Small is beautiful… at least in emerging markets

Written By:

|

Chris Williams |

Chris Williams of Diam outlines the advantages of targeting small and mid-cap companies in emerging markets equities

Emerging market equities have been the poor relations in 2013. While the MSCI World Index was up 24.68% for the year to the end of November, the MSCI Emerging Markets Index was down 0.84% over the same period (both in US$ total returns). Indeed, emerging markets have been lagging developed markets pretty consistently since late 2010.

However, the underperformance of emerging markets in terms of their stock market returns doesn’t tally with their economic performance as emerging markets have experienced higher rates of real GDP growth than developed markets over the same period. Indeed, consensus forecasts tell us that this growth advantage is expected to continue into the foreseeable future.

The relationship between GDP growth rates and stock market returns is a complex one, but it is not unreasonable to expect that over a sufficiently long period, these higher growth rates should translate into superior returns for investors.

Most investors would therefore think it wise to have some emerging market exposure in their portfolios in order to benefit from this growth potential and also to enjoy some diversification from developed market equities. But what is the best way to achieve these objectives? Is it through the standard emerging market indices?

According to our analysis, investors may be able to gain better exposure to the growth of emerging market economies and better diversification against developed market equities by investing in emerging market small- and mid-cap stocks.

Beyond their own backyard

A quick glance at the largest constituents of the MSCI Emerging Markets Index reveals some interesting patterns. Firstly, there are names such as Samsung and Hyundai which are familiar brands whose footprint is global rather than restricted to emerging markets. Secondly, there are commodity stocks such as Gazprom and Vale whose products are priced on global markets. Thirdly, there are a lot of banks.

These global brand stocks and commodity stocks are exposed to developed markets as much as to emerging markets and therefore may not be giving the “pure” emerging market exposure that would best capture emerging market domestic growth. The banks are more domestically focused, but the heavy weighting to this sector could be viewed as a dangerous source of concentration. In view of the long history of banking crises (of which the recent global financial crisis is an especially gruesome example), investors may well be wary of taking such a large banking exposure in their portfolios.

So, how do emerging market small- and mid-cap stocks compare?

Bringing it all back home

The first difference to note is that they represent a broader and less concentrated universe. The MSCI Emerging Markets Small and Mid Cap Index (EMSMID) includes more than 2,000 stocks while the standard MSCI Emerging Markets Index (EM) includes a little over 800. Of these, the top 20 stocks in EMSMID represent only 8% of the index weight, while for EM the top 20 represent 25% of the index weight.

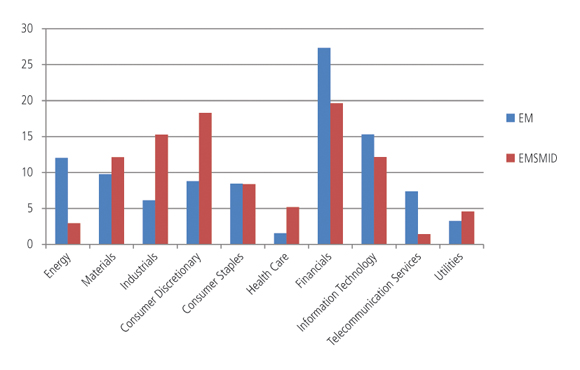

Figure 1: Index weights by sector (%)

Source: MSCI, Factset

The sector exposures of the EMSMID and EM indices, represented in Figure 1, show some notable differences. EMSMID has a lower exposure to Financials (19.7% vs 27.3%) and a lower exposure to Energy plus Materials (15.1% vs. 21.8%). By contrast, EMSMID has greater exposure than EM in the consumer-related sectors (26.7% vs. 17.3% for Consumer Discretionary plus Consumer Staples).

This consumer-related exposure may be a particularly attractive one. As emerging markets move up the income scale, they are creating a burgeoning middle class with disposable income at their command. The spending power of this group offers a bright future for companies operating within this area.

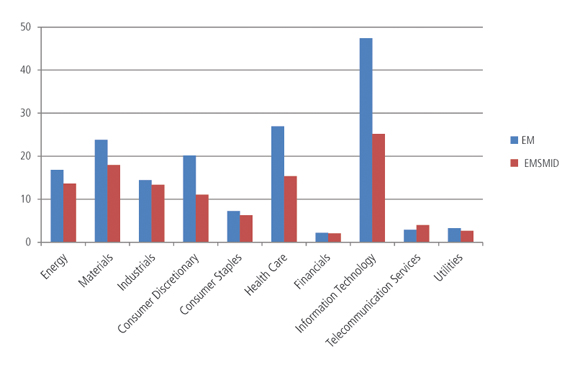

Figure 2: Sales to developed markets (%)

Source: MSCI, Barra

It is possible to analyse the breakdown of sales between emerging and developed markets for EM and EMSMID stocks using MSCI’s Economic Exposure data. Figure 2 shows the % of sales to developed markets for EM and EMSMID by sector.

Telco Services, Utilities and Financials are domestically focused, with very little exposure to developed markets for either EM or EMSMID stocks. In all remaining sectors, which are to varying degrees more internationally oriented, the EM stocks show consistently higher exposure to developed markets than the EMSMID stocks.

Different strokes

One corollary we might expect from the lower percentage of sales to developed markets is a lower correlation with developed market equity returns. Sure enough, the correlation of the EMSMID index with the MSCI World Index (US$ monthly returns June 94 – Oct 13) has been 77.3% compared with 81.5% for the EM index.

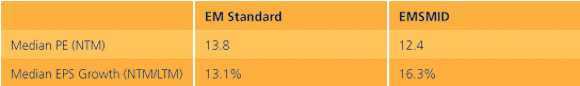

Of course, the investment case for EMSMID stocks would be weaker if they looked unattractive in terms of their valuations and growth prospects. Here also, though, the comparison works in their favour as shown in Figure 3.

Figure 3: Valuations and growth prospects for EM and EMSMID stocks

Source: MSCI, Factset

In conclusion, most investors have enough exposure to developed markets and want their emerging market holdings to give them something different. Choosing small- and mid-cap emerging market stocks can give investors a “purer” exposure, involving less overlap with their developed market holdings and leading to better diversification.

Additionally, they offer a more balanced sector exposure, less biased towards financials and more exposed to emerging market consumers. And if all of that isn’t reason enough, they look cheaper and are forecast to grow faster.

In emerging markets, it seems that small may indeed be beautiful.

For further information please contact www.diam-international.com

The financial promotion is issued by DIAM International which is authorised and regulated by the Financial Conduct Authority (FCA). This document is only made available to Professional Clients and Eligible Counterparties as defined by the FCA. The value of an investment portfolio and the income from it may fall as well rise and investors may not get back the amount originally invested. Past performance is not necessarily a guide to the future.

More Related Content...

|

|

|