Resource scarcity and the efficiency revolution

Written By:

|

Bruce Jenkyn-Jones |

Resource scarcity is a topic of increasing concern to pension fund managers given the potential impact on their portfolios. Bruce Jenkyn-Jones of Impax Asset Management examines the issues

A growing body of evidence has highlighted the issue that certain resources are becoming increasingly scarce – water and oil to name but two. Some investors believe that investment in supply constrained resources, for instance via commodities, is the best response to this issue. Unfortunately this ignores the fact that efficiency gains can often reduce the problems of constrained supply, generating superior shareholder returns for those companies with the right products. At Impax Asset Management, we believe that a revolution in efficiency has already begun that is creating unprecedented opportunities for investors.

We can’t take resources for granted

The price of commodities has risen significantly in recent years and the volatility of prices is at an all-time high. Two factors appear to explain this transformation:

Demand shock

The expansion of multiple emerging markets is unprecedented, partic – ularly in China and India, whose combined middle class now exceeds 200 million people.

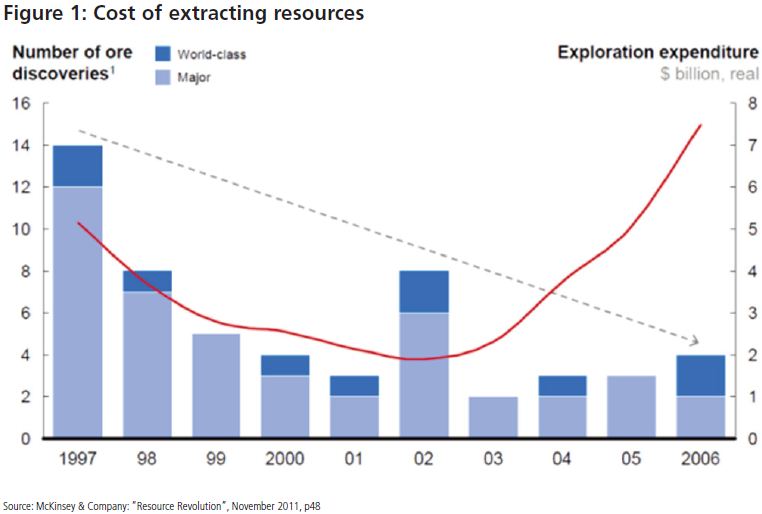

Rising cost of supply of commodities

As illustrated by McKinsey and Company, the cost of extracting resources has been rising (Figure 1). This trend has also been accompanied by supply shocks linked to political instability, particularly for crude oil.

There is now evidence that the depletion of basic environmental resources such as clean water, clean air and arable land limits the potential for economic growth in many countries. At the same time, losses from weather related events have increased sharply. In 2011, the United States experienced a record of twelve billion-dollar weather disasters, resulting in c.US$52 billion in damage.

Efficiency – much achieved: much more to go for

A natural consequence of rising prices, improved efficiency has historically underpinned improve – ments in productivity and thus contributed to economic growth. Given this new resources paradigm, we believe that a revolution in efficiency is underway that is creating unprecedented opportunities for investors. Focusing on four areas:

Energy

The energy sector is set for transformation, and energy prices for most of the world’s population are set to rise. By 2035 China will consume in total 70% more energy than the USA, yet per capita consumption will still only be 50% of US levels. Globally there will be 1.7 billion passenger vehicles on the road, twice the number today.

In response to this, three trends are expected to lead to substantial investment opportunities:

Incremental efficiency improvements

Across the built environment, industry and transportation, the energy efficiency of current products and services is set to increase relentlessly. For example, today’s petrol and diesel engines are capable of delivering 80 miles per gallon4, a figure that should rise to 100 mpg within 15 years5, bringing the US fleet average up from the current level of c.26mpg.

Rapid adoption of breakthrough technologies

Light emitting diodes consume 15% of the power of equivalent incandescent bulbs and last 50 times as long.

Leapfrogging by developing countries

Emerging economies faced with limited availability of fossil fuels are likely to encourage the adoption of the most energy efficient technologies. China’s Ministry of Construction recently called for 65% energy savings targets for buildings in major cities.

Water

The prevalence of water stress has increased sharply in recent years. Several countries have built advanced economies while coping with limited water supplies; however, sustained droughts elsewhere, for example in Australia, the United States and China, have taken governments by surprise. The UN estimates that, by 2030, 47% of the world’s population will live in areas of high water stress.

Investment opportunities in the water sector are likely to arise in three areas

New asset creation

The construction of new water supply and treatment infrastructure in emerging economies is set to be a dominant theme over the next decade. The Chinese government has earmarked US$780 billion of investment in water assets by 2020.

Asset upgrading

Notwithstanding constraints on public sector expenditure, OECD countries will continue to improve and extend their water infrastructure, particularly in areas of drought and/or flood risk.

Roll-out of proven technology

Faced with an expanding range of contaminants in the water supply, regulators have mandated the adoption of new technologies, such as membrane filtration, ultra violet light disinfection or using activated carbon.

Food

Of the nine billion people on the planet by 2050, it is anticipated that two thirds will live in urban areas, while there will be 80 million new mouths to feed each year. As a result, global food production needs to rise by 70%, requiring not only additional land, but also other vital inputs such as agrichemicals, energy and water. The pressure from an increased population is further exacerbated by rising affluence and changing tastes. For example, in developing countries meat consumption is growing, which requires more inputs than simple basic foods.

On the expectation of rising demand and changing tastes, major opportunities are emerging for additional investment and efficient management of global food and agriculture resources, for example:

Improving productivity

Rising crop yields are vital to increasing food production. Investment in seeds, crop protection and irrigation are all expected to expand in the search for higher yields.

Improving storage, transport and distribution

Areas of food production are not always aligned with areas of food demand and there is considerable wastage during transport, storage, preservation and processing of food. Investment opportunities exist both in the expansions of these supply chains as well as driving greater efficiencies – for example, the use of enzymes in food production.

Changing tastes

Changing tastes, both from more affluent consumers in developing countries and more health-focused consumers in developed countries, provide opportunities for companies with products, dominant market positions and brands.

Materials

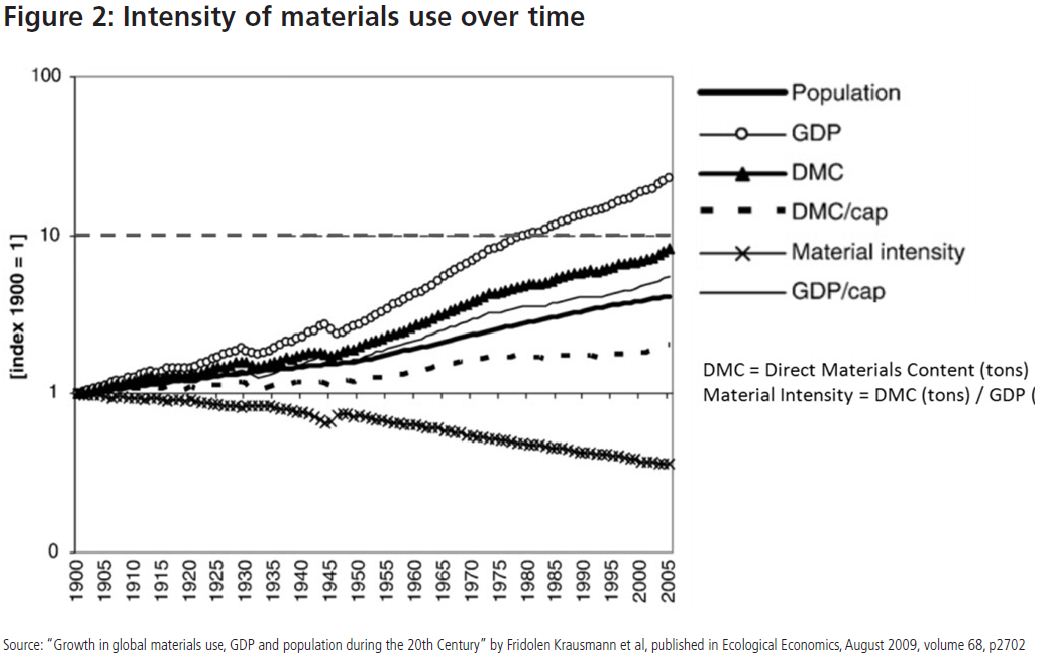

Materials use in the global economy has risen almost ten-fold over the past century11, with consumption of industrial materials and ores rising 27- fold.12 Since 2000 this has accelerated further as direct materials usage per capita has increased as emerging market economies have expanded their consumption – with China in particular becoming the largest global end user of many raw materials.

Improving primary materials extraction and processing yields Rising costs and complexity in the primary materials sector has created a large end market for products and services to raise efficiency. For instance, industrial gases such as oxygen are used in the steel and chemical sectors to improve yields.

Efficient industrial manufacturing processes There are significant cost savings to be realised by optimising the use of materials during manufacturing. In the UK alone, it is estimated that the potential savings from resource efficiency initiatives with a less than one year payback is US$8.4 billion a year.

Recycling and reuse Recycling has been one of the key measures for dealing with scarce resources and an important source for numerous raw materials. Recycling is now estimated to supply 40% of global raw material needs with an annual turnover of US$200 billion.

Smart materials Advanced materials are replacing incumbents due to better features, lower cost and reduced environmental impact. For example, 50% of the new Boeing 787 Dreamliner’s frame is made of a lightweight carbon fibre composite resulting in lower expected fuel costs for airlines.

What does this mean for investors?

In our view, investors who assume that incremental efficiency improvements will continue to ensure that the supply market of energy, water, food, materials and other resources will expand to meet demand without dislocation, could miss out on an enormous opportunity for value creation. These opportunities are to be found in under–researched areas of the equity market that are not well represented in mainstream equity mandates and benchmarks. We believe that in future, a successful investment programme that delivers the benefits promised must take into account the hidden opportunities in efficiency described above.

More Related Content...

|

|

|