The case for unconstrained fixed income

Written By:

|

Paul Myles |

Traditional fixed income strategies are dominated by interest rate risk. Paul Myles of Nordea Investment Management outlines an approach from MacKay Shields that can help minimise this risk

Traditional fixed income strategies are generally benchmarked to a broad market index such as the Barclays Global Aggregate Index, which tracks high-quality “core” sectors of the bond market including sovereign bonds, government agency debt, mortgage-backed securities, and investment-grade corporate bonds. In each of these sectors, interest rate risk is the dominant risk factor today.

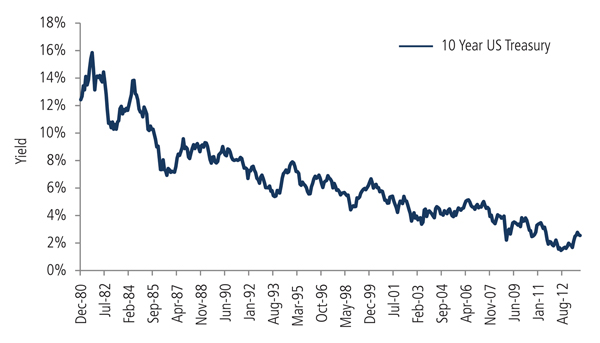

The traditional approach to fixed income was adopted during an era when globalisation, disinflation and other secular trends aligned to produce a 30-year decline in major government bond market interest rates (Figure 1). Investors adopted this approach for three primary reasons. 1) diversification benefits in a portfolio of risky assets, 2) a steady source of income, and 3) consistently positive total returns as the dominant secular themes drove interest rates lower. In today’s environment of low absolute yields, however, we are not convinced that a traditional bond portfolio concentrated in duration risk necessarily offers any of these historical benefits.

From a diversification standpoint, future returns from sovereign bonds may not exhibit negative correlations to equities as they have in the past. Historically, an increase in risk aversion and an equity market sell-off had typically been accompanied by a rally in interest rates. However, considering the low level of rates today, even a broad-based increase in risk may not lead to a significant decline in interest rates, thereby negating the diversification benefits of traditional fixed income.

In our opinion, the income benefits of traditional fixed income have also been diminished. Over the past several years, financial markets have been increasingly driven by central banks’ massive liquidity injections. Bond purchase programs by central banks have driven yields lower on government and other high-quality bonds, lessening their risk-return attractiveness.

Figure 1: Decline in major government bond market interest rates

Source: Bloomberg

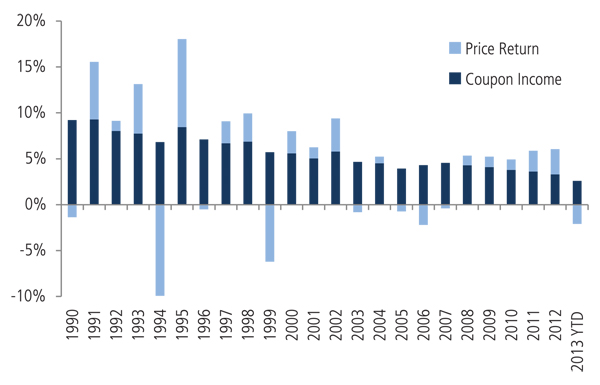

Further, with coupon income on core bond sectors near record low levels, even a modest rise in rates could generate capital losses that may overwhelm the income component, producing negative total returns (Figure 2). For example, at current interest rate and duration levels, the Barclays Global Aggregate would deliver a negative return with only a modest 0.32% rise in yields.¹ Clearly, interest rate risk is asymmetric, as nominal rates can only fall slightly before hitting a 0% floor, but could rise significantly from current levels.

A strategic solution

The total return impact of a rise in interest rates can be mitigated through active management, but most traditional bond portfolios are too constrained by benchmark considerations to consistently generate positive total returns in a prolonged environment of rising rates. The concept of “unconstrained” investing offers a potential solution to the strategic challenges facing most fixed income investors today. An unconstrained approach is a risk management approach that allows an investment manager to divorce himself from traditional benchmarks in favour of allocating capital more efficiently to reduce (or accept) certain risks at different stages in the cycle. While some have argued that unconstrained investing is about substituting interest risk for credit risk, the global fixed income team at MacKay Shields believes that it is more accurately described as shifting away from uncompensated risk in favour of compensated risk.

The potential benefits of unconstrained fixed income depend on a manager’s ability to generate alpha through active sector rotation across the spectrum of global fixed income, and to select and size positions according to risk-adjusted return potential. MacKay Shields believes this can best be accomplished through a consistent and repeatable process for allocating risk capital.

Unconstrained approaches generally target absolute returns, and allow a manager greater flexibility to size risks according to the opportunity, rather than relative to a benchmark. We believe the benefit of this approach is that by removing the constraints that establish duration as the dominant risk factor, the risk factors driving returns in an unconstrained portfolio can be more diverse. Importantly, this approach is not one that merely swaps interest rate risk for higher yielding credit risk. More precisely, by mitigating interest rate risk and giving a manager greater flexibility in expressing relative value views across sectors, the dominant driver of performance becomes the manager’s asset allocation capabilities, as opposed to interest rate beta, or the direction of interest rates. Additionally, the manager has the ability to more actively adjust these views over time in anticipation of secular shifts in the market. Thus, one of the key benefits of an unconstrained approach is the ability to opportunistically allocate relatively larger amounts of capital to sectors that offer the most attractive risk-adjusted return potential in a given environment, while avoiding those that are unattractive, thereby enhancing the overall risk control of the portfolio.

Figure 2: Contribution of coupon income to overall return

Source: Barclays Capital. This is a simplified example that excludes the impact of currency and other factors. As at 14 November 2013.

Implementing an unconstrained approach

MacKay Shields believes that success in unconstrained fixed income investing is driven by a manager’s ability to correctly anticipate turning points in market cycles and to adjust the portfolio’s asset allocation accordingly. Consistent with this belief, MacKay Shields uses a flexible, multi-sector approach implemented through a rigorous top-down and bottom-up investment process.

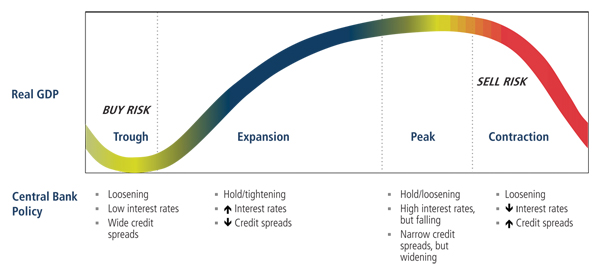

The top-down element of our investment process incorporates an analysis of the important economic underpinnings of the market’s risk cycle. This is led by a basic understanding of the stages of the economic cycle, and an appreciation of the significance of monetary policy and its impact on the capital markets (Figure 3). We recognise that monetary policy, as dictated by central bank actions, is the single largest contributor to credit availability and an important driver of the inflection points in the market cycle. By understanding monetary policy, we are able to identify credit excesses and cross-sector developments more clearly, allowing us to reposition our portfolios in anticipation of cyclical turning points. The bottom-up component of our investment process continuously feeds into the macro analysis to help identify significant changes in financial market conditions, real economic developments and areas of credit excess. Thus, the primary sources of alpha (and overall portfolio performance) are asset allocation across credit sectors and security selection within those sectors. MacKay Shields’ approach also affords us the ability to preserve capital by allocating to non-credit sectors during defensive periods and for liquidity purposes. Consistent with this approach, duration management is focused on downside protection and capital preservation.

Figure 3: Federal reserve policy and stages of the economic cycle

Views expressed above are subject to change without notice and are not intended to be a guarantee of future events.

In summary, the low level of interest rates globally and the asymmetric risk of rising rates pose a unique strategic challenge to fixed income investors today. A traditional approach to fixed income investing is unlikely to offer the same benefits that investors enjoyed in the past. While income-oriented strategies will continue to be a critical component of an overall diversified asset allocation, we believe many fixed income strategies are too concentrated in duration risk and too constrained by benchmark allocations to adapt to this environment. Many investors may benefit from a strategic allocation to unconstrained fixed income approaches that have greater flexibility to allocate capital to sectors that offer more attractive risk-adjusted return potential. Given the strategy’s focus on sector rotation, a manager’s skill and expertise in this area are critical to the successful implementation of unconstrained fixed income.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all MacKay Shields Portfolio Management Teams. Any forward looking statements speak only as of the date they are made, and MacKay Shields LLC assumes no duty and does not undertake to update forward looking statements.

1. As at 14 November 2013, the Barclays Global Aggregate had a yield to maturity of 1.98% and a duration of 6.25 years. An increase in yields of 0.32% would result in an estimated loss of 2%, thereby eliminating gains earned through yield.

More Related Content...

|

|

|