Sustainable infrastructure: why it’s not just about clean energy

Written By:

|

Ingrid Edmund |

|

Ben Kelly |

Ingrid Edmund and Ben Kelly of Columbia Threadneedle Investments discuss the idea that decarbonising existing infrastructure is an effective way of reducing greenhouse gas emissions and can reinforce investment returns

Policymakers, financial regulators, NGOs and professional bodies all have Environmental, Social and Governance (ESG) benefits and risks firmly in their sights. A plethora of recommendations, directives and guidance has been issued recently with the aim of strengthening ESG integration in the investment processes of all asset owners. And for good reason. Well-governed companies with strong ESG risk management credentials should deliver more sustainable returns by not being so materially exposed to operational, regulatory and reputational risk.

However, the perception that responsible investment means compromising on financial return and diversification still prevails among some institutional investors. Alongside the growing bank of evidence that sustainable investing can boost risk-adjusted returns, the consensus among all stakeholders in society is, in fact, shifting firmly in favour of the maxim that a company or institution that is not investing responsibly is investing irresponsibly. Consequently, the spotlight is on institutional investors, whose financial muscle and discretion over asset allocation can make a real difference to society and the environment.

Infrastructure may be best known for stable long-term returns, low volatility and inflation protection, but the most lasting impact from investing in this asset class could yet come from its huge potential to generate environmental and social benefits.

The United Nations Sustainable Development Goals (UN SDGs) provides a salient guide for investing towards a more sustainable world, for investors and governments alike. The 17 Development Goals signpost global development priorities and if these are to be met, significant investment in sustainable infrastructure will be required.

The concept of a social licence to operate is starting to be recognised and adopted by infrastructure market participants. Infrastructure investment has tremendous potential to help mitigate greenhouse gas emissions while enhancing countries’ resilience to climate change. It therefore represents a key element of the climate change agenda and has the power to help create a more sustainable future.

Clean energy can’t do it all

Clean energy immediately springs to mind as an obvious solution, but it’s not the be-all and end-all. No one doubts the pressing need to redirect capital to activities that can significantly contribute to the transition to a net-zero economy. But the headline-grabbing technology of renewable energy generation risks masking the reality that clean power alone is not going to address climate change. If climate risks are recognised as investment risks and factored into all infrastructure investment decisions, cleaner transport and buildings, more efficient water systems, and smarter, more resilient infrastructure will emerge as sources of more sustainable returns for investors over the long term.

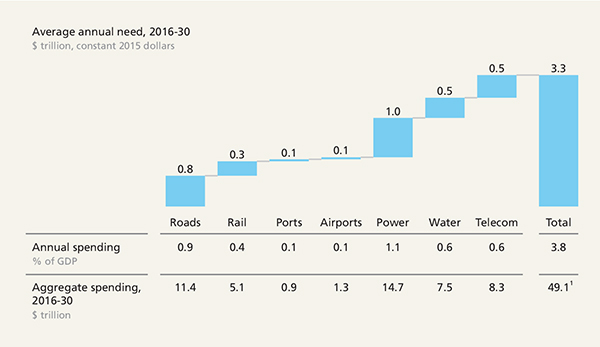

Figure 1: Future infrastructure needs

Source: HIS Global Insight, ITF; GVWI; National Statistics; McKinsey Global Institute Analysis.

Since 2012, renewable energy generation has grown by 8.6%1 per year (excluding hydro and nuclear). However, this added capacity has not been enough to offset growth in fossil fuel energy consumption. Clean power generation, thanks in large part to its youth and low base, may be increasing exponentially. But at a global level, industry, transport and the heating of buildings still rely for the most part on fossil fuels, whose combustion collectively produce more than enough CO2 emissions to jeopardise the Paris climate targets.

Indeed, decarbonising existing infrastructure and other industry sectors is an absolute necessity if we are to achieve the SDGs by 2030. We believe decarbonisation will not only reduce the assets’ or companies’ environmental impacts, but will also deliver the long-term resilient investment returns that the infrastructure asset class is known for.

From clean energy to clean transport: targeting sustainability

Consider the built environment and how it is heated and cooled. In Europe, buildings account for approximately 40% of all carbon dioxide emissions2. Globally, fossil fuel-based equipment makes up more than 50%3 of sales related to heating and cooling buildings, while less efficient and more conventional electric heating equipment adds another 30%4. Energy efficient devices such as heat pumps and more sustainable building practices are promising to transform this. Gold-certified buildings under the Leadership in Energy and Environmental Design (LEED) programme can generate up to 34%5 less greenhouse gas emissions than the average commercial building. The investment case is compelling too: in a 20-year building lifecycle, savings outweigh costs from between 12 and 17 times6.

Transport is another vital sustainable infrastructure investment. Globally, the sector is responsible for nearly a quarter7 of emissions from energy-related fossil fuel use and nearly 16% of the overall total from human activities. Oil is the fuel feedstock for the vast majority (92%8) of the transport energy mix, while 61% of global oil supply is consumed by the sector.

Perhaps counter-intuitively, some of the biggest available impacts for transport lie not in the zeitgeist applications, such as self-driving electric cars, but in the traditional spheres of airports (including aviation generally) and ports. Aviation currently contributes between 2% and 2.5%9 of total global CO2 emissions and 12%10 of the total from the entire transport sector. Developing airports will have a crucial impact on reducing greenhouse gas emissions through the use of tariffs to promote more efficient jet combustion. Sustainable aviation fuel offers an 80%11 reduction in CO2 emissions compared with current standard fuel. Reducing airports’ environmental impacts elsewhere provides additional financial and social benefits. Examples include supporting the development of electric transport to and from the airport, including passenger buses with electric models between the aircraft and the gate; making energy efficiency improvements such as LED lighting replacements; better metering, monitoring and controlling systems; and improving heating / cooling systems and introducing power factor correction. Airports also have the potential to generate their own renewable energy to power their own waste and water recovery and management. With international air traffic doubling every 15 years12, the financial returns available from such sustainable investments are considerable.

Ports provide another important area of opportunity for responsible infrastructure investors. Maritime transport accounts for approximately 90%13 of world trade. While this dominance means that emissions from ships are high in absolute terms, the sea remains an extremely efficient means of transport in terms of energy and emissions. But requirements for energy efficiency – including those limiting sulphur content in a ship’s fuel – are increasing fast. Some ships limit their emissions by installing exhaust gas cleaning systems or scrubbers, which must be fitted and maintained at ports. Many ships are moving to Liquid Natural Gas for power, for which large-scale infrastructure projects are required to convert existing ports or fit out new ones.

Sustainable infrastructure has more than environmental benefits

We shouldn’t forget about the huge social benefits infrastructure can have. McKinsey Global Institute (MGI) estimates that for every pound invested in infrastructure, 20p is produced in socioeconomic benefits. In large-scale infrastructure projects, investing also means working closely with local governments and communities to maximise the social dimension of an investment such as job creation. Without sustainable infrastructure investments, the absence of these projects will have huge social and economic costs: failing to expand Europe’s airports to meet growing demand, for example, will cost €96.7 billion in foregone economic impact14.

How all this translates into portfolios

We believe that infrastructure investing must be structured in a way that allows for the flexible deployment of capital into portfolio companies over time. Major sustainability projects such as electrification or vessel replacement, for example, involve long timescales that closed-ended funds, with a target date at which to return capital to investors, may struggle to match.

Consideration of the financial impacts of ESG risks is also key. One often overlooked example of climate-related investment risk is that of physical damage or destruction stemming from climate change and extreme weather events, which may impact financial returns negatively if not properly assessed and considered. Even renewable energy production is sensitive to extreme weather such as droughts and heatwaves – e.g. decrease in cooling system efficiency, water availability for cleaning. Roads and railways may suffer from buckling of rails or melting of asphalt or flooding damage. Such examples that have a direct impact on the maintenance costs, and effectively on the financial returns, exist across all infrastructure sectors.

The pressing climate and social challenges today, along with the rising importance of companies’ social responsibility, could yet define the next era of infrastructure investing. Many infrastructure assets have a lifespan of 50 or more years, so any investment decisions made today will have lasting repercussions, not just for investors’ returns but also for the environment and society. The way investors allocate and redeploy investment has a major role to play in protecting our environment and enhancing outcomes for society. While a focus on clean energy is certainly important, investors should consider the vast amount of opportunity in decarbonising infrastructure assets, not just for financial return but also for doing good.

1. Global Carbon Project; BP

2. European Commission: Energy Performance in Buildings Directive, January 2019

3. Commission: Energy Performance in Buildings Directive, January 2019

4. Commission: Energy Performance in Buildings Directive, January 2019

5. LEED

6. World Green Building Council, 2013

7. World Bank: https://www.worldbank.org/en/news/feature/2012/08/14/urban-transport-and-climate-change

8. BP Energy Outlook, 2019 Edition

9. European Commission: https://ec.europa.eu/clima/policies/transport/aviation_en

10. Columbia Threadneedle Investments add the date

11. European Commission: https://ec.europa.eu/clima/policies/transport/aviation_en

12. Airports Beyond Benefits, IATA, November 2018

13. International Chamber of Shipping: https://www.ics-shipping.org/shipping-facts/shipping-and-world-trade

14. Airports Beyond Benefits, IATA, November 2018

More Related Content...

|

|

|