Style investing: the long and the long/short of it

Written By:

|

Antti Ilmanen |

Antti Ilmanen of AQR looks at style investing and how it might apply to smart beta and other strategies.

Long-only, or “smart beta”, strategies apply tilts (typically within equities) to give exposure to styles such as value, momentum, size or low-risk. That is, they overweight stocks that are relatively cheap, have recently outperformed peers, have a small market cap, or are classified as low risk or high quality. These “tilts” aren’t always explicit, as some smart beta strategies focus on portfolio goals like maximum diversification or minimum volatility rather than on rules for picking individual securities.

The same principles can be applied in a long/short context. That is, going long cheap assets and short expensive ones, long outperformers and short underperformers, and so on. These strategies have many names; here, we refer to them as “style premia”. Unlike smart beta, we find that style premia can be applied in multiple asset classes, with little or no traditional beta exposure.

Each approach to style investing has its merits, and we see a role for both long-only and long/short, even for the same institution. There is little doubt that long/short approaches can provide better diversification to portfolios dominated by market-directional risks, and they can more efficiently capture style premia. However, long-only approaches are typically easier for many institutions to adopt because they involve less peer risk (lower tracking error to conventional portfolios and benchmarks), greater capacity, and do not require the use of leverage, shorting or derivatives.

Before turning to practical examples of long-only and long/short applications of style investing, we note that this distinction has clear implications for fees. Long-only “smart beta” returns are dominated by their market beta, which can be accessed very inexpensively. For this reason, we think smart beta fees should reflect the fact that they are mostly market beta with a small amount of “smart.” In contrast, long/short approaches seek to capture only the style premium and none of the beta, and so offer a return source that is diversifying to traditional portfolios, but also has lower capacity; thus we think their fees should reasonably be higher. As such, investors should try to determine how much they are paying for cheaply accessible market beta versus uncorrelated style premia.

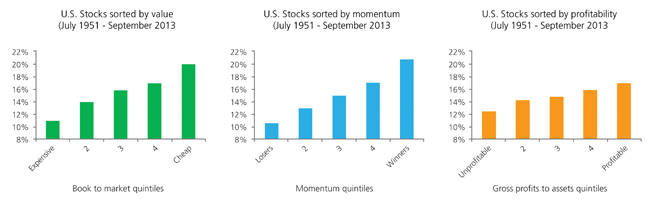

The first step is to identify the most useful styles. Within equities, we find decades of evidence across multiple geographies for a few styles. For example, AQR’s research1 analysing historical data on value (since 1926), momentum (1927) and profitability (1951) in US stocks has shown that the stocks that rank the highest on each style have significantly outperformed stocks that rank the lowest2 (see Figure 1). Importantly, each of these classic styles has economic explanations for why it has performed well and may be expected to continue to do so over the long term.

Figure 1: Three intuitive styles for a long-only equity portfolio

Source: Ken French Data Library, AQR. Value and Momentum quintiles based on decile-level information provided by Ken French. Profitability quintiles are based on CRSP/Compustat data, using the same universe as the Ken French Value and Momentum series. The profitability quintiles are based on a single factor – Gross Profits over Assets (GPOA). Returns are gross of transaction costs.

Style premia can be effectively harvested in a long-only portfolio of stocks by evaluating each stock against several lowly-correlated styles, and then over- or underweighting according to its combined attractiveness. The resulting tilts can be scaled to ensure a meaningful and manageable amount of active risk while avoiding the use of leverage, shorting or derivatives.

We believe an even broader, more diversified and more efficient approach is to combine long/short styles in multiple asset classes. The use of leverage, shorting and derivatives may enable the efficient and market-neutral implementation of styles in many contexts, while also allowing for reasonable risk and return targets given the increased diversification and pursuit of higher risk-adjusted returns. Four styles — value, momentum, carry and defensive3 — have generated positive returns in many different asset classes globally.4

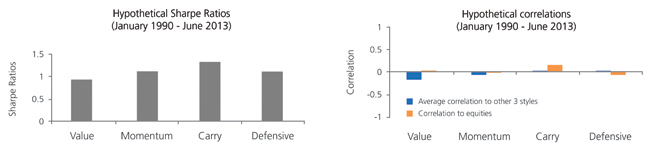

An analysis of market data from January 1990 to June 20135 found that diversified style premia theoretical portfolios delivered both positive risk-adjusted returns (Sharpe ratios ranging from 0.9 to 1.3) and diversification from equity-directional risk (correlations to global equities ranging from approximately -0.1 to +0.2). Thus, a well-diversified combination of style strategies in several asset classes may provide attractive risk-adjusted returns uncorrelated with long-only asset-class premia (see Figure 2).

Figure 2: Long/short style premia may offer attractive and uncorrelated sources of return

Source: AQR. Hypothetical performance of theoretical style portfolios, gross of transaction costs. Correlations are based on monthly returns. “Equities” is MSCI World Index. Each style is applied in multiple asset contexts, including stock and industry selection, equity country selection, fixed income, currencies and commodities Each strategy is designed to take long positions in the assets with the strongest style attributes and short positions in the assets with the weakest style attributes, while seeking to ensure the portfolio is market-neutral. Hypothetical results have certain inherent limitations, and are for illustrative purposes only and not based on an actual portfolio AQR manages. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE PERFORMANCE.

Whether investors choose long-only “smart beta” or long/short “style premia,” we think they should broadly agree on two other portfolio design choices: 1) more styles are better than only one and 2) strategic diversification is better than tactical style exposure.

1. Many or just one? Relative to a single-style approach, we generally find multistyle approaches provide better diversification, deliver more consistent performance, reduce transaction and other costs, and promote patience.6

2. Strategic or tactical? We prefer strategic style diversification as a starting point because we believe it is much easier to identify styles that work well in the long run rather than try to tactically time them. Even if investors could pick the right style more than 50% of the time, they could still be doing their portfolio harm — even ignoring transaction costs — because tactical calls usually imply deviating from a diversified base to a more concentrated portfolio, which means that an investor’s timing skills must be good enough to overcome not only transaction costs but also the forgone benefits of diversification. We believe many investors are “underinvested” in style premia, and a strategic allocation therefore may make sense regardless of current strategy “valuations” or other tactical signals related to style premia strategies.

So how should investors think of styles? Perhaps confusingly, even long/short style premia strategies are sometimes referred to as “alternative beta.” This is not a reference to traditional market beta (after all, long/short style premia strategies are typically designed to be market neutral); nor is it a reference to “alternatives”, which can include relatively illiquid asset classes such as private equity (style premia strategies typically focus on liquid assets). Rather, it is based on the idea that strategies previously considered sources of “alpha” can be seen as an alternative source of “beta” once they become well-known.

In the end, what we choose to call these strategies comes down to semantics. Irrespective of labeling, we believe style premia, whether applied in long-only or long/short portfolios, may provide investors much of the excess uncorrelated returns they hope to find from manager alpha, only in a more transparent and systematic framework, and at a fair cost. Because of this, we believe styles deserve consideration as strategic allocations in institutional portfolios.

1. AQR internal white paper by Israel and Villalon (2013) “Building a Better Core Equity Portfolio.” Profitability may be considered part of the broader defensive or quality style (Novy‐Marx 2012) and (Frazzini et al. 2012). This list excludes size because we find the historical reward for small‐cap investing to be less consistent than for other style premia, and because we emphasize liquid investments while size mainly reflects an illiquidity premium.

2. US stock market data provide the longest histories on these strategies, but the general results hold in European and other markets where the data is shorter (but still spanning multiple decades).

3. Here we consider long/short strategies that are designed to remain market‐neutral in each asset class. It is, however, possible to apply similar ideas to market‐directional trading. Indeed, a trend‐following strategy – a time series equivalent of the momentum strategy – which goes long (short) liquid assets after good (bad) performance and allows directional positions (when all markets in an asset class move in the same direction) could be added as a fifth style with strong empirical backing.

4. AQR internal white paper by Ilmanen, Israel and Moskowitz (2012) “Investing With Style.”

5. AQR internal white paper by Israel and Maloney (2013) “Understanding Style Premia.”

6. As an exception, we see a standalone role for some risk‐reducing styles (such as defensive equity or trend-following) when an investor’s focus is on downside protection for their total portfolio.

More Related Content...

|

|

|