Structuring European renewables infrastructure investments in a post-subsidy world

Written By:

|

Barney Coles |

Renewable power infrastructure in specific parts of Europe can sometimes compete directly with conventional fossil-fueled technology. However, the full value of the asset class is not easily accessible to all. Barney Coles of Capital Dynamics examines the challenges faced by investors

The journey towards subsidy-free

Renewable energy projects, like traditional power stations, earn revenues through selling the electricity that they generate. Electricity market prices, like the prices of other traded commodities, can be volatile and the potential riskiness of revenue streams over the course of a long-term investment in this class of infrastructure might dissuade more risk-averse investors. However, due to the innate low-carbon properties of generating electrical energy from renewable resources, and the increasing geopolitical benefits in harvesting these resources domestically, governments across the globe have proactively supported private investment in new renewable energy infrastructure to tap these resources through a series of subsidy mechanisms to mitigate against this revenue uncertainty.

In Europe, subsidies for renewables have typically taken the form of inflation-linked feed-in tariffs (“FiTs”) or tradeable renewable energy certificates (“RECs”), providing renewable energy projects with a fixed price government-backed payment for each unit (or megawatt-hour, MWh) of electricity generated for up to 20 years from the commencement of operations.

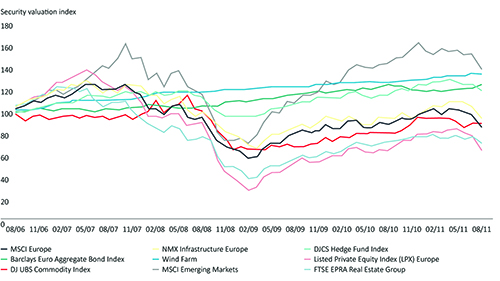

Consequently, high-quality renewable assets have added a degree of uncorrelated, cash-yielding stability to investment portfolios. Renewables’ low macroeconomic correlation can be seen in the case of a German onshore wind farm through the financial crisis of 2008, shown below in Figure 1.

Figure 1: Onshore wind farm vs. select asset classes during 2008 financial crisis1

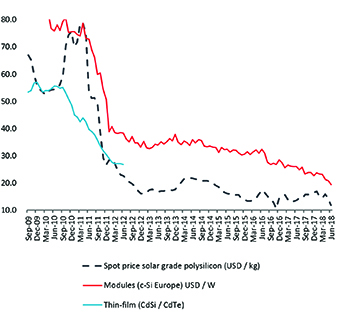

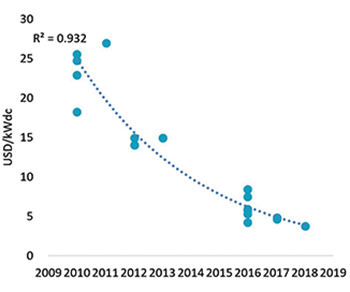

This global government support for renewables has underpinned a huge expansion in the industry over the last fifteen years, allowing it to now reach a point of relative maturity. The benefits of economies of scale and consolidation across the industry and supply chain have resulted in significant technology cost reductions as shown in Figure 2 and Figure 3 below.

Figure 2: Solar technology costs over time2

Figure 3: Observed solar O&M costs, 2009-20193

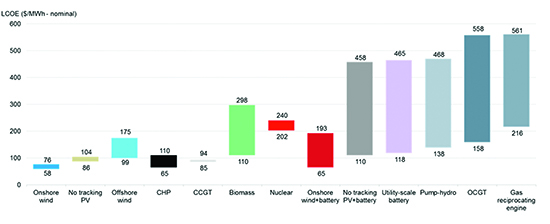

Importantly, in relatively high-wind and high-solar resource locations, unsubsidised renewables can now compete against conventional fossil-fuel power generation infrastructure using the industry-accepted levelised cost of energy (“LCOE”) metric4, as shown in Figure 4 below.

Figure 4: Levelised cost of development of new fossil fuel and clean energy assets in the UK (USD/MWh)5

As a consequence of the decrease in wind and solar technology costs, and the fall in annual costs to operate these, governments have begun withdrawing subsidies to renewable power generation infrastructure across Europe. This means unsubsidised renewables projects must now effectively compete both with each other and with other conventional power stations to provide new power capacity, with the wholesale electricity price providing the signal to the market for new entry. In the absence of any public support or commercial structuring, projects will therefore be exposed to the relative volatility of wholesale electricity prices, which may dissuade some risk-averse sources of capital (bank debt and low cost institutional money) from investing in the sector. However, experienced investors in the space are able to structure contracts for the sale of power from select renewable projects in such a way that the risk and revenue profile can mirror that of the previous subsidised world6.

Power Purchase Agreements in a subsidy-free world

The key to establishing long term fixed price revenues for a renewables project in the subsidy-free world lies in the commercial structuring of the power purchase agreement (“PPA”) that is struck between the project and the universe of potential buyers of power. There are broadly three main classes of these long term power offtakers:

- 1. Utilities; such as RWE and Statkraft, who buy renewable power and supply it to their underlying customer base. They typically offer up to a 15 year contract to acquire 100% of the power generated from a renewables project at the prevailing wholesale price, minus a small fee. In some instances they can offer a floor price for the power they acquire for the duration of the contract.

- 2. Trading platforms and virtual power plants; who typically seek to trade the power in current and future markets. Typically select entities from this sub-set of buyers can offer fixed prices for 100% of a project’s generated power over a 5-8 year horizon.

- 3. Corporates; who seek 10-20 year fixed price contracts with renewables projects to meet Corporate Social Responsibilty (“CSR”) goals and to hedge their long-term electricity prices. It is this type of buyer that is key to the new world of energy investing and is covered in more detail below.

Corporate PPA drivers

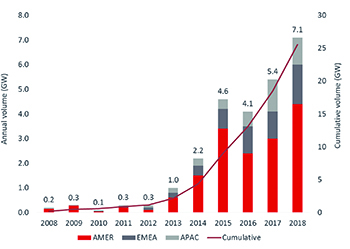

Over the last five years there has been growing demand from global, credit-worthy corporates to sign long-term PPAs with renewable energy projects. The trend in corporate PPA transactions over recent years is highlighted in Figure 5 below.

Figure 5: Volume of GW capacity contracted under a corporate PPA over time7

This is driven by a combination of factors including:

- 1. A desire or requirement of certain large consumers of power to decarbonise. A number of the world’s large corporations such Apple, Facebook, Google, General Motors and Vodafone, have signed up to the ‘RE100’ Club, under which companies set a public goal to source 100% of their global power needs from renewable resources. A number of these entities have already struck long term PPAs with renewable energy projects in Europe and North America.

- 2. Increased demand for electricity, particularly in the technology and IT sectors, means corporates are progressively looking to buy electricity ‘at-source’ rather than through typical supply models in order to minimise intermediary fees.

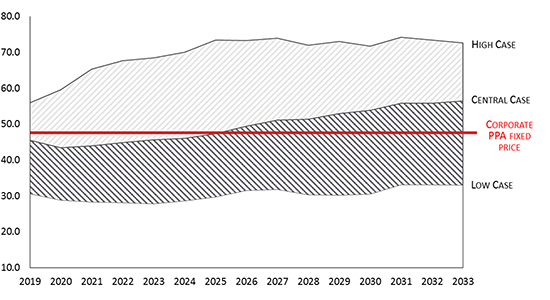

- 3. Price volatility in the electricity markets. In seeking to minimise operating cost volatility, corporates are increasingly seeking to hedge their power costs over a long term horizon. This is typically between 10 and 20 years. In addition, where renewables projects can be paired with commercially-viable battery storage technology (which allows renewables projects to control when they dispatch power to the grid, rather than only when the wind blows or when the sun shines), this can allow corporates to mitigate their exposure to peak power prices at specific hours in the day. Figure 6 above highlights the difference in the future power prices of a renewable generator with and without a corporate PPA in real terms.

Figure 6: Forecast merchent power prices and spread versus fixed price corporate PPA (£/MWh, Real 2017)8

Corporate PPA structures

Corporate PPAs can take a number of forms. Direct, ‘off-grid’ physical arrangements, where a generator delivers physical power directly to the corporate end-user through a private interconnection, are possible but rare. These arrangements typically require the generating plant and the end user to be geographically co-located to keep the costs of constructing the private interconnection to a minimum. More typically, projects and corporates structure fixed price arrangements (inflation-linked) with each other via a utility intermediary. Two such structures are outlined below:

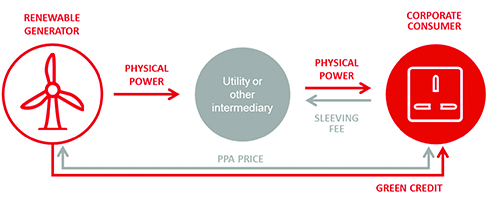

1. Back-to-back PPAs

Back-to-back arrangements (also referred to as ‘sleeved’ arrangements), involve a single utility signing separate PPAs simultaneously with both the generator (from whom it buys the physical power) and the corporate consumer (to whom it sells the physical power) with mirroring commercial terms. The corporate consumer pays the utility a small fee for arranging the trade. The generator and corporate consumer agree to a price for each MWh of electricity generated and payments are paid directly from corporate to generator. This arrangement also ensures that any green credits associated with the power (a green ‘stamp’ certifying that the unit of power was generated from a renewable power plant), transfer to the consumer.

Figure 7: Back-to-back PPA structure diagram

Source: Capital Dynamics

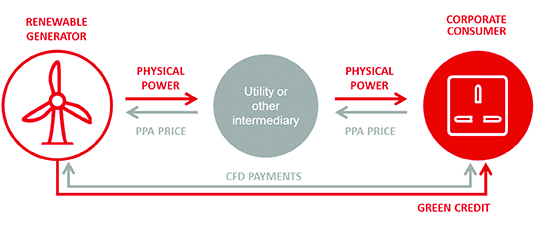

2. Synthetic PPAs

A synthetic PPA acts a form of contract for difference (“CfD”) between the generator and corporate consumer. Both generator and consumer enter into traditional offtake and supply contracts with the utility. However, under the separate financial contract, the two parties agree to a fixed strike price for the sale/purchase of power, with payment flows being determined by comparing that strike price against a market reference price. Where the market reference price is higher than the strike price, the generator pays the difference to the buyer. Where the market reference price is lower, the buyer pays the difference to the generator. They do not involve the physical delivery of output to the buyer or a utility agent of the buyer. This arrangement also ensures that any green credits associated with the power transfer to the consumer.

Figure 8: Synthetic PPA structure diagram

Source: Capital Dynamics

In the UK, the synthetic PPA structure is most often adopted as it is regarded as more flexible and more efficient to scale up or down if multiple transactions are to take place with the same generator and offtaker.

Delivering investments in renewables projects backed by corporate PPAs

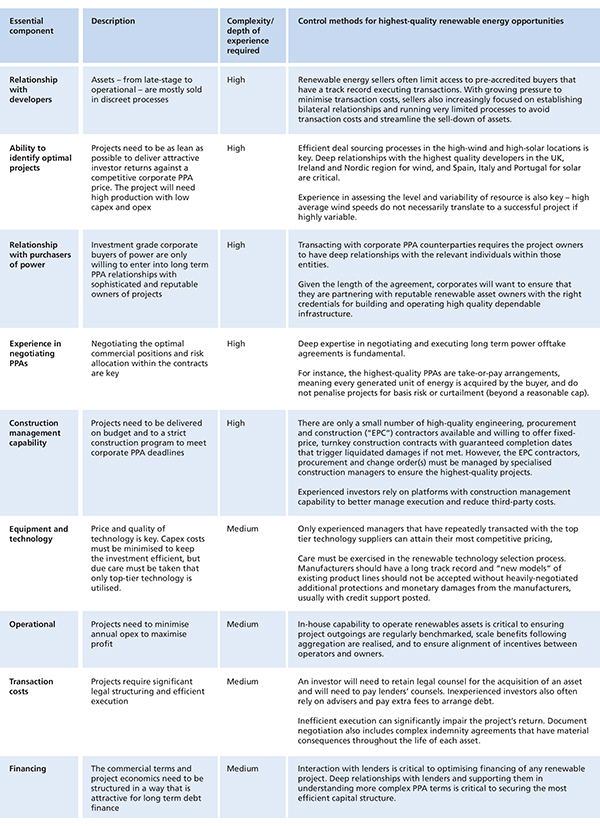

Structuring investments in renewables projects with credit-worthy corporate PPAs is highly complex. It typically requires a manager to piece together a number of separate components to form a commercial structure that provides investors with the long term fixed revenues that they seek. Each component is addressed in turn in the table below (Table 1).

Table 1: Essential components for structuring investments in PPA-backed renewables

Conclusion

Over the last fifteen years, long term fixed-price subsidies for renewable energy infrastructure in Europe have attracted substantial volumes of low-cost capital to the sector. This has underpinned a period of tremendous growth and cost rationalisation, bringing the industry to its current level of maturity. The recent trend of governments withdrawing subsidies from the sector is a signal of the industry’s success; renewable power infrastructure in specific parts of Europe can now, under the right management, compete directly with conventional fossil-fueled technology in providing a country’s new power generation capacity. The challenge to delivering this competitive infrastructure lies in attracting lower risk capital in a world without subsidies. This requires renewable energy managers to leverage the growing demand for renewable-sourced power, particularly from corporates, to structure attractive, long-term de-risked revenue streams for investors in renewables projects through structured PPA arrangements.

The full value of this asset class’ risk-return profile is not easily accessible to all investors. The identification, optimisation, construction, operation and financing of projects that deliver attractive risk-adjusted returns in the new world requires specialised knowledge across many aspects of power market operation. This includes financing, engineering, development and contracting, as well as deep industry relationships. It is imperative to partner with an experienced industry specialist who can address the risks that less experienced investors may face when identifying the highest-quality renewable projects, and understanding (and pricing) the nuances that make these assets most suitable for long term investors.

1. Source: Portfolio Institutionell Magazine, Allianz Capital Partners (2012). Past performance and projected performance is not a reliable indicator or guarantee of future results.

2. Source: “Solar Modules to Get Even Cheaper and More Efficient.” Bloomberg New Energy Finance. May 30, 2017.

3. Source: CEI internal database, based on current and historic solar investments.

4. Levelised Cost of Energy is the net present value of the unit-cost of electricity over the lifetime of a generating asset. It is often taken as a proxy for the average price that the generating asset must receive in a market to break even over its lifetime.

5. Source: Levelised Cost of Energy Comparison and Visualisation. 1H 2018 LCOE Global Report. Bloomberg New Energy Finance.

6. The CEI Team has a long track record in negotiating PPAs for its underlying renewables assets. In 2017, the Team agreed to a deal with Switch to offtake power from a portfolio solar projects in the US https://www.capdyn.com/media-events/press-releases/switch-announces-rob-roy-s-gigawatt-nevada-the-largest-solar-project-in-the-united-states/

7. Source: Bloomberg NEF. Note: Data is through July 2018. Onsite PPAs not included. APAC number is an estimate. Pre-market reform Mexiko PPAs are not included. These figures are subject to change and may be updated as more information is made available.

8. Source: Poyry Consulting Q2 2018 Forecast GB Power Prices – High, Central and Low Case forecasts. Corporate PPA price based on CEI Team market knowledge and recent transactions.

More Related Content...

|

|

|