The diversification and performance potential of global small-cap stocks

Written By:

|

Trevor Gurwich |

|

Jim Shore |

Trevor Gurwich and Jim Shore of American Century identify the advantages of a dedicated global approach to small-cap asset allocation, but warns that this is a complex marketplace requiring rigorous research and analysis

While investors’ home country holdings often represent various sectors and market capitalisations, international holdings are often concentrated in large-cap companies and developed markets. Taking a global approach to investing in small-cap stocks can offer diversification and performance potential through exposure to a greater opportunity set. We believe the inherent inefficiencies of global small-cap markets create opportunities for well-resourced active managers. A global approach to small caps has also historically delivered better risk-adjusted returns compared to regional small-cap approaches and provides greater investment flexibility for active managers.

Global small caps offer a greater, expanding opportunity set

Investing in a truly global small-cap mandate offers several advantages. Global small-cap managers can avail themselves of the best opportunities and highest conviction ideas regardless of region, sector, industry, or domicile. They can take advantage of an expanding opportunity set while managing exposure among higher-growth potential emerging markets and more established developed markets. Global managers can also tactically allocate assets to individual companies with exposure to local or global markets, or both, as global economic conditions shift.

Small-cap markets are less efficient

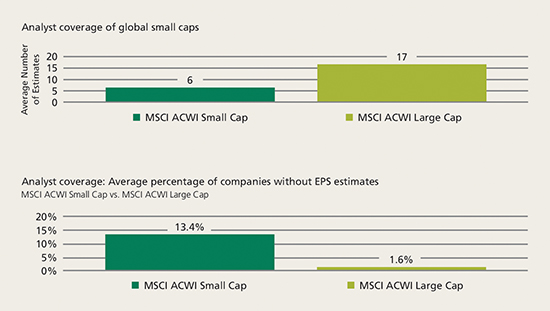

Despite the expansion in the global small-cap universe, this area of the market still contains inefficiencies relative to traditional large-cap investments, as follows:

- Lower levels of analyst coverage

Globally, small-cap stocks tend to be followed by fewer financial analysts, and a higher percentage of smaller companies have no coverage. With approximately three times as many small-cap companies as large caps in a volatile and less cost-effective marketplace, it is not surprising that about 14% of smaller companies go uncovered by sell-side analysts.

Global small caps receive less analyst coverage

Figure 1: Inefficiencies in global small-cap market relative to large cap

Source: FactSet. Data as of 30/9/2019.

Greater likelihood of earnings revisions

The limited availability of information about some global small-cap companies may lead to more frequent revisions of earnings estimates and/or more earnings surprises than would normally be seen in large-cap companies. This creates the potential for abrupt shifts in stock price, which would once again favour active managers with research teams proactively following these less covered companies.

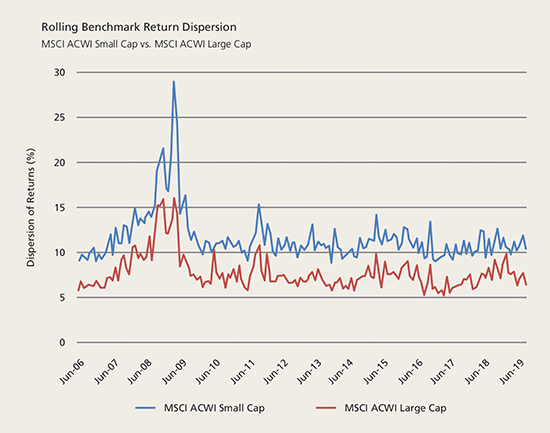

Greater dispersion of returns

The relatively higher levels of inefficiency in smaller companies can also be seen in the greater range of performance for the names that comprise the index. Dispersion of returns is significantly higher for the past decade in the MSCI ACWI Small Cap Index relative to the larger cap MSCI ACWI.

Figure 2: Higher levels of return dispersion create opportunities for active managers

Source: FactSet. Data from 30/6/2006 to 30/9/2019

The effects of factor exposure on small-cap stock performance favors active management

Small-company stocks are generally more susceptible to stock-specific, or idiosyncratic, risk than larger company stocks. While the higher stock-specific risk of small caps may lead to greater individual stock volatility compared to large-cap peers, it also may benefit global small-cap investors.

High stock-specific risk tends to translate to lower correlations among individual small-company stocks. As a result, diversified global small-cap portfolio may offer lower portfolio volatility. Higher idiosyncratic risk also helps explain the diversification benefits of adding an allocation to global small caps.

The fact that small caps are more heavily affected by company-specific attributes (i.e. stock-specific risk) favours active management, in our view. A rigorous bottom-up fundamental approach to small-cap investing may be able to identify the upside and downside associated with stock-specific risk. For example, a disciplined research process may help avoid regulatory, balance sheet, and corporate governance risks, while helping to identify companies successfully launching new products or expanding into new geographies.

We believe ample evidence shows that active managers have been able to exploit these market inefficiencies to deliver excess returns relative both to their benchmarks and to active global large-cap managers. Above-median global small-cap managers generally delivered higher alpha than global large-cap managers over the past five years. (Source: FactSet)

Global small caps may help boost portfolio return and reduce risk

In part due to the generally accepted higher levels of risk associated with smaller companies, small-cap stocks have historically outperformed their large-cap counterparts. Data suggests this relationship also remains true on a global basis. Since 2000, global small-cap stocks have outpaced global large caps by more than two to one. By adding global small-cap stocks to a portfolio, investors may also be able to increase return potential while mitigating risk. Over the long term, global small caps have delivered more compelling risk-adjusted returns than regional small-cap approaches, as measured by their Sharpe ratios.

We believe a global mandate allows an active manager to select investments across the large and diverse opportunity set of global small-cap stocks. Thus, the dispersion of small-cap returns and earnings growth across regions creates opportunities for active managers with well-resourced investment teams. They have the flexibility to gravitate toward those markets with the most attractive fundamentals, including the strongest earnings growth rates. Global small cap investors may also benefit from the generally faster earnings per share growth rates of small cap companies relative to large caps.

Taking advantage of the size premium

Investing in smaller companies comes with unique risks:

Size risk

Smaller companies face many challenges, including default risk, access to capital, limited product offerings, less flexibility to adjust to shifting market conditions, and reliance on smaller, less diverse markets.

Liquidity risk

Smaller companies tend to have lower liquidity, and global companies may trade in less liquid markets than local developed markets. These lower levels of liquidity, combined with greater price sensitivity, increase the risks of holding small-cap stocks because trades may take longer to execute.

Information risk

Less available information and a potential lack of transparency also add to the size premium for small company stocks. Difficulty in obtaining information about a company can delay investor decision-making and negatively affect returns if prices move suddenly. This additional risk is built into the size premium. Additionally, a new directive may further reduce analyst coverage of global small caps.

Idiosyncratic risk

Risk specific to an individual company, not correlated to market risk, contributes to small caps’ greater volatility relative to large caps. Data suggests smaller companies are more affected by idiosyncratic risk than their large-cap counterparts.

We believe well-resourced active managers are better able to navigate the above-mentioned risks compared to a passive approach. A disciplined stock selection and rigorous analytical process may not only reduce risks associated with size, information and idiosyncratic risks, but may be able to take advantage of those conditions. Eliminating stocks in the universe with insufficient liquidity, constructing a well-diversified portfolio, and continuous liquidity monitoring is also critical for active small-cap managers.

Global small caps offer diversification benefits through low correlations

In addition to historically higher risk-adjusted returns relative to large caps, global small-cap stocks have demonstrated significant portfolio diversification benefits. Correlations between global small caps and regional mandates, on a rolling five-year basis, have been low, providing an opportunity for diversification and an improved risk/return profile. An allocation to global small caps may also offset home-country or home-region bias for many investors.

Small caps are more domestically focused

One reason for low correlation between global small caps and global large caps is market focus. Global large caps tend to be multinational in scope, with exposure to markets around the world. Small caps, however, are likely to be more domestically focused, generating a greater proportion of their revenue from domestic sources than their larger-cap counterparts. Global small caps generally have less exposure to shifting global macroeconomic conditions and trends, and they are more closely tied to conditions in their local markets.

Recent trade tensions between the US, China and others is a case in point. Small caps’ lower exposure to the effects of tariffs and export issues helps shield them, to some extent, from global trade conflicts. Thus, combining small caps whose revenues have a greater domestic focus and large caps which tend to have larger global orientation, may improve diversification in a portfolio.

Diligent research and analysis is key to unlocking the potential of global small caps

The historical outperformance of small-cap stocks has been well-documented, and the advantages of a dedicated global allocation are becoming more widely understood. Consequently, more investors have been adopting a truly global approach to their small-cap asset allocation. Global small caps represent a larger, and expanding, opportunity set for investors relative to global large caps or local market small caps. But this complex marketplace requires diligent research and analysis. Lack of available information and other inefficiencies make a strong case for active management and bottom-up stock picking in this asset class. Allocating to global small caps also offers distinct portfolio diversification benefits due to the asset class’s low correlations to developed markets, global large caps, and regional small and large-cap stocks.

For institutional use only. Not for public use.

Past performance is no guarantee of future results.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any American Century Investments portfolio. This information is for an educational purpose only and is not intended to serve as investment advice. References to specific securities are for illustrative purposes only, and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

This information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

This promotion has been approved with limitations, in accordance with Section 21 of the Financial Services and Markets Act, by American Century Investment Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. This promotion is directed at persons having professional experience of participating in unregulated schemes and units to which the communication relates are available only to such persons. Persons who do not have professional experience in participation in unregulated schemes should not rely on it.

American Century Investment Management (UK) Limited is registered in England and Wales. Registered number: 06520426. Registered office: 12 Henrietta Street, 4th Floor, London, WC2E 8LH.

©2019 American Century Proprietary Holdings, Inc. All rights reserved.

More Related Content...

|

|

|