The de-risking challenge for local authority pension schemes

Written By:

|

Neil Falconer |

A fall in bond yields has led to a rise in value of future pension fund liabilities. Neil Falconer of Aberdeen Asset Management outlines a strategy for pension funds wishing to switch focus to their liabilities

Local authority pension funds have tended to shy away from liability-driven investment (LDI) solutions. In part, this may be due to a perception that LDI invariably involves derivatives, and that regulatory considerations may preclude local authority pension funds from following this path. In this article we highlight that although it may be difficult to implement a full derivative-based LDI solution, this should not prevent local authority pension funds from implementing de-risking strategies that allow them to manage the transition to a fully funded and fully de-risked position.

To understand the benefits of implementing such a de-risking strategy it is helpful to consider how “traditional” investment strategies have fared in recent years.

With “traditional” investment, the aim is to achieve the highest possible absolute investment return or relative return over a generic benchmark. On the face of it, this sounds sensible and logical – and that is why historically, pension schemes have adopted such an approach. In absolute terms, traditional equity and corporate bond strategies have performed well over the last few years.

However, as well as witnessing strong performance in equity and corporate bond markets, we have also seen huge falls in long-dated bond yields. As the discount rate for valuing pension fund liabilities is directly linked to those long-dated bond yields, the huge fall in yields has caused a significant rise in value of future liabilities. The reality is that the liabilities increased by more than the assets so in spite of the strong performance on the asset side, the funding position of most schemes has deteriorated.

The key take-away from this experience is that the focus needs to change. Rather than investing to generate returns in absolute terms, pension schemes should invest with a view to outperforming the scheme’s liabilities (i.e. it means adopting an LDI strategy). This generally means increasing the level of interest rate and inflation exposure within the asset portfolio up towards the level of interest rate and inflation exposure implicit within the liabilities.

The simplest means of increasing that exposure is to invest in a portfolio of fixed coupon and index-linked bonds to match the interest rate and inflation profile of the scheme’s liabilities. However, as most schemes are underfunded, they do not have the luxury of investing 100% of assets in a bond portfolio – growth assets need to be retained in the hope that they will outperform the liabilities and therefore help plug the funding gap.

For private sector schemes the solution to this problem lies in a derivative-based LDI strategy that allows the scheme to hedge interest rate and inflation exposure without having to be fully invested in bonds. However, given regulatory restrictions on derivatives and exposure to pooled funds, this route may not be open to local authority pension funds. While local authority schemes, may therefore have to accept that they can’t retain exposure to growth assets and fully hedge liabilities, this doesn’t mean they have to accept that their funding position will always be vulnerable to market volatility. Instead, local authority pension funds should look to implement a de-risking flight plan.

A de-risking flight plan is a framework through which a scheme will manage the transition from an underfunded position with high exposure to growth assets to a fully funded and fully hedged position.

At Aberdeen Asset Management we have developed a dynamic de-risking framework, specifically for local authority pension schemes. There are three key elements to our proposition:

Diversified Exposure to Growth Assets:

Traditionally the growth engine for most pension schemes has been equities. While equities have provided positive returns, the returns have been volatile. Diversified portfolios which take exposure to a much wider range of growth assets have provided returns on a par with equities but with much lower volatility. We will work with clients to understand their objectives and to design a growth portfolio aimed at meeting those objectives in a risk-efficient manner.

A Bespoke Matching Portfolio:

We will spend time with the scheme’s actuary to fully understand the nature of a scheme’s liabilities and then develop a bespoke portfolio of Gilts and index-linked Gilts to replicate the interest rate and inflation sensitivity of the liabilities as closely as possible.

A Dynamic Flight Plan Framework:

A key differentiator of Aberdeen’s proposition is the dynamic framework through which we aim to move the scheme from an underfunded position with high exposure to growth assets to a fully funded and fully hedged position.

Our solution is flexible and transparent. It shows a clear target path to the desired target funding position, while also leaving us enough flexibility to react to market events and capture all opportunities.

In order to better understand our approach, we first explain how flight plan strategies have evolved over time:

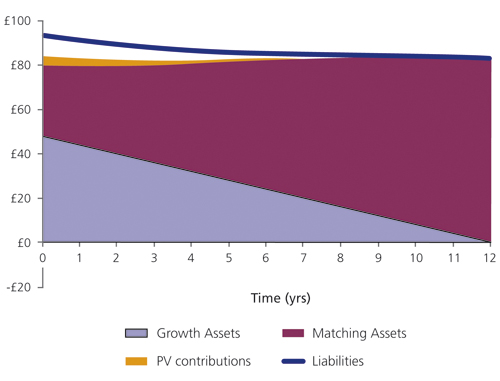

Figure 1: Pension Scheme ABC – Flight plan

Source: Aberdeen Asset Management. For illustrative purposes only.

The earliest flight plans were simplistic, with growth assets switched into matching portfolios on a series of pre-determined dates. While this provided certainty in respect of the de-risking timeframe, a major flaw was that the framework ignored market levels – and could lead to switching at exactly the wrong time. Such a plan might compel the sale of equities after a crash, or buying bonds when yields were really low.

To counter this shortcoming, flight plans evolved to include market-based triggers, based on FTSE levels or bond/swap yields. But these triggers ignored the overall funding position. If the funding ratio had deteriorated because interest rates were low, this means growth assets are needed even more than before to help make up the funding shortfall. It therefore wouldn’t make sense to sell out of growth assets based purely on the FTSE level.

More recently, flight plan strategies evolved to focus on funding ratios along the lines of “switch x% out of growth assets when the funding ratio gets to y%”. Such a strategy takes into account overall affordability, but has the drawback that it can lead to missed opportunities in individual markets.

At Aberdeen we think traditional flight plan solutions which rely on only one metric (i.e. time-based, market-level-based or funding-ratio-based triggers) to manage the transition from growth assets into the LDI hedges are too restrictive – and result in missed opportunities.

We have therefore developed a framework that captures the key advantages of what has gone before while avoiding some of the drawbacks.

- If the funding ratio moves as expected we execute time-based switches.

- If the funding ratio moves outside of tolerance we react to market volatility and recalibrate our plan.

- And finally, outside of the funding ratio-based framework we also have the flexibility to react to opportunities in individual markets.

Through this structure, our framework aims to maximise the chances of achieving the scheme’s objectives through providing the flexibility to respond to market conditions when a trigger event occurs and the flexibility to react to opportunities in individual markets as and when they arise.

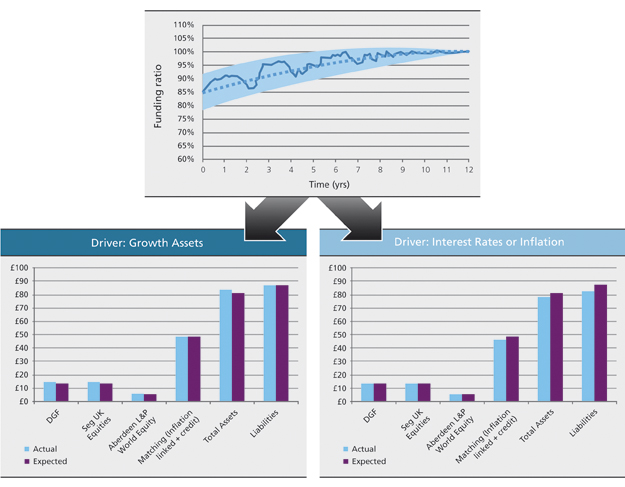

Figure 2: Dynamic de-risking – reacting to market conditions when a trigger event occurs

Source: Aberdeen Asset Management. For illustrative purposes only.

In the above example, the funding ratio has improved more rapidly than expected, breaching the tolerance levels around the flight plan on the upper bound. This might trigger two possible courses of action, dependent on the underlying cause. If the improvement is the result of outperformance on the part of the growth assets in the portfolio, this provides an opportunity to de-risk by reallocating from growth assets into hedging assets. If, however, the improvement is caused by a rise in interest rates or falling inflation, this may also allow the manager to increase the duration of the hedge portfolio in addition to switching assets from the growth portfolio into the matching portfolio.

Having a fund-manager-led solution that incorporates the flexibility to react to conditions at the time when a trigger event occurs can be incredibly powerful. Our framework provides us with the management information to quickly identify the drivers behind a trigger event, consult our market experts for views on key market prospects going forward and then take the most appropriate course of action in light of those views.

Conclusion

As noted earlier, regulatory restrictions on derivatives and exposure to pooled funds mean local authorities may be precluded from a derivative-based LDI strategy.

Nevertheless, de-risking remains a viable option for local authority schemes seeking to close the funding gap. At Aberdeen Asset Management, our dynamic de-risking framework allows schemes to react to market opportunities whenever they occur, maximising the chances of closing the funding gap.

Provided three key elements are in place – diversified exposure to growth assets, a bespoke matching portfolio and a dynamic flight plan framework, a scheme has the ability to efficiently navigate a flight plan from an underfunded status to a fully funded and fully hedged position.

More Related Content...

|

|

|