Six things to know about sustainable bond markets

Written By:

|

Scott Mather |

Scott Mather of PIMCO identifies the different forms of debt instruments geared towards sustainability and sumarises the range of benefits they offer to investors

So what are green bonds? And how do they relate to – and differ from – social, sustainability and sustainability-linked bonds? Green bonds and other debt instruments geared toward sustainability are becoming an important part of global fixed income markets. More and more, investors look to align their portfolios with their financial goals and internationally recognised sustainability goals such as the Paris Agreement or UN Sustainable Development Goals (SDG).

What are green bonds?

These bonds are devoted to financing new and existing projects or activities with positive environmental impacts. We believe impactful green bonds should be issued in line with the Green Bond Principles (GBP) from the International Capital Market Association (ICMA), a set of voluntary guidelines that promote more transparent, unified reporting on bonds’ environmental objectives and estimated impact. In fact, ICMA is relevant for green, social or sustainability-linked bonds, since ICMA provides guidelines for all forms of such bonds.

Examples of project categories eligible for green bond issuance include: renewable energy, energy efficiency, clean transportation, green buildings, wastewater management and climate change adaption.

What are social bonds?

To qualify as a social bond, the proceeds must finance or refinance social projects or activities that achieve positive social outcomes and/or address a social issue. In many cases, social projects are aimed at target populations such as those living below the poverty line, marginalised communities, migrants, unemployed, women and/or sexual and gender minorities, people with disabilities, and displaced persons.

Similar to green bonds, issuance of social bonds is oriented by a set of voluntary guidelines – in this case the Social Bond Principles (SBP) from ICMA – aimed toward improved disclosure and transparency in the social bond market. The SBP outline best practices for issuing a social bond; they also arm investors with the information necessary to evaluate the social impact of their investments.

Recently, we have seen a new type of social bond emerge in the form of Covid-related bonds. These bonds have use of proceeds specifically aimed at mitigating Covid-19-related social issues and are particularly focused on the populations most impacted.

Examples of project categories eligible for social bonds include: food security and sustainable food systems, socioeconomic advancement, affordable housing, access to essential services, and affordable basic infrastructure. Social projects can include related and supporting expenditures such as research and development and, in situations where projects also have environmental benefits, issuers may determine classification as a social bond based on the primary objective of the underlying project.

What are sustainability bonds?

Sustainability bonds are issues where proceeds are used to finance or re-finance a combination of green and social projects or activities. These bonds can be issued by companies, governments and municipalities, as well as for assets and projects and should follow the Sustainability Bond Guidelines from ICMA, which are aligned with both the GBP and SBP. They can be unsecured, backed by the creditworthiness of the corporate or government issuer, or secured with collateral on a specific asset.

Examples of project categories eligible for sustainability bonds include those in the green and social bonds categories.

What are sustainability-linked bonds?

Sustainability-linked bonds – such as key performance indicator (KPI)-linked or SDG-linked bonds – are structurally linked to the issuer’s achievement of climate or broader SDG goals, such as through a covenant linking the coupon of a bond, according to ICMA. In this case, progress, or lack thereof, toward the SDGs or selected KPIs results in a decrease or increase in the instrument’s coupon. These bonds can play a key role in encouraging companies to make sustainability commitments at the corporate level, particularly through aligning with UN SDGs or Paris Agreement.

Why invest in sustainable (green, social, sustainability and sustainability-linked) bonds?

Sustainable bonds, which include green, social, sustainability and sustainability-linked bonds, can offer a range of potential benefits including:

- Mitigating physical, transition, and long-term sustainability risk, and seizing potential opportunities: The long-term challenge of decarbonising the economy in a socially equitable way comes with risks, but it also offers opportunities for active investors. We recognise that ESG factors are increasingly essential inputs when evaluating global economies, markets, industries and business models. Material ESG factors are also important considerations when evaluating long-term investment opportunities and risks for all asset classes, public and private markets.

- Meeting investor demand: Sustainable bond issuance is rising, regulations are setting global standards, client interest in ESG practices is increasing and, most importantly, responsible investing is becoming more mainstream. We expect that the Covid-19 crisis could cause even more investors to look for sustainable investment choices, and we have observed growing issuance in social, SDG, and specifically pandemic-related bonds on top of a growing green bond market. Focusing on sustainability supports growth over the medium and long term in an inclusive way.

Where else can investors look for impactful bonds?

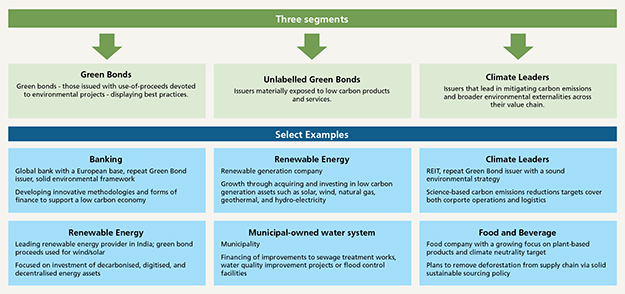

While the explosive growth in green bond markets is encouraging, we believe the opportunity set for climate action within the bond universe is even larger. For those specifically looking to invest in climate solutions, it’s important to understand that the growing climate bond market not only includes labelled green bonds, but also unlabelled green bonds, and the bonds of climate leaders:

- Green bonds are debt securities issued explicitly for environmental or climate-related projects, as detailed above.

- Unlabelled green bonds are debt securities of issuers fundamentally aligned to low carbon products and services, such as a renewable energy company or a municipal water system improvement bond, rather than a certified green bond.

- Bonds of climate leaders, as we define them, are debt securities of issuers we deem to be at the forefront of the net-zero carbon transition, leading their industries forward. These issuers have demonstrated a commitment to mitigating carbon emissions and their broader environmental impact in sectors that may involve water, plastic, air pollution or biodiversity.

Figure 1: Seeking to spot the winners of the transition to a net zero economy

Source: PIMCO, Company filings. For illustrative purposes only.

A word about risk: Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested.

The services and products described in this communication are only available to professional clients as defined in the Financial Conduct Authority’s Handbook. This communication is not a public offer and individual investors should not rely on this document. Opinion and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness.

For investment professionals only. PIMCO Europe Ltd (Company No. 2604517) Ltd (Company No. 2604517) and PIMCO Europe Ltd – Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK. PIMCO Europe Ltd services are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication. ©2020, PIMCO.

More Related Content...

|

|

|