SDG bonds: their time has come

Written By:

|

Samuel Mary |

|

Christian Schuetz |

|

Olivia Albrecht |

The emergence of bonds linked to sustainable development goals signals that fixed income markets have entered a new phase, says PIMCO’s Samuel Mary, Christian Schuetz and Olivia Albrecht

The bond market has seen a flurry of issuances whose proceeds are mapped to the SDGs, including green, social, and sustainability bonds, as well as a growing number of issuers embracing the SDGs in their strategies. A rising group of issuers in a broad range of sectors has also come to the market with sustainability-linked loans, which have incentives for borrowers to achieve sustainability performance objectives; these can include overall practices (such as B-Corp certification, and human and labor rights audits), as well as output (e.g., low-carbon products and services) and outcomes (e.g., carbon emission reduction or waste recycling). Increasingly, these objectives are related to the UN SDGs. As investors, we welcome such developments as positive steps.

The emergence of SDG-linked bonds

We see two fixed income instruments in particular as key to advancing the SDG bond marketplace.

The first key structure, which is already established, is use-of-proceeds bonds, including green, social, and sustainability bonds. With these instruments, issuers commit to using the actual funds raised in the bond offering to achieve certain SDG objectives. The second innovative way of integrating SDGs into the bond market is to include a covenant that links the coupon of a bond to the issuer’s achievement of climate and broader SDG goals. Essentially, progress or lack thereof toward the SDGs then results in a decrease or increase in the instrument’s coupon.

We think the emergence of such SDG-linked bonds may help further cement bondholders’ role in advancing SDG-related targets. Moreover, this SDG-linked approach opens up large potential opportunities: The proceeds are typically for “general corporate purposes” and may therefore be well-suited to issuers in sectors without large investment needs that are taking compelling steps to align their business models and strategies with the SDGs.

We think that use-of-proceeds bonds and SDG-linked instruments may be complementary and can coexist in harmony under the overarching framework of SDG-aligned bonds.

Looking ahead, we see the articulation of these two instruments and approaches as the next stage of development in the sustainable bond market. Specifically, we expect to see:

- 1. More explicit integration of issuers’ climate and SDG strategies and profiles into the existing green, social, and sustainability bond standards.

- 2. Progress on defining standards for SDG-linked bonds, based, for example, on SDG targets that are most material to the issuer’s business and investment strategy, as well as the most connected to its main externalities.

- 3. Development of disclosure expectations for SDG-aligned bonds, including mapping of use-of-proceeds to specific SDGs and robust measurement of impact based on the SDG indicators.

Meanwhile, our expectation toward issuers of these bonds includes:

- 1. Evidence of the alignment of the issuer’s business – which may include input (e.g., capex), output (e.g., business mix), and outcomes (e.g., carbon emissions) – with SDG-related targets (e.g., zero net carbon pathway, zero net deforestation, no net loss of biodiversity, and ecosystem services).

- 2. Third-party oversight for the method, monitoring, and reporting of such targets, which could for example build on science-based targets for climate change.

These exciting developments may soon allow fixed income investors to target thematic objectives, such as climate action, in a portfolio that emphasises bonds linked to the relevant SDGs. Investing in the debt of companies demonstrating climate leadership by targeting SDG 13, climate action, is just one example of how SDG bonds may enable investors to have a role in financing the achievement of SDGs.

Issuer’s core strategy: the missing link is SDG debt

As SDG-aligned bonds have evolved, a missing link has persisted. Many issuers of green or social bonds are not articulating how their sustainability objectives for these bonds align with their broader corporate strategy.

This means, for example, that an issuer lacking a long-term plan to adapt to climate change and contribute positively to the Paris Agreement can issue a bond devoted to low-carbon sources of energy that concern a fraction of its total business and capex, and still claim that the bond warrants the “green” label.

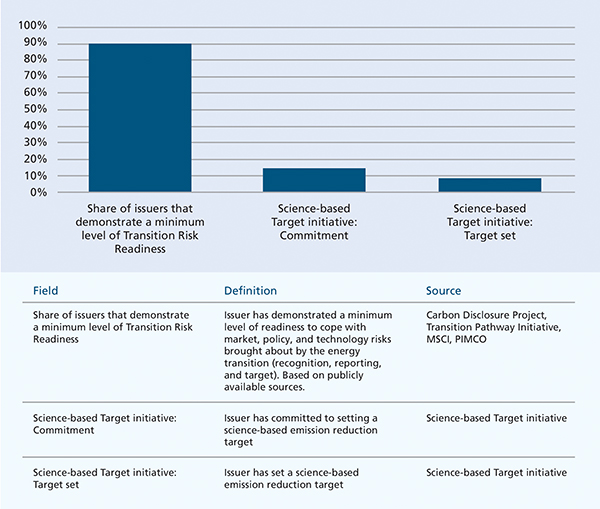

Focusing on the Bloomberg Barclays MSCI Green Bond Index, we found that the majority of issuers have demonstrated some level of readiness to cope with climate risks, which means they have demonstrated awareness of climate change as a business risk in their public reporting and have taken steps to report and mitigate carbon emissions. However, a meaningful share of green bond issuers has not. Importantly, only a fraction of those that do show climate preparedness have also demonstrated best practices by reporting a long-term carbon emission reduction target connected with the Paris Agreement, as per the science-based method (see Figure 1).

Figure 1: Share of green bond issuers that report evidence of an advanced climate strategy and target

Source: Bloomberg Barclays MSCI Green Bond Index as of 19 September 2019

Establishing a framework: assessing the issuer’s strategy

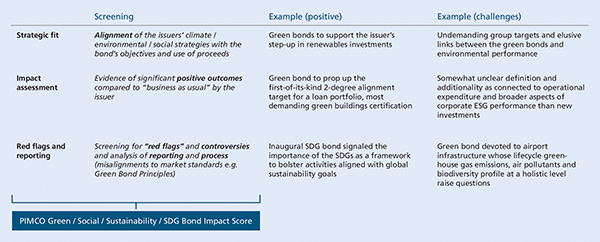

To identify these inconsistencies and encourage best practices, It’s important to analyse recent use-of-proceeds bonds in order to develop a framework to assess their suitability for ESG-focused strategies. A key criterion in our analysis is the alignment between the objectives of use-of-proceeds bonds and the issuer’s broader sustainability strategy and targets. (See Figure 2.)

Bottom line: Sustainability debt markets have entered a new phase. Looking ahead, we think covenants can be introduced to provide incentives for issuers to connect their core business objectives and financing conditions with the UN sustainable development goals.

Figure 2: Analysing issuer strategy in SDG bonds

Source: PIMCO

Important Information

For professional investor use only.

PIMCO Europe Ltd (Company No. 2604517) and PIMCO Europe Ltd – Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2020, PIMCO.

More Related Content...

|

|

|