Secure income opportunities: delivering stable cashflows and positive outcomes

Written By:

|

James Sparshott |

|

Amie Stow |

James Sparshott and Amie Stow of Legal & General Investment Management survey some of the key asset classes and potential areas of opportunity in 2020 for secure income investors

2020 looks set to be a year of significant change for local government pension scheme (LGPS) funds and their members. At the time of publication, a new government with a powerful mandate will be hoping to re-set the UK’s relationships with trading partners around the world, whilst geopolitics is likely to dominate markets.

But how will this affect the investment landscape for the LGPS? Many column inches have been devoted to the threats on the horizon for the economy, so in this article we take the opportunity to look at the other side of the coin, and highlight some of the potential areas of opportunity that could be of particular interest to LGPS funds. The UK has seen decades of underinvestment. There is a clear requirement for better public services – schools, hospitals, transport – and our young people need homes that are affordable. Urgent action is also required to reduce dependency on fossil fuels and, although the UK is a leader in offshore wind, much more can be done. All of these represent opportunities for long-term owners of capital – insurers and pension schemes – to affect real and lasting change.

The cashflows associated with such assets are contractual in nature and often referred to as “secure income”. This combination of income – often inflation linked – and risk-adjusted returns, can be attractive to pension schemes and we provide a brief description of some of the key asset classes and opportunities in more detail below.

Private credit

Private credit can be split into three key sectors: infrastructure, corporate, and real estate debt. Institutional investors have traditionally focused on the investment grade part of this universe, but we believe that sub-investment grade private credit could also be an attractive asset class for the LGPS, as it offers higher illiquidity premiums than its investment grade counterpart.

Infrastructure debt

Overview: Providing financing for infrastructure assets such as wind farms, solar power, sewers and trains.

Features: Linked to inflation, typically with longer duration (greater exposure to changes in interest rates), lower historical default rates and higher recovery rates than comparable corporate bonds.

Outlook

Deal supply in the UK has been strong. The government’s announcements around net zero carbon targets are expected to drive more opportunities in the energy sector, particularly in solar and offshore wind. Communications is an increasingly active sector with a good pipeline of opportunities across data centres, fibre networks and smart meters.

Private corporate debt

Overview: Providing financing to mid-size companies who are seeking to borrow outside public markets. Examples include housing associations, consumer goods businesses and utilities.

Features: Pricing is linked to broader fixed income market trends; downside protection may be available through tighter covenant protection; may be linked to inflation.

Outlook

The long-term shift of companies borrowing from institutional lenders instead of from banks is expected to continue, which, when coupled with refinancing activity, should fuel growth. There are likely to be opportunities across the full spectrum of industries and rating categories, with common themes such as consistent, strong cashflow generation.

Real estate debt

Overview: Lending which is secured against commercial property where rental income supports interest payments.

Features: Stable, income-driven returns with a duration around five years; senior ranking in the capital structure and a maximum loan-to-value ratio of 65%.

Outlook

Senior loan opportunities are abundant, despite the slowing in capital growth. In our view, there is likely to be strong demand for London offices over the next 12 months, where the majority of new supply has already been pre-let. We are more selective on regional offices, paying particular attention to tenants, transport links and demographics. Industrials is another sector that may be attractive for LGPS funds due to stable cashflows, but the retail segment may warrant some caution, with a focus on well-let assets in strategic locations at conservative leverage.

Long lease property

Overview: Owning property where there is a long-term (typically 20 years plus), contractually agreed rental agreement in place with an occupier.

Features: Bond-like contractual rental income (fixed or inflation-linked) makes up roughly 75% of the value. Residual property value offers a layer of protection for the investor on account of the ability to re-let in the event of an occupier default.

Outlook

Institutional demand for this type of asset, especially at the lower end of the risk spectrum, continues to be strong, leading to on-market deals experiencing continued yield compression. There are a number of exciting opportunities in the market involving collaboration with occupiers to create deals off-market and to create new assets via partnerships with local authorities and the government.

Residential property

Overview: A diverse range of opportunities that include:

- Shared ownership: investors co-own property with residents. “Rental yield” on the loan is set at the outset and linked to inflation.

- Social/affordable housing: provision of housing at rental yields set by government. Rental uplifts are often in-line with inflation.

- Build to rent (BTR): purpose-built rental properties, typically with higher rental income, but less certainty of cashflows.

Features: Cashflows from rental yields are likely to increase in line with inflation with security from the underlying property investment.

Outlook

Despite persistent political and economic uncertainty, the UK real estate market has shown continued resilience, with the exception of the retail sector. The UK BTR market has performed particularly well, with a strong outlook in schemes backed by top sponsors and operators.

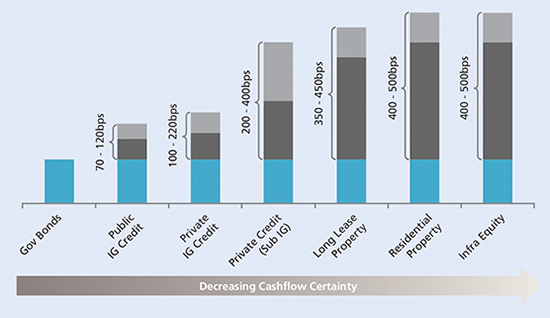

Figure 1: Expected returns of secure income assets over government bonds

Source: LGIM, January 2020. bps = basis points (one basis point = one hundredth of a percentage point)

Bringing it all together

The spectrum of opportunities is diverse, as are the means for accessing these various asset classes. In addition to risk and return characteristics, there are also further points to consider, such as:

- What role does each asset class or underlying investment play in the transition to a low-carbon economy?

- Could it create positive social value for the local community?

- Is the underlying investment managed in line with recommended industry ESG standards?

Given strong equity performance over recent years, LGPS funds are increasingly looking to diversify into alternatives which deliver the cashflows they need to pay pensions. Investing long-term capital in secure income assets can offer a compelling opportunity to generate these cashflows with attractive risk-adjusted returns and the potential to create real and lasting change for communities.

Important Information

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Past performance is not a guide to the future. Unless otherwise agreed in writing, this Information (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Any trading or investment decisions taken by you should be based on your own analysis and judgment (and / or that of your professional advisors) and not in reliance on us or the Information.

Legal & General Investment Management, One Coleman Street, London, EC2R 5AA Registered in England and Wales no. 2091894. Authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|