Searching for the oasis of return

Written By:

|

Mark Hale |

Mark Hale of Prytania examines the options in structured finance for investors in search of yield

Six years on from the credit and liquidity crunch, it is a bitter irony for many investors that amidst a tsunami of liquidity they are left stranded in a desert far from yield or total return. The surge in volatility and sharp drop in many markets in May and June were early warning signals that, having feasted on the fattened calf of the extraordinary policy stimulus since 2007, investors are facing years of wandering in search of an oasis of yield under the unrelenting glare of monetary and fiscal retrenchment. The apparent lure of high yield bonds or emerging markets seemed more of a mirage this summer and the need to find a reliable source of floating rate return became all the more urgent.

The short-term outlook remains for continued policy turmoil across the major economies remains, but this should not blind institutions from making significant readjustments to their portfolios while climatic conditions remain calm.

Near-term inflationary pressures may have subsided, but state and central bank-induced persistent inflation seldom fades, even if few authorities are as open in their intentions as the Bank of Japan. The challenge for investors to find attractive investment returns without taking undue risks has become ever more testing, as the impact of excessively loose monetary and fiscal policy in most of the major nations exerts its inexorable pressure across all asset classes. Drinking deep from the apparently limitless well of easy money has seemingly been the right strategy for capital providers, as preparing for the more difficult times ahead will necessitate both a willingness to make substantial adjustments and a readiness to move quickly. In the most simplistic sense, the printing presses have encouraged a search for yield and a toleration of higher risk across most sectors, including a willingness to embrace illiquidity and junior positions in the capital structure.

An enthusiasm for large-cap equities was understandable in this environment, despite their historical underperformance, as it was for small-cap stocks and emerging market bourses. Less easy to comprehend was the continual ardour for the usual range of hedge and private equity funds, where returns did not seem to compensate clients for the elevated risks.

Within the conventional fixed income world, quantitative easing is likely a final hurrah in the long-standing 30-year bull market. A tighter regulatory environment has also forced further allocations to government-related debt. The inevitable migration from the safety of high-grade towards high yield bonds and emerging markets tasted sweet to many during the feast, but the mere hint of an end to official sector largesse this spring has left investors with, at best, severe indigestion over the summer.

The Fed’s bungling of tapering QE in recent times, and the adverse reaction to Governor Carney’s “forward guidance” may have been glossed over amid recent political ructions and ample supplies of credit, but the signals of leaner times to come have become increasingly appreciated by investors.

As concern has risen about the impact of higher interest rates and the need to protect against persistent inflation, the interest in non-correlating and floating rate strategies has surged. However, the task of increasing exposure to floating rate instruments appears much more onerous to many than before the credit crisis.

There are three main floating rate products: bank debt, structured products (derivatives) and structured finance (asset-backed securities and collateralised debt obligations). Six years after the credit crisis, it has become increasingly clear that prior relaxed attitudes towards bank, insurance and broker counterparty risk was misguided. Outright failure of financial institutions has been constrained by governmental support, but confidence about future assistance given current political trends has been shaken.

Recent bail-in language and forced conversions have amplified these worries. With internal risk management and external regulation highlighting the need to assess counterparty risk more completely, and other rule changes likely to make banks less willing and competitive in future transactions with pension funds, the appeal of alternative asset classes has become more obvious.

Structured finance (SF) is increasingly recognised as an important addition to portfolios. In an uncertain world, the confidence of a bankruptcy remote vehicle no longer needs to be stressed so often to investors bruised by past years of unexpected losses. UK holders of Co-op bonds are the most recent example of clients looking hungrily at the return enjoyed by owners of its ABS securities.

SF offers an almost infinite variety of choice in terms of combinations of exposure by sector, seniority and nature of return. For fixed rate and long duration buyers, a large part of the US ABS market carries a fixed coupon with a range of maturities out to 30 years. Some UK sectors also offer fixed rate products including infrastructure and small business sector.

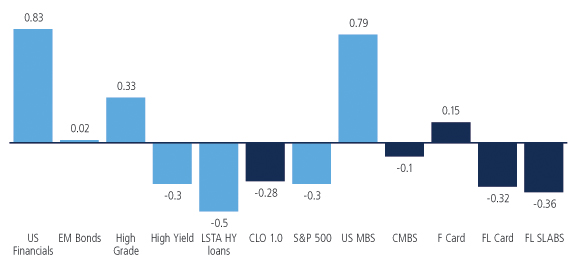

Figure 1: Correlation to treasury monthly returns, 2006 – 2013

Source: Bank of America Merrill Lynch

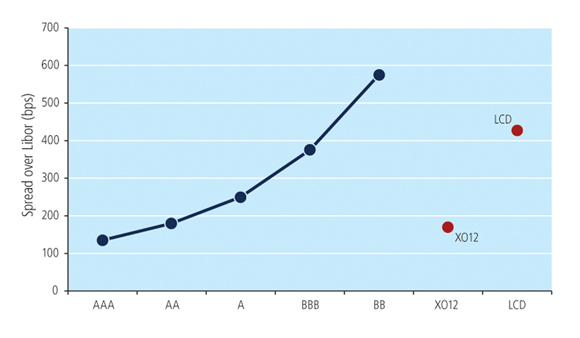

Figure 2: Collateralised loan obligation YTM vs. high yield indices

Source: JP Morgan; Bloomberg; LCD; October 2013

The remainder of the global market is floating rate, which should attract those investors looking for a short duration while still enjoying a reasonable yield. The depth and breadth of the market allows investors to deploy significant sums in the better quality securities with little fear of distorting prices. Bespoke or customised solutions may also suit the larger scale buyers.

SF securities offer substantial diversification benefits, including access to securities covering a significant part of national economies which are typically not available to investors in the public markets such as consumption( mortgage, credit card debt, auto loans) and the small business sector.

The above considerations highlighting the appeal of SF would be less persuasive without the strengths observable from the strong fundamentals and technicals driving performance of the sector.

While new issue supply has picked up since the crisis, partly encouraged by the official sector in many regions, it is insufficient to keep up with investor demand and the shrinking supply from redemptions, amortisations, early calls and tenders. Therefore, even a modest reallocation of portfolios towards SF could induce further significant price appreciation as the supply imbalance tightens.

SF is also attractive due to its non-correlating characteristics with many mainstream asset classes. The portfolio benefits of adding an allocation of ABS (asset-backed securities) and other leveraged finance sectors appear compelling in both a short- and longer-term horizon. We can track inter-sector correlations over time to show how SF as a whole can add diversity and improve a portfolio’s long-term efficiency, as well as the differences within the universe of the major components of the SF market.

It may be simplest to observe the correlations to Treasuries over the last credit cycle. In Figure 1, we show a reduced universe for simplification, but it reveals how floating rate ABS and CLOs (collateralised loan obligations) have significant negative correlations with the main fixed markets such as Treasuries, financials, mortgage backed securities and high grade bonds. While the exceptional yields seen since the crisis in SF assets are now harder to find after the long rally, there remains a large variety of risk-adjusted high returns across the globe. Even if we limit the comparison to the high yield universe, such as the burgeoning popularity of high yield bonds and loans, SF offers higher returns for lower risk. Figure 2 highlights how the returns for European CLOs, even after the significant rally seen since 2009, remain high given the additional safety that tranched debt provides through subordination and diversion tests designed to protect more senior investors.

The comparable indices for bonds (X-over index from a similar vintage to CLOs) and loans (LCD) offer limited rewards given the absence of protection against defaults in pools of lowly-rated, typically single-B assets.

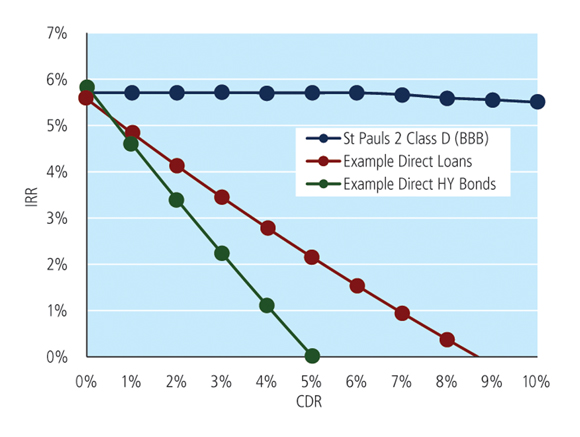

Figure 3 illustrates the benefits of the safety available to CLO investors in a new issue transaction today offered by one of the leading managers in European loans over the last 30 years, using a market standard set of assumptions.

Figure 3: IRR resilience of a EUR BBB CLO vs. Direct loan vs. Direct HY bond portfolio

Source: Prytania Investment Advisors LLP

The simulation shows that even consistently high stress over a 12-year horizon, that has not been witnessed to date in data that extends back to 1920, will usually not break a CLO tranche that is even in the lower part of the mezzanine debt.

More senior bonds, rated AAA, AA or A, show even greater resilience. From Figure 3, we see that holders of loan or bond funds would have experienced zero returns relatively quickly. Using more conservative assumptions than the market consensus, the difference in performance of the CLO asset would be more dramatic still.

In summary, even a modest allocation of portfolios into structured credit should be compelling to many yield-hungry investors. The potential for relatively high returns but comparatively limited risk is truly a case of having one’s cake and eating it.

More Related Content...

|

|

|