Social infrastructure: one asset class, multiple returns

Written By:

|

Raymond Jacobs |

Investing in social infrastructure such as schools and hospitals can deliver steady returns to investors and many benefits to communities. Raymond Jacobs of Franklin Real Asset Advisors explains why opportunities for investing in this asset class have never been greater

Social infrastructure holds communities together and determines our quality of life. But governments across Europe have for many years been struggling to meet the growing demand for the building blocks of strong communities, such as affordable housing, schools and sports facilities, libraries and fire stations, hospitals and nursing homes.

Now this gap between need and supply is providing a double opportunity for institutional investors: by participating in new financing models they have the chance to strengthen both their portfolios and their reputations.

Mind the gap

After the financial crisis, government cutbacks opened an investment gap in social infrastructure estimated at €150 billion a year by the European Investment Bank. That is more than 40% of the estimated annual €350 billion required to keep up with demand. The funding gap is particularly acute in healthcare, housing and education. We all know about the consequences of this shortfall: health systems in crisis, unaffordable housing, run-down schools, not enough nursing homes for our elderly.

Increasingly, the private sector is stepping in to bridge the investment gap. Between 2009 and 2016, private investment in social infrastructure grew to $247 billion, according to Preqin data and McKinsey. Of the 1,264 deals completed globally, 71% were in Europe – the top region for this growing asset class.

With public finances still under strain, expectations for partnerships between public and private sectors in social infrastructure are soaring. This in turn will improve the liquidity of social infrastructure assets, and, in our view, deliver a steady stream of investment opportunities for fund managers.

Investing for financial and social impact

In addition to stable, long-term returns, social infrastructure assets offer a second opportunity to institutional investors – the chance to make a positive contribution to local communities.

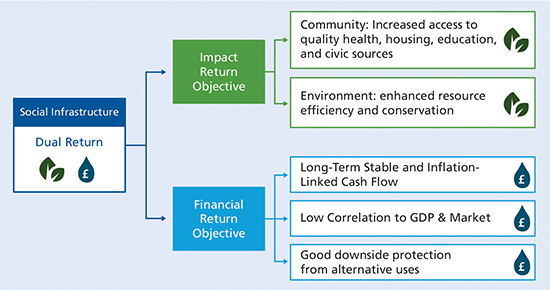

In many instances, social infrastructure investments are naturally aligned with both financial return and the social and environmental impact on the local community. Each reinforces the other. Investments that directly improve the utility of the space for occupiers and visitors can both improve the quality of social services being provided and increase the value of the social infrastructure asset.

Local partnerships can be created that enhance the experience of stakeholders. For example, working with a local school to have students volunteer time at a nursing home facility can create a more enjoyable experience for the elderly, thereby increasing demand for that facility in the community. Another example of a win-win involves making energy efficiency upgrades. These improvements can cut service costs while reducing greenhouse gas emissions.

Investing in social infrastructure with a focus on impact can not only deliver market-rate returns, it can also create financial resiliency that improves financial results.

Figure 1: Social impact return …and financial return

Source: Franklin Templeton Investments

Growing opportunities in Europe

In the coming years, private and institutional investors are likely to play a growing role in building and managing social infrastructure assets in Europe, due to continued public investment constraints, government divestments and policies to encourage private sector participation.

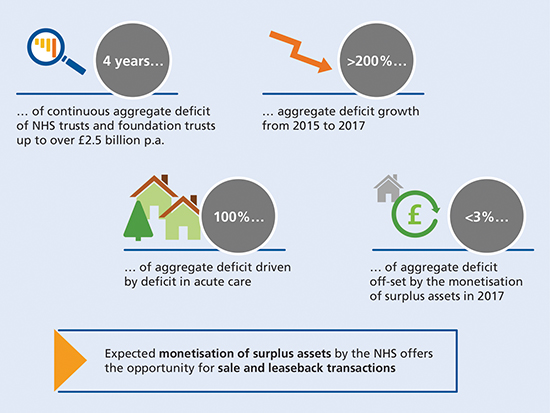

In the UK, for example, a recent independent review1 recommended the sale of surplus land and properties belonging to the National Health Service to raise additional funding for acute care, where costs far outpace allocated resources. The review estimated the NHS could raise as much as £5.7 billion from the sale of land and properties, in addition to saving on the maintenance of buildings. The proposal appears to open new opportunities for property asset managers, including the sale and leaseback of healthcare assets.

Figure 2: Privatisation of healthcare assets in the UK

Source: NHS Improvement (2016-17, 2017-18)

Other countries in Europe, including Spain, Ireland, Greece and Portugal, already use public private partnerships to supply a large proportion of new healthcare infrastructure, such as hospitals. The sale of NHS land in the UK might also deliver collateral social benefits: it could be used to build much needed affordable housing and begin a virtuous cycle as, in the long run, better housing nurtures healthier families, which results in lower healthcare costs.

Across Europe, the private sector is likely to become more involved in filling the significant vacuum in low-cost housing investments, opening up new opportunities for social impact investors.

Risks and challenges

Social infrastructure investments, however, are not without their challenges. They face specific risks related to political and regulatory exposure. For example, governments can modify the standards of service expected from privatised facilities, the length of their leases or concessions, or the level of risk-weighted returns on capital outlays. Also, when the public and private sector share risks, the responsibility for future liabilities is sometimes blurred.

The social infrastructure opportunity

Even with these risks in mind, it is clear that social infrastructure as an asset class will continue to grow in size and relevance for investors aiming at both a financial and an impact return. The need for more and better social infrastructure is clear, as are government efforts to encourage private investment in its delivery. This growing asset class will allow property funds to diversify their portfolios while pursuing a dual investment objective: to earn steady, non-cyclical returns and to make a positive impact by helping to build stronger communities.

For professional client use only. Not for distribution to retail clients.

This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of any of the Franklin Templeton Investments’ fund ranges. Nothing in this document should be construed as investment advice. The value of investments and any income received from them can go down as well as up, and investors may not get back the full amount invested. Past performance is not an indicator or a guarantee of future performance.

Franklin Templeton Investments have exercised professional care and diligence in the collection of information in this document. However, data from third party sources may have been used in its preparation and Franklin Templeton Investments has not independently verified, validated or audited such data. Opinions expressed are the author’s at publication date and they are subject to change without prior notice.

Any research and analysis contained in this document has been procured by Franklin Templeton Investments for its own purposes and is provided to you only incidentally. Franklin Templeton Investments shall not be liable to any user of this document or to any other person or entity for the inaccuracy of information or any errors or omissions in its contents, regardless of the cause of such inaccuracy, error or omission. Investments entail risks.

Issued by Franklin Templeton Investment Management Limited, Cannon Place, 78 Cannon Street, London EC4N 6HL. Authorised and regulated by the Financial Conduct Authority. © Copyright 2018. Franklin Templeton Investments. All rights reserved.

1. Sir Robert Naylor, “NHS Property and Estates: Why the Estate Matters for Patients” March 2017

More Related Content...

|

|

|