Strategic asset allocation in a post-pooling world

Written By:

|

Karen Shackleton |

Karen Shackleton of MJ Hudson Allenbridge says that the triennial review due in March 2019 will provide an excellent opportunity for the reassessment of asset allocation strategies

With the fast-approaching March 2019 triennial valuation date on the horizon, LGPS officers and members will soon need to start thinking about their strategic review. The triennial valuation presents a good opportunity to reassess the investment strategy and the asset allocation to ensure that it remains fit for purpose, in light of the updated valuation data.

By the time March 2019 comes around, LGPS funds should have a good proportion of their assets in their chosen pool, or as a minimum, they should have an expected timeline of when those assets will be transitioned across. The pools are all at different stages of development, they are prioritising different asset classes; some will be focusing on internally managed funds, others on externally managed funds. The degree of granularity being offered by pools will also vary and this will impact the strategy review. So how should members and officers go about preparing for this important task?

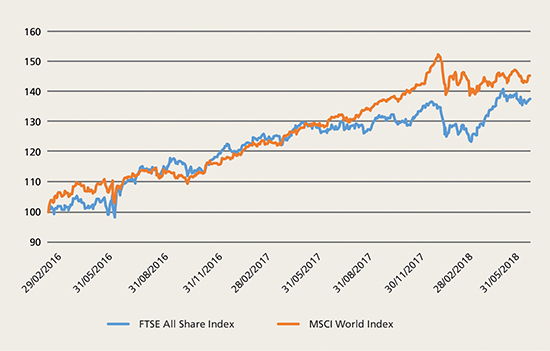

Figure 1: Cumulative performance of equities since March 2016

Source: Bloomberg

Indices: ASX Index; MXWO Index

Since the last triennial valuation in March 2016, equity markets have risen substantially, with UK equities increasing by 37.6% and global equities by 45.3%. It is likely that the return on the investment portfolio will be well ahead of any assumptions made by the actuary in 2016, simply because of the strong bull market that has been seen around the world. All other things being equal, this should lead to an improvement in funding positions for most LGPS. Indeed, many funds have been implementing protection strategies to guard against markets falling between now and March 2019, so that they can lock in those gains.

The strategic review will be a good opportunity to de-risk the portfolio, by reducing the equity allocations and switching into lower volatility asset classes. LGPS funds can prepare for this expected de-risking by looking at the range of lower volatility sub-funds that their pools offer (or plan to offer in the future) and begin member training around some of these. Pools, in turn, should be anticipating this likely trend towards de-risking by thinking carefully about which sub funds they plan to offer, and by when. They should also be thinking about the transition process around that, and communicating with member funds about how to achieve cost efficiency by working collaboratively as any common de-risking decisions begin to roll out.

Working with your consultant

A key difference between asset liability modelling work undertaken in March 2016 by investment consultants, and the exercise that will be undertaken in March 2019, is that the level of granularity available to LGPS funds is going to reduce, post pooling. There will also be differences between sub-funds on offer in a given asset class, from pool to pool. Investment consultants will need to take that into account in their recommendations for the new strategic asset allocation and implementation.

Let’s take active equities as an example. According to their website, Brunel Pension Partnership (BPP) plans to offer the following sub funds:

- UK equities

- Core global equities

- High alpha global equities

- Low volatility global equities

- Sustainable equities

- Smaller companies

- Emerging market equities

Border to Coast, on the other hand, plans to offer:

- UK equities

- UK equities alpha

- UK equities alpha plus

- Overseas developed equities

- Overseas developed equities alpha

- Global equities alpha

- Global equities alpha plus

- Emerging market equities

Whilst there is some overlap, the risk/return characteristics of these sub-funds will differ between the two pools, and the investment consultant will need to take these differences into account when recommending a new strategic asset allocation. (These two pools are cited as an example only of the differences, and no comment is being made on the specific range of funds being offered – these will have been offered after intensive dialogue with member LGPS funds).

Pensions committees will need to discuss their strategic review with their investment consultant in the context of the range of sub-funds being offered or planned by their pool. Across the industry as a whole, the output (i.e. the end asset allocation) is unlikely to look the same as in previous strategy reviews, where consultants would recommend a broadly common shift away from one asset class into another. Going forward, there can only be that commonality between member funds of the same pool, or where pools have similar sub-funds on offer.

The importance of effective transition management

An effective, efficient transition of assets from the underlying LGPS funds to their chosen pool is essential. This is the biggest expense that the LGPS could face, other than manager fees. The pools are already beginning to hire their transition managers to carry out the transactions, but member funds will need to ensure that each transition that they make is monitored carefully, so that the transitions manager can be held to account for any deviation from the agreed strategy. In short, transition management is one of the biggest threats to investment performance at this crucial time.

Training members ahead of time

The best governed LGPS funds are those who invest heavily in training. This allows them to make informed decisions. Going forward, that training will need to prioritise the importance of the asset allocation decision. For example, pensions committees should ensure that they fully understand the implications of de-risking for their fund, why it is likely to be recommended by their investment consultant, the associated impact on future deficits and contribution rates, and the relationship between de-risking and the actuarial valuation. They also need to understand the role that the pools have in implementing the strategic asset allocation, how they (as a committee) should be monitoring and challenging the pool, and what they will no longer be responsible for. Agreed, most pensions committees have a broad understanding of this already, but the devil is always in the detail, and an ongoing process of learning in a post-pooling environment will undoubtedly be necessary.

Is the future rosy, or not?

We are entering a transitionary phase with pooling: the onboarding of all LGPS assets into their chosen pools will take time and the journey is unlikely to be completely smooth. This process will be aided if pensions committees are able to maintain a strategic perspective and have confidence in the team (pool) implementing their strategy and provided the pool’s management of the sub-funds is effective. If this is the case, then in four years at the next triennial valuation, we may well look back and be heartened by how far we have come.

More Related Content...

|

|

|