Striking the right balance for durable income: blending art with science

Written By:

|

Damien McCann |

|

Joseph Roberts |

Multi-asset credit portfolio manager Damien McCann and risk and quantitative solutions specialist Joseph Roberts from Capital Group discuss how active management and sector flexibility enhance income generation, with high-quality corporate bonds offering resilience amid geopolitical and economic shifts

Increasing deglobalisation, geopolitical uncertainty and the transition toward renewable energy makes it unlikely we will see a return to a low inflation environment. As such, policy rates and bond yields are widely expected to remain structurally higher and closer to the levels seen during the 1990s than those of the post global financial crisis (GFC) era. In turn, this provides a strong and supportive backdrop for healthy income generation across fixed income markets, including high-quality corporate bonds.

The return to a higher-yield environment allows for a more balanced and diversified approach to generating a more resilient high total return. Unlike the low inflation and low yield era of the 2010s, this can be achieved without the need to concentrate risk in select corners of the market. Instead, a diversified and balanced portfolio, with flexibility to adapt to changing conditions without compromising risk, can generate attractive risk-adjusted results. The rise in yields means such a portfolio can include significant allocations to more liquid, high-quality bonds.

This is the argument behind a fixed income strategy that seeks income from a variety of different sources.

The engine behind a multi sector credit approach

A successful multi-asset credit strategy is built on the foundation of its neutral allocation/reference index – i.e. ultimately solving for the outcome investors want to achieve. From this neutral allocation, flexibility with clear risk guardrails can allow active positions that respond to changing conditions while ensuring an appropriate risk profile . Building the reference index is therefore not a passive consideration but the first step in portfolio construction.

Finding the right neutral asset allocation blends science and art. For a portfolio seeking a higher income, we suggest a reference index with allocations to four distinct areas of fixed income: investment grade and high yield corporates, emerging market debt and securitised credit.

In addition to different fundamental drivers, each market also offers a range of credit ratings and maturities (high yield and securitised debt typically have shorter maturities while emerging market debt and investment grade bonds tend to have broader issuance across the curve) that further help increase the diversification of the reference index.

Allocating across the four sectors provides opportunities to target relative value across the entire yield curve, which in turn, means credit and interest rate risk can be more effectively managed, helping to stabilise returns. Similarly, targeting different quality bonds through the cycle can help reduce overall portfolio risk.

Striking the right balance

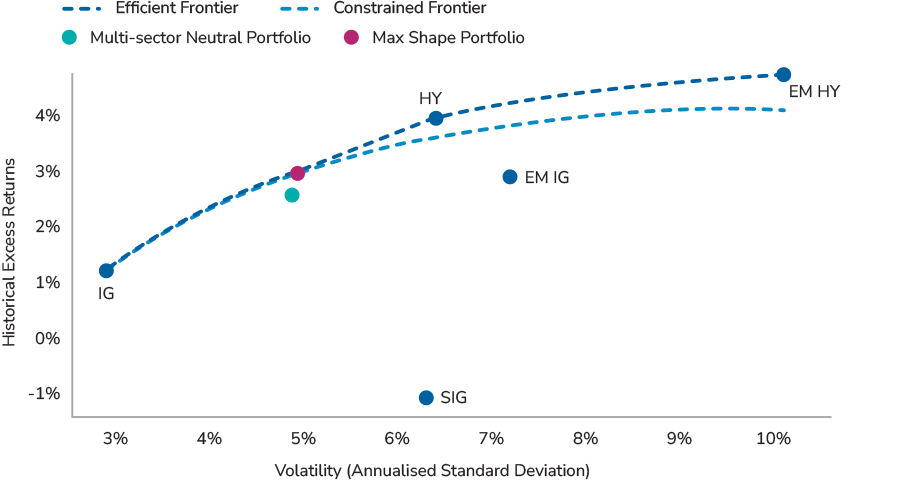

Efficient frontier analysis is commonly used as a means to help define an “optimal” portfolio based on historical risk and returns. However, on their own, efficient frontiers can often create unrealistic portfolios that potentially act inconsistently through time. As an example, when ranking the returns of the major credit sectors by calendar year, there is no consistent winner. This is also one of the reasons we believe flexibility and active management are crucial to optimise results.

As shown in Figure 1, allocating to high yield has increased a portfolio’s total return. This should not come as a surprise as, ultimately, the total return of a bond is driven by starting yield and coupon, which by definition are high for high yield corporates. This is why the highest allocation within our strategy is to high yield. However, also including high-quality investment grade helps reduce volatility and optimise risk-adjusted returns – i.e. the Sharpe Ratio.

Figure 1: Figure 1: Excess Return Efficient Frontier: 02-2005 through 07-2024

Source: Portfolio Analytics, Capital Group. Data as at 16 July 2024.

High yield is Bloomberg US high yield index 2% Issuer Capped, IG is Bloomberg US Corporate IG Index, EM HY is JP Morgan EMBI Global Diversified HY Index, EM IG is JP Morgan EMBI Global Diversified IG Index. SIG (Structured Credit) is Bloomberg Custom 80% US CMBS Non-Agency ex AAA/20% US ABS ex AAA index from 1 October 2023; before that date it was 80% Bloomberg CMBS ex AAA/20% Bloomberg ABS ex AAA.

While high yield and investment grade are the two most important credit buckets, allocating to these is just the starting point. To achieve an optimal portfolio, we think it is important to broaden the allocation to other sectors: adding structured credit can help achieve some interesting results, for example.

As shown in the Figure 1, structured credit (SIG) did not provide attractive risk-adjusted returns over the past 20 years. This is the result of the massive sell-off and volatility experienced by the asset class during the GFC. However, looking at the data more closely, it is clear there were long periods – pre GFC (2005-2007) and GFC to Covid (2011-2020) – where structured credit provided one of the best risk-adjusted returns in bond markets. These results support the case for it being included in an optimal portfolio, a viewpoint, strengthened by the fact the asset class has shown a low correlation to other areas of the credit market1.

Our view is that including some securitised credit in can provide significant diversification benefits and help generate attractive risk adjusted returns.

Emerging market debt has also delivered attractive results with good diversification in different market environments. However, emerging market debt can be concentrated in a number of large countries so a substantial allocation could limit broader diversification. Furthermore, while index level data can provide good proxy for these markets, it is important to realise emerging markets are not monoliths, they are relatively fragmented and bifurcated. For the active investor, this provides plenty of idiosyncratic opportunities.

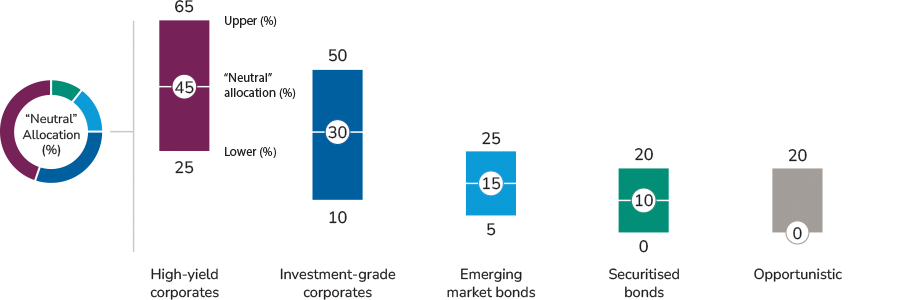

Through a combination of art and science, we arrive at the neutral allocations, as seen in Figure 2.

Figure 2: Capital Group model of diversification across income sectors

The allocations illustrated indicate the typical range within which a sector will be represented. ‘Neutral allocation’ reflects the allocation under normal market conditions. The managers have the option to invest in other areas in an opportunistic way if they identify particularly attractive opportunities, but this typically remains a small part of the overall allocation. This may include, but is not limited to, US government debt, municipal debt and non-corporate credit, in response to market conditions.

Creating a neutral portfolio with balanced risks across various sectors allows an investment team to use their expertise to actively rotate through sectors and produce a return profile consistent with what investors expect. However, it must be accompanied by guardrails (clear upper and lower limits across the four different sectors), which help prevent the portfolio deviating too far from the original neutral allocation.

Based on the analysis of market sectors over multiple decades, the relative valuation between sectors has mean-reverted – values move back towards their long-term average over time. This pattern happens because of a combination of economic and market cycles as well as underlying borrower behaviour.

Given this past behaviour, we have often taken a counter-cyclical approach to sector allocation. This means we usually aimed to reduce exposure to higher-yielding, lower-quality sectors after periods of spread tightening and strong results. Simultaneously, exposure to less-risky, higher-quality sectors such as investment grade was increased as they had tended to offer better relative value despite the overall lower spread. We then typically looked to add back the exposure to higher-yielding, lower-quality sectors such as high yield after a period of spread widening and underperformance, in anticipation that spreads would likely normalise if fundamentals improved.

Conclusion

A regime of structurally higher rates allows for a more balanced approach across fixed income sectors between high yielding and high-quality bonds. The latter, unlike in the recent past, now offer an attractive level of yield while also providing diversification and resilience in periods of market stress.

Although a mix of traditional high yield and investment grade corporate bonds has historically exhibited the highest Sharpe Ratio portfolio over the long term, there have been periods in which asset classes such as securitised credit and emerging markets bonds have provided strong risk-adjusted results. This is why it is important to use these as returns enhancers and diversifiers, although active investors, must also be cognisant of liquidity.

1. Excess return correlations for structured credit between February 2002 and July 2024 are 0.36 versus high yield, 0.31 versus investment grade, 0.24 versus emerging market investment grade and 0.28 versus emerging market high yield.

Risk factors you should consider before investing:

This material is not intended to provide investment advice or be considered a personal recommendation.

Statements attributed to an individual represent the opinions of that individual as of the date published and may not necessarily reflect the view of Capital Group or its affiliates.

Invested capital is at risk. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

In the UK, this communication is issued by Capital International Limited, authorised and regulated by the UK Financial Conduct Authority.© 2024 Capital Group. All rights reserved.

More Related Content...

|

|

|