The changing face of bond investing

Written By:

|

Stephen Thariyan |

Stephen Thariyan of Henderson Global Investors gives his views on the changing landscape in bond markets and why an active, multi-sector, diversified approach is well-suited to capturing the opportunities ahead

Economic theory is constantly changing and evolving in response to uncertain conditions. Following the global financial crisis, central banks around the world have adopted numerous policies to try to restore the health of economies and spur growth, with mixed results. The consequences of easing measures by central banks include pushing investors further down the risk spectrum in search of acceptable returns.

The list of central bank easing policies to date includes quantitative easing, qualitative easing, forward guidance, near zero interest rates, and lately, negative interest rates. The latter alone, in combination with the shift in inflation expectations linked to lower commodity prices, has created $6-7 trillion of negative yielding government bonds, where in essence investors pay to lend to governments.

This search for yield has changed the landscape within fixed income markets. Many instruments no longer yield the same returns as in the past, and are not expected to do so for the foreseeable future. The only constant in this equation is investors’ need for income and investments in assets with reasonable rates of return (and stable capital).

The market backdrop in 2016

The main topic of concern in the financial markets in 2015 was when and if the US Federal Reserve would begin to raise rates; but since the start of 2016 investors have focused on multiple issues. The bear market list includes the possibility of a hard landing in China, continued falls in the price of oil, global growth/recessionary fears, negative interest rates and lately, the future profitability of European banks, culminating in heavy falls in risk asset prices. The falls were exacerbated by heavy consensus positioning and the subsequent unwinding of highly-correlated strategies.

Markets appear to have turned a corner from the middle of February. Risk assets such as high yield corporate bonds and equities rallied as the price of oil rose, despite no radical change in fundamentals. The recovery rally was helped by the resultant, more attractive, valuations. Further relief seems to have come from the stabilisation in the price of oil, improving economic data and sentiment in the US (together with signs that inflation may finally be picking up), and a bold easing package from the European Central Bank in early March, which included cutting rates and expanding asset purchases.

A new era in bond investing

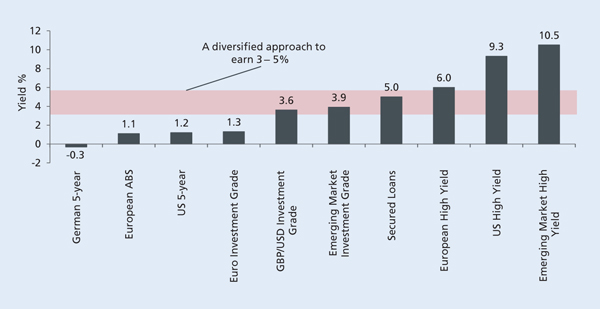

The need to look for opportunities to produce higher returns has increased. Bond investors need to work harder than ever to enhance investment returns. Figure 1 below shows the range of returns that are currently available across the fixed income landscape. It is clear that previously safe haven investments, such as government bonds, no longer deliver the level of income that investors require — hence, the need to become more active and look beyond traditional investments.

Figure 1: Broad fixed income yields

Source: BofA Merrill Lynch, Credit Suisse, Bloomberg, as at 29 February 2016

For income, corporate bonds (credit) have been a better place to be; the excess yield on the bonds still provides a source of additional income for investors. An active strategy will exploit the opportunities that arise from a number of different sources, such as the current desynchronisation of credit cycles in the US, Europe and most emerging markets (EM). While Europe is in the earlier recovery and restructuring phase, the US is displaying typical late cycle behaviour, such as increasing leverage and mergers and acquisition (M&A) activity.

Emerging markets present further opportunities. The EM asset class is not homogenous, but is made up of a diverse mix of credits with varying risk and reward prospects. EM corporate bonds offer a compelling long-term investment proposition given better growth levels that exist in some regions, while investors are paid an attractive risk premium because of the “emerging market” label despite the investment-grade characteristics of much of the asset class.

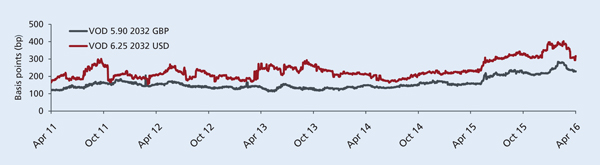

The anomalies between different fixed income markets and related volatility can also provide attractive opportunities. Outside the US, the high yield market continues to grow in Europe as companies reduce their reliance on bank funding. While default rates here may tick up in the future, we believe that investors are more than compensated for the risk. Opportunities can also arise from anomalies in different markets, as illustrated below in Figure 2, which shows the variation in the credit spreads of sterling- and dollar-denominated bonds of the same issuer, Vodafone.

Figure 2: Utilise the full opportunity set

Source: Henderson Global Investors, Bloomberg, option-adjusted spreads (OAS, bid), 12 April 2011 to 12 April 2016

A diversified approach to enhanced returns

The key to unearthing higher yields and better returns remains, we believe, in detailed credit analysis and the bottom-up selection capabilities of the investor. Based on these foundations the required level of income (yield) can be captured through investing in the appropriate strategy.

Blending different yields in a diversified approach, which gives exposure to a broad range of global assets, could help reduce risk. “Diversification” is not an overused terminology within the investment world, but a useful risk-reducing strategy. A dynamically managed portfolio, combining different sources of return that are lowly correlated, can both improve the return prospects and lower the volatility in the portfolio.

By way of an example, given the spectrum of yields currently on offer in corporate bonds, a well-diversified portfolio aiming for mid-single digit returns could include US investment grade and selected high yield bonds. It could also include European high yield bonds, plus a small exposure to emerging market high yield.

Ultimately, the key to success will remain in detailed analysis and credit selection and this can be applied to good effect through a multi-sector approach.

More Related Content...

|

|

|