US is led by a domestic energy resurgence and a competitive manufacturing base, which has led to less, not more, demand for foreign products. An ample, low-cost domestic energy supply, combined with advancements in robotics and a cheaper USD (relative to ten years ago), may lead to a “manufacturing renaissance” in the US coming at the expense of traditionally low-cost Asian exporters. Moreover, a decelerating rate of investments may slow China’s growth further, given the over-capacity in its manufacturing sector. Incremental growth, therefore, will be less commodity-intensive. Recent weak industrial data from China coupled with better-than-expected data from Europe have reinforced the view that the emerging economies are not benefiting from stronger developed-world growth.

Figure 1: Fund manager survey growth expectations vs. EM allocations

Source: BofA Merrill Lynch fund manager survey 22 January 2014.

Recent weakness in EM and their currencies, however, may be more related to Fed policy uncertainty and the possibility for a Chinese credit event. We believe the market has digested well the shift from “QE infinity” to policy normalisation, by incorporating the tapering and interest rate hikes expectations into the yield curve without major accidents. The tail risk particularly on investors’ minds today is the potential for a disorderly deleveraging process in China. Some investors are also comparing the current situation to the 1990s, when a strong USD and US stock market was accompanied by weak EM, similar to today.

These fears are not without substance, in our opinion. However, we feel that the negativity surrounding these concerns has weakened EM currencies and equities too far and too fast. Our research shows that this hyper-bearishness towards EM in general, and Latin America (LatAm) in particular, may present investment opportunities at some point this year. Valuations in EM relative to DM are at multi-year lows. For instance, the market capitalisation of Google alone now exceeds that of the entire MSCI Brazil index.1 Also, LatAm’s public balance sheet today is very different to the 1990s. Sovereign debt ratios (net debt-to-GDP) are marginal, averaging 30-35%, and foreign exchange reserves (a buffer for absorbing external volatility) are up almost seven-fold. Further, LatAm countries today have free floating exchange rates, which act as an equilibrium force, making industrial manufacturing more competitive and stabilising current-account-deficits. We are already seeing this in Mexico and Brazil. Finally, in the 1990s these countries had large levels of USD-denominated debt, and therefore a weakening in their currencies meant that debt levels deteriorated.

Mexico, of late a darling within EM owing to a combination of major reforms in the energy, fiscal, education, financial and telecom sectors, is likely to see a re-rating of its potential GDP growth rate in 2015. Its large and dynamic manufacturing export base (25% of GDP) is supported by cheap labour costs, a competitive currency and, thanks to the energy reform, lower future electricity costs. However, the short-term outlook is not as bright, as consumer recovery is yet to occur, effective tax rates for companies are rising, new regulations are in place for the telecom sector and many companies are likely to cut capex given the sluggish cycle and the impact of fiscal reform on cashflows. Ironically, the same reform process that makes Mexico’s medium-term outlook attractive is clouding its near-term investment scenario. Also, with 2014 P/E multiple for the market at 17.5, we think valuations are high. We expect Mexican equities to rebound once downward earnings revisions have ended and consumption, infrastructure and energy investments pick up. We expect to see an inflection point in economic activity by mid-2014. At that point investors will start looking at 2015 multiples, which seem more attractive considering Mexico’s favourable medium- and long-term prospects.

Unlike the extremely bearish consensus opinion on Brazil, we have a nuanced view. Declining earnings trends in a weak revenue environment is forcing companies across all sectors to focus on capital discipline and efficiency, which will inherently increase operating leverage when the domestic cycle eventually turns. This is an important source of upside, particularly as investors are increasingly focused on macroeconomic headlines. These headlines create dislocations in the market whereby, due to fund outflows, stocks continue to fall despite positive developments and earnings trends. With its currency supported by a short-term interest rate at 10.5% and reserves now covering 400% of short-term liabilities, Brazil remains in good shape to absorb any exogenous shocks. Anecdotal evidence of hyper-bearishness and our more-positive-than-expected takeaways from meetings with specific companies, have led us to reduce our underweight position in Brazil.

Chile de-rated significantly last year as some of its structural advantages within LatAm became less apparent and investors grew uneasy about certain policies proposed by incoming president Michele Bachelet. As a result, Chile’s valuation premium to the rest of LatAm is now approaching zero, especially if considered on a sector-adjusted basis. Although we share many of the market’s concerns, we believe that the new government will actually be relatively pragmatic – similar to Ms. Bachelet’s first term in 2006-2010. Chile has one of the healthiest balance-of-payments profiles in the world and a net cash-to-GDP position. Further, with a supportive monetary policy and given where the valuations and ownership of equities are, we think the bearishness is overstretched and the risk/reward dynamic has tilted upwards in Chile.

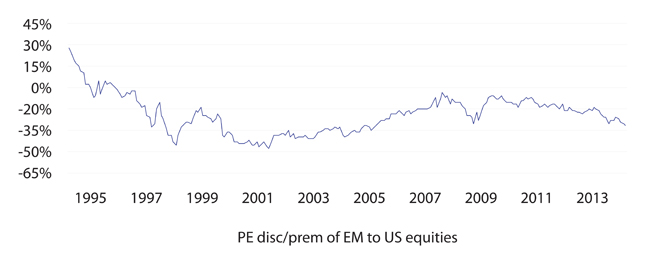

Figure 2: Price-to-earnings discount/premium of EM to US equities

Source: Bloomberg, 29 January 2014.

Peru’s economy is still growing at region-leading rates of 5-6% with limited structural headwinds and policies aimed at stimulating investment in mining, energy and infrastructure. Peru has significant reserves, favourable demographics, low mineral production costs and low penetration across many sectors. Valuations remain attractive on a growth-adjusted basis, while investment plans are unlikely to change in the absence of any major commodity price shocks.

The valuation discount of EM to US equities is currently 35% (Figure 2). A bottoming-out of earnings expectations is necessary for EM equities to outperform DM, which could narrow this discount to 20%, the historical average. Also, we believe the 10-year low correlation between DM and EM is unsustainable. Eventually, better dynamics in DM will translate into stronger global growth and therefore, better dynamics for EM. This may not happen immediately. Instead, earnings estimates may decline further as currencies have continued to weaken. A resolution of the worst-case fears regarding China would be another catalyst for EM equities. China’s government is currently pursuing policies aimed at curbing the aggressive expansion of debt and addressing overcapacity in several sectors, particularly commodities.

Today’s environment calls for investing in companies that benefit from weaker currencies and improving industrial manufacturing competitiveness of their underlying economies. As mentioned earlier, we now find Mexico to be less attractive than it was earlier, and Brazil to be more attractive, and we are making an adjustment from one to the other. We believe that the large-scale sell-off in domestic sectors will present investment opportunities in 2014. Therefore, the best position is to stay nimble.

1. Source: BofA Merrill Lynch

More Related Content...

|

|

|