“Smart beta” or just “dumb alpha” for corporate bonds?

Written By:

|

John Atkin |

Today the phrase “smart beta” seems to be more used than ever. From The Economist to the FT, the financial press is abuzz. But what exactly is it? What do the strategies do, and do they work for fixed income? In this article, we’ll aim to deliver our critique of the corporate bond smart beta phenomenon, and offer alternative ideas for alleviating the issues that the strategies aim to tackle.

What is smart beta and where did it come from?

In the 1950s, Harold Markowitz became the father of “Modern Portfolio Theory”, which put forth the concept that holding negatively correlated assets reduced a portfolio’s risk. By the 1960s, this led to the Capital Asset Pricing Model, which is where the term “beta” (without the ‘smart’) first appeared.

Put simply, beta represents the risk and return of a “fully diversified market portfolio”, immune to “specific risks”, like an unpredictable BP-oil-spill style catastrophe. Instead, it’s only prone to “market risks” – like the economy faltering.

In practice, investors usually attempt to capture “beta” by passively managing a portfolio against a market-capitalisation weighted (market cap) benchmark. Later, in 1968, Michael Jensen introduced “alpha”, which represents outperformance. So if beta is delivered through passive management and alpha through active management, where does “smart beta” come in?

The term itself has no academic heritage; instead it’s a blanket slogan for a type of strategy which aims to deliver “the fully diversified market portfolio” more effectively than a traditional benchmark.

Why the need? Because market cap equity indices are not necessarily a “fully diversified” investment. For example, at one point last year, Apple made up 20% of the entire NASDAQ, an index of 100 stocks. What’s more, some quantitative analysis indicated that the stocks with the highest market cap were more likely to underperform their index. Consequently, a dizzying array of smart beta strategies arrived, typically involving analytics and screening to build passive portfolios of stocks weighted by almost anything other than market cap. And it’s probably fair to say that some of these equity strategies may have succeeded in delivering a better “diversified market portfolio” and therefore – a better beta. But what about in fixed income?

Fixed income and smart beta – do they go together?

While a single equity is capable of dominating an index, there is a notion that this problem is worse in the corporate bond world. The argument goes: by definition, the most indebted issuers will occupy more of a given credit index than anyone else – simply because they have the most bonds outstanding.

But this is a myth. Don’t forget that there are no credit analysts simply concerned about a company’s absolute level of debt. Far more important are factors like the issuer’s ratios of debt to equity, the industry it operates in, and a whole host of other considerations.

As it turns out, the most active investment grade bond issuers simply tend to be the largest companies. And (when comparing like with like) larger issuers actually tend to have lower debt ratios (or leverage) than smaller issuers. So it’s simply not true to say that indices are biased towards those most burdened by debt.

Having said that, it doesn’t mean fixed income benchmarks can’t be improved, but we think the scale of the problem has been greatly exaggerated. Whereas it’s possible for a single stock to grow to 10-20% of an equity index, a single corporate bond issuer will hardly ever breach 4%. That level of exposure can still be undesirable, but it’s fixable simply by limiting the weighting of any one issuer.

So if it’s possible to improve bond benchmarks, is there still a case for throwing them out entirely in favour of something like a smart beta strategy? For some investors, the undeniably poor performance of benchmarks during the financial crisis is reason enough, which leads us on to our next section.

Bond benchmarks – were they to blame during the financial crisis?

For investment grade corporate bonds, 2008 was the worst year since records began. But because bonds are supposed to be stable, predictable assets, benchmarks came in for a great deal of criticism for delivering equity-style volatility that year.

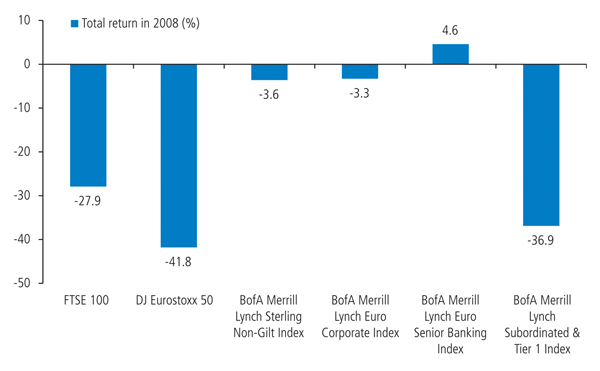

Looking back at the raw data, it’s clear that a lot of this criticism was simply not justified. Figure 1 shows how different bond and equity indices performed in 2008. While blue chip equities lost 30-40%, investment grade bond indices lost less than 4%.

This data may seem surprising, because so many remember investment-grade bond funds suffering total returns of -15% to -20% in 2008. In reality, those funds just underperformed their indices.

But how did certain bond funds underperform their index by as much as 17% in a single year? The main culprits were substantial overweight positions in one investment grade sector in particular – subordinated financials – as represented by the sixth column.

Subordinated bond holdings get wiped out when a bank fails, right after the equity holdings, which explains why they behaved just like equities during 2008. It’s worth noting that it’s specifically the subordinated bonds which were responsible for the dire performance of many active managers. All too often, the blame is levelled at all financials. But in 2008, as shown, European senior financial bonds actually outperformed investment grade indices.

If the indices had excluded subordinated financials, it might have saved many investors a great deal of pain.

Figure 1: Performance of investment-grade benchmarks compared to equities benchmarks

Source: Bloomberg, Merrill Lynch (UKX Index, SX5E Index, UN00 Index, ER00 Index, EB3A Index, EBSS Index), 30 June 2013

A critique of typical smart beta approaches

We’re not sure if smart beta strategies actually solve the diversification issues we identified earlier. A typical investment grade bond index contains around 350 names, but smart beta strategies usually attempt to screen the “best” 100 to 150. But even the greatest analysts or screening processes in the world have little chance of predicting events like the BP oil spill, or the tragic Japanese tsunami, so doesn’t it make sense to spread your specific risks across more names rather than less? Owning more will surely help to minimise the potential impact of entirely random disasters.

As discussed earlier, the concept behind beta is to deliver the “fully diversified” market portfolio, while alpha is about delivering superior returns to that portfolio by stock picking. So surely using detailed analysis to pick 150 names out of 350 isn’t in the spirit of beta at all? Shouldn’t it be labelled and considered active management?

Certainly smart beta fees at least tend to be closer to active rather than passive ones. And this is our largest issue with smart beta. If a client pays (let’s say) 70% of an active fee, shouldn’t they expect 70% of the outperformance? We think they should, but smart beta strategies don’t aim to deliver any outperformance at all, firstly because that would explicitly be an “alpha” strategy, and secondly because they attempt to screen “healthy” credits, rather than attractively priced ones.

Is a “better beta” possible?

Benchmarks can certainly offer better diversification and tailoring them in a way that caps their exposure to single issuers could allow for effective diversification across the full index, and genuinely passive fees. This approach is applicable to active management too, in that a manager could be tasked with delivering alpha against a tailored benchmark. Even better if the benchmarks themselves were improved along the lines outlined above, then the cost of tailoring them would be eliminated.

Removing bonds which may behave like equities during times of economic stress is also worth considering, as these securities are liable to perform with equity-style volatility during times when investors really need their bond portfolios to be stable and somewhat reliable.

Bond benchmarks can definitely be improved, but we don’t feel that smart beta strategies are a better option, and some do indeed look like “dumb alpha”. While bond benchmarks are not always necessary, much of the criticism they have come in for is unfair. By throwing them out too rashly you can lose a key tool which allows a client to be able to measure just to what extent their manager is justifying its fees.

The value of investments can fall as well as rise. This article reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. The distribution of this article does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|