Smart beta investing and the benefits of rebalancing

Written By:

|

Stuart White |

Stuart White of HSBC Global Asset Management analyses the impact of regular rebalancing on a portfolio.

Investment management has long been viewed as either passive or active management. Passive seeks to track a reference index and deliver performance net of fees as close as possible to the performance of that index. Active management seeks to outperform either an index or an absolute return benchmark such as the return on cash. The fairly recent introduction of smart beta has put this two-sided relationship in flux. Smart beta offers a third solution: the transparency, reliability and low cost of passive management associated to the potential outperformance of active management.

In the case of equities, this is made possible by ignoring indices constituted by weighting companies in proportion to their market capitalisation. The FTSE 100 index, for example is a market capitalisation index, where each constituent of the index has a weighting based on how large the company’s size is. The FTSE 100 index was created back in the mid 1930’s, which shows how share price has been the standard “brick” in index construction for decades. But the design is not without flaws. Such indices are prone to bubbles wherein stock prices seem to lose connection with rational valuations, often for periods of several years.

Smart beta looks to avoid such bubbles by a variety of methods, of which the common theme is breaking the link between share prices and index weighting. Instead, smart betas are devised on companies’ actual wealth creation or measures of risk. These alternative measures are the first step in making these strategies contrarian. Where price-weighted indices follow share prices faithfully up and down, smart betas can avoid the irrational behaviour that drives such ups and downs. Using its alternative measures, smart beta instead looks to offer investors better long-term, risk-adjusted returns.

The second step to achieving this goal is their constitution as indices rather than active strategies. The mechanistic nature of rebalancing an index one or twice a year ensures that smart beta adheres to its principles and does not get lured into evaluations based on prices.

Rebalancing is more than a mere necessity in the whole process. In a paradoxical way, cutting winners, i.e. stocks that have appreciated, and reassigning money to underperforming stocks, could itself be a powerful source of return. This is because when rebalancing occurs at a low frequency, one is reducing positions in stocks that are statistically more likely to be overvalued and increasing positions in stocks that are statistically more likely to be undervalued.

A Cass Business School research suggests that almost any combination of stocks, reshuffled annually every year, would outperform a US equity cap index. To prove this, the authors generated ten million portfolios of 1,000 stocks weighted randomly using equity market data. They then resorted each of the ten million portfolios, using the same random process of creation, for each of 44 calendar years to 2011. Almost all the portfolios beat the market-cap index. Even when adding extra trading costs, the percentage of simulated portfolios achieving superior performance is highly significant.

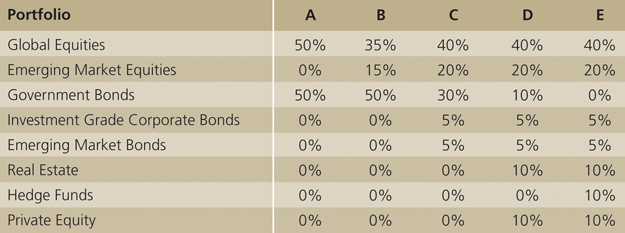

Figure 1 shows five different portfolios. Each has different weightings to a variety of asset classes chosen more or less randomly, based on the typical asset allocation of a pension fund. What is of particular interest is the positive relative outperformance of each of the five portfolios when rebalanced once a year versus the portfolios that did not rebalance.

Figure 1: Sample portfolios

Source: Bloomberg, data to February 2014. Any performance information shown refers to the past and should not be seen as an indication of future returns. For illustrative purposes only.

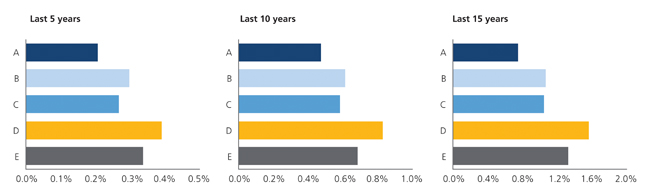

Figure 2 shows that Portfolio A would have generated a return which is 0.80% higher every year if the portfolio was rebalanced once a year to its original weights, compared to a portfolio that was left “untouched” over a period of 15 years. This outperformance becomes more evident when more asset classes are included in the portfolio, and the outperformance of a rebalanced portfolio over a non-rebalanced portfolio worked for different periods, including the last five, 10 and 15 years.

Figure 2: Annual relative outperformance: rebalancing vs non-rebalancing portfolios

Source: Bloomberg, data to February 2014. Any performance information shown refers to the past and should not be seen as an indication of future returns. For illustrative purposes only.

What all the simulations lack is any awareness of, or contribution from, market timing. What they all share is automatic, blind low-frequency rebalancing. The Cass paper recognises that one of the risks in market-cap indices that explain its relatively terrible performance is concentration risk. The 10 largest names in the EURO STOXX 50 Index, for example, represent about 40% of the index’s weight. By virtue of probability alone, automatically rebalancing portfolios, whatever their underlying strategy would tend away from the risk of “mega caps”. As long as they tend away to broader portfolios, as smart beta does (but randomly-generated portfolios by their nature need not), this should be of benefit to investors. It brings a kind of diversification that has most significance after stock market bubbles burst.

Smart beta proponents such as HSBC Global Asset Management do not claim to have found the perfect measures of fair value. However, we believe that the frequent rebalancing to some measure of company wealth is a better proxy for fair value than the majority of traditional cap-weighted strategies.

More Related Content...

|

|

|