Strategies for managing equity risk

Written By:

|

Madeline Forrester |

Madeline Forrester of MFS Investment Management outlines the advantages that a well-managed low volatility equity strategy can bring to LGPS funds

Within the Local Government Pension Scheme (LGPS), it is fair to say that equities remain the engine of the growth portfolio. However, after interest rate and inflation risk, equity risk remains the largest source of investment risk for the LGPS.

The traditional method of reducing equity risk without sacrificing the returns from equities that schemes continue to need, is to increase the level of diversification. In this context, Diversified Growth Funds “DGFs” can provide some clear and distinct advantages to certain types of investors. The strongest arguments I often see being made by proponents of DGFs generally fall under three broad (and highly inter-related) theoretical advantages that they are said to provide:

- A “governance” solution; for investors who believe in the benefits of diversification, but perhaps face constraints on time, internal resources or access to expertise to manage a properly diversified investment portfolio

- A “scale” solution; allowing investors with smaller pools of capital to benefit from a level of diversification that would be very difficult for them to generate on their own

- An “access” solution; providing an in-road to certain types of niche asset classes which are often difficult to access and manage

While there has been much discussion around whether DGFs have delivered on their risk/return objectives in practice over their long-term history, the real question in our mind is how valuable these DGF advantages will be in the new world of the LGPS going forward. The new pools will surely have the governance, scale and access required to build their desired return-seeking portfolios in more direct, transparent and cost-effective ways.

In any case, the purpose of this article is not to discuss the place of DGFs directly, but to focus on something that takes a different approach to tackling the root cause of the problem (equity risk); and works well alongside a DGF product or as part of a “build your own” diversified return-seeking portfolio. And that something is “low volatility equity”.

What do we mean by low volatility equity?

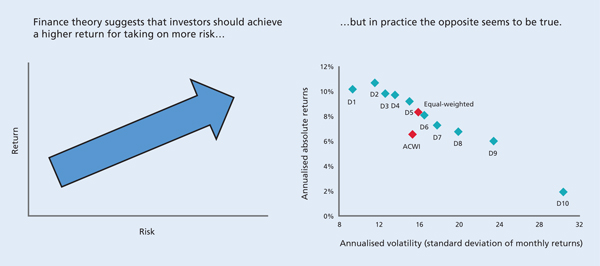

As with much of the jargon used in our industry, the term “low volatility” can be interpreted in many ways. In theory, targeting low volatility stocks should not generate a better outcome. The axioms of finance are built on the premise that investors demand more return for more volatile investments. Therefore, excluding or avoiding volatile stocks should lead to a commensurate fall in expected return.

However, well documented empirical evidence suggests that a “volatility anomaly” exists in financial markets. Although it seems counterintuitive, high-volatility stocks actually consistently underperform over the long run, as seen in Figure 1. The chart on the right of Figure 1 shows average annualised returns for equities based on their level of volatility where D1 represents the least volatile equities and D10 represents the most volatile.

Figure 1: High volatility stocks consistently underperform over the long run

Source: As at 30 September 2016. FactSet Universe defined as the 1,000 largest US stocks, 400 largest Japan, 600 largest developed Europe, 200 largest Emerging Markets, and 200 largest Asia-Pacific ex-Japan, by market capitalisation. Returns are relative to that universe. Based on USD returns linked monthly. Volatility based on average monthly standard deviation of USD returns using past 24-months, maximised at 50.

Various explanations for the low-volatility anomaly have been offered based on research studies and industry observations, among them behavioural biases such as overconfidence, availability, and herding. Structural developments are also an important consideration, such as the impact of the increased usage of derivatives and exchange-traded funds to name a few.

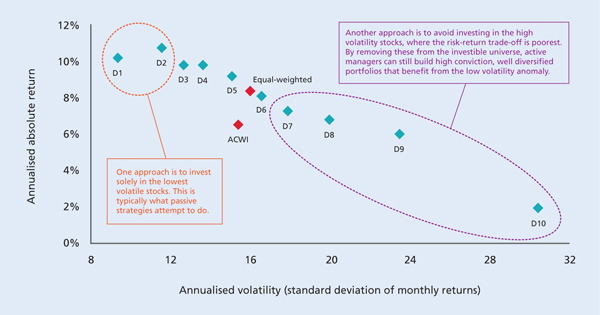

One aspect of the low-volatility anomaly we believe is worth focusing on is how to correctly interpret and act on it. In order to illustrate this clearly, see Figure 2, which builds on the chart on the right of Figure 1.

Figure 2: The “so what?” – how could you react to the low volatility anomaly?

Source: As at 30 September 2016. FactSet Universe defined as the 1,000 largest US stocks, 400 largest Japan, 600 largest developed Europe, 200 largest Emerging Markets, and 200 largest Asia-Pacific ex-Japan, by market capitalisation. Returns are relative to that universe. Based on USD returns linked monthly. Volatility based on average monthly standard deviation of USD returns using past 24-months, maximised at 50.

One way of attempting to build a low volatility equity portfolio would be to target the least volatile stocks. In Figure 2, this would be to target those stocks in the very lowest volatility deciles (D1 and D2). This is often characterised as a “minimum variance” approach, a technique that is often used by passive strategies. The benefits of this simple, rules-based approach is that it often carries a fairly low fee, and you are not paying an active manager to exploit a well-known long-term anomaly. The main disadvantage is that, as with all such market anomalies, the markets eventually recognise this disconnect and the return advantage is eroded away over time. We have already begun to see signs of this, as equities with the lowest levels of volatility, which are typically concentrated in highly defensive sectors, have experienced a crowding effect in recent years and now carry relatively high valuations by historical standards. This approach also ignores underlying stock fundamentals and does not factor in any forward-looking expectations or analysis.

Another way of building a low volatility equity portfolio is to avoid the highest volatility stocks. For example, in Figure 2, this could be done by excluding all stocks within the volatility deciles D7 to D10 from the investable universe. The resulting universe (in this example D1 to D6) is still broad and deep enough for an active manager to build a robust portfolio, and it is also one that still benefits from the low volatility anomaly.

In general, low volatility equity strategies aim to provide protection during an equity market downturn in exchange for giving up some return potential when equity markets rise. There are many different approaches that investors can choose from, ranging from active to passive; qualitative to quantitative; physical to synthetic; and many other combinations in between.

As with all investment decisions, it is imperative that investors stay true to their objective and rationale for choosing a lower volatility equity strategy, or risk getting overwhelmed by the range of different options to choose from.

How does it work alongside other typical LGPS investments?

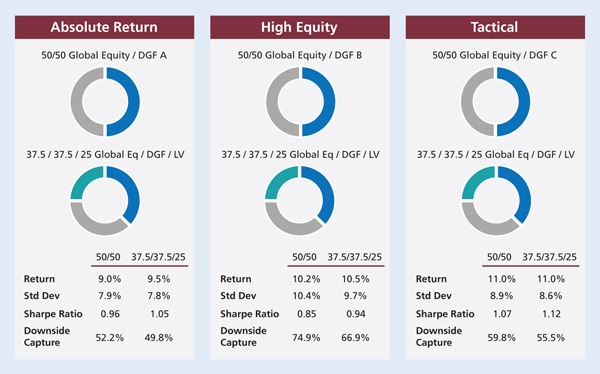

Amongst the many considerations LGPS funds take into account is whether a new investment strategy is additive at the total scheme level. As evidenced in Figure 3, adding a low volatility equity strategy to a typical portfolio structure – which we have simplified to a 50:50 split between a DGF and passive equity – increased return and reduced risk at the aggregate level.

Why is this particularly important for the LGPS?

Against the backdrop of increasing investment complexity and low yields, the LGPS, like most pension schemes, may find it harder and harder to generate the returns required to meet their funding objectives.

Low-volatility strategies may be part of the solution, simultaneously providing exposure to the equity markets with more explicit risk management objectives.

This could be particularly relevant in the early stages of pooling, where the pools will be keen to build up credibility with the underlying funds, and therefore may be more anxious than usual to minimise downside risk. In addition, for those pools that initially lack the capability to run money in-house, low volatility strategies can offer an attractive way to access a broad, low cost, risk averse equity strategy.

Figure 3: Low volatility equity combined with three different types of DGF Historical data and hypothetical results (Jan 09 – Sep 16)

Source: Morningstar Direct observed historical risk and return patterns from Jan 2009 to September 2016 (the longest common time period of indexes used)

Asset Class Proxies: Global Equity – MSCI ACWI NR USD (converted to GBP, GBP-denominated version of the index unavailable), UK Equity – FTSE Allsh TR, Global Bonds – Barclays Global Aggregate TR, UK Gilts – FTSE Gilts All Stocks TR, DGF proxies used as a basis for modelling were identified based on a combination of investment objective, AUM, and length of track record, DGF A – SLI Global Absolute Return Strategy, DGF B – Schroder Diversified Growth, DGF C – Baillie Gifford Diversified Growth, Low Volatility Equity – MSCI ACWI Minimum Vol

Summary

Overall, a well-managed, low volatility equity strategy should be aligned to the LGPS’s future requirements and objectives. These strategies are typically liquid, transparent, lower cost ways of seeking to reduce risk, while still retaining equity exposure. They can complement alternative asset classes, and have the capacity and scalability that the new pools will demand. Low volatility strategies may also help pools establish credibility early on by helping to reduce deficits while taking acceptable levels of risk.

More Related Content...

|

|

|