Renewable infrastructure: finding value and managing risk

Written By:

|

Peter Rossbach |

The European renewable energy market is an attractive prospect for private capital investment. Peter Rossbach of Impax discusses the investment opportunities

With no carbon emissions, no fuel costs and strong drivers for continuing strong growth, the European renewable energy market offers a compelling opportunity for UK investors seeking diversified exposure to infrastructure. In particular, the European market offers:

- A large stable economic region: dominated by single currency

- Supportive regulation: based on consistent climate change policies and the aim to shift the generation mix away from fossil fuels and nuclear

- Regions with strong winds and sunlight

- A strong market with a declining cost structure in wind and solar markets.

Throughout Europe there is a strong commitment to construction to 2025 and beyond. Furthermore, in contrast to many emerging markets, Europe represents a more stable investment region, with strong and growing demand for operating projects from experienced developers and operators. Global investment vehicles can fall foul of emerging market volatility and currency issues. We do not believe that the UK’s decision to leave the European Union will have a significant impact on this investment opportunity.

A rapidly expanding market

The International Energy Agency expects that the combination of EU climate change policies, renewable energy targets at both EU and member state levels, energy security imperatives and declining technology costs will continue to drive the strong growth in renewables across Europe.1 Most of this growth will come from wind and solar and these sources are projected to account for 24% of total power generation in the region by 2030.2

The National Energy Plans of nine key European countries set targets that will require over €200 billion of investment in renewables by 2020.3 This level of investment creates an attractive opportunity for private capital. Most developers are undercapitalised, and many utility power generators suffer from capital constraints to fund the construction costs.

Falling costs of generation are driving growth

The technology evolution in both wind and solar photovoltaic generation, coupled with lower installation costs, continues to improve the prospects for the sector. The cost of electricity produced from wind has dropped by more than 50% in just five years4 and the cost for solar the decline is approaching 80%5.

These costs are expected to decline further as both technologies continue to evolve. Wind is now at “grid parity” in as much as it is below retail prices, and solar is close to grid parity in many countries in Southern Europe. Importantly, both are materially cheaper in long-term marginal generation cost than new nuclear power plants now in construction.6 We expect the falling unit cost of wind and solar generation to march in step with the gradual reduction in long-term power sales pricing incentives offered in the EU, whether set by auction tender or by tariff, allowing investors in new projects to sustain attractive profit margins.

Managing risk

Renewable infrastructure projects span a wide risk spectrum: onshore wind and solar projects in Europe typically use proven technologies, in relatively accessible locations with engineering expertise and repair equipment and therefore have the most “controllable” risks. Project development and construction risk are highest at the early pre-permitted stage. As the project progresses, development and construction risks decrease alongside the expected investment returns.

The construction risks faced by renewable energy plants are similar to those of other construction projects and should be managed by a team that can evidence strong project management skills and a successful track record in constructing renewable energy projects on time and within budget.

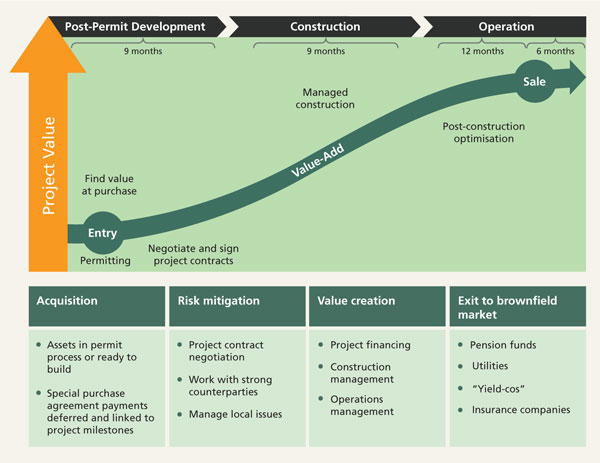

Figure 1: Generating rapid capital gains: value add buy-build-sell model

Source: Impax internal analysis

Operational risk

Wind and sunshine are variable! This dictates how much electricity a project generates and therefore its revenues. To manage this risk, sites are chosen based on extensive historical wind or solar data, and conservative assumptions are made prior to construction. However, year-on-year variability can occur, effecting the financial performance of projects. Typically, any variance in the wind or solar resource can be expected to average out over time. Portfolios that combine wind and solar projects across geographies improve portfolio resilience.

Regulatory/country risk

All infrastructure investment is dependent to some degree on government regulation. Renewables are no different. A return on capital investment is driven by long term power purchase agreements (PPAs) or feed-in-tariffs (FiTs) starting when a plant becomes operational, and typically lasting for 15-25 years. Generally the tariff structure in Europe is robust, and investors have long term visibility.

Investors may have heard of the steps taken by a number of governments in Europe (including Spain and Italy) to introduce “retroactive” tariff which have given rise to some significant challenges. These cuts were the consequence of local economic downturns and poorly designed incentive programmes, which had encouraged booms in new capacity, prompting panicked responses by cash-strapped governments. However European directives and individual case precedents now help shelter against future unexpected regulatory changes. Countries with well-constructed renewable energy support regimes, including France, Germany, Ireland and Finland, do not carry the same level of risk. Better designed schedules tend to place limits on potential costs, or become less attractive over time to match falling costs of technology.

Moreover, well-publicised environmental goals and targets are often imposed at the supra-national level and help to insulate against short term fluctuations with longer-term demand side pressure. For example, in October 2014 the European Council adopted a target for the EU whereby renewable energy was to account for at least 27% of energy consumption by 20307 – a decision that made a significant contribution to the European Union’s action plan. This commitment was at the heart of Europe’s preparations for the Paris Climate Agreement which was signed by 196 nations in December 2015.

As with all investments, investors must consider how the assets will perform given the outlook for the macro-economic environment. This can be tricky given the 20-plus year horizon for most renewable energy projects. However, some renewable energy regimes are explicitly protected from inflation. For example, UK green certificate prices are linked to the Retail Price Index. French and Italian tariffs also have an inflation hedge.

Accessing value in a growing market

The European renewable energy market is undergoing rapid growth. However, the industry remains fragmented at many levels, creating a compelling opportunity for experienced developers. It is a market ripe for investment as large financial investors and utility power generation companies look to buy scaled renewable energy portfolios with operating histories.

Investors face challenges in finding low-risk, long-term assets that offer a good match for their liabilities. This is especially true in the current interest rate environment, where high and even mediocre quality debt instruments offer even lower yields. We believe that investment in renewable energy assets offers a solution to these challenges. If chosen carefully, diversified portfolios of wind and solar assets can provide predictable, low-risk returns, targeting mid-teens IRR returns, often with a degree of government guarantee or linkage to inflation.

The exit markets for Impax’s “buy, build, sell”, business model are well established. Institutional investors are committing capital to the infrastructure sector, but mostly in the downstream or “destination buyer” brownfield markets. PGGM in the Netherlands is an active investor in on- and offshore wind farms. Pension Danmark has made six renewable energy investments since 2010. Insurance giant Munich Re is investing €2.5 billion in wind farms and solar parks in Europe. Warren Buffet’s Berkshire Hathaway has also emerged as a major investor in US renewables assets – particularly in solar.

Investors and their advisers should become better acquainted with the opportunity presented by these markets, and consider how best to allocate capital to the sector. Long term investors will then recognise the potential of renewable energy assets in helping match their longer-term liabilities.

Wind turbine site constructed by Impax at Kuolavaara-Keulakkopää in Finland

1. International Energy Agency, energy Policies of IEA Countries, European Union, 2014 Review. Available at https://www.iea.org/Textbase/npsum/EU2014SUM.pdf as accessed on 15/9/2016

2. Wind in Power, 2014 European Statistics, European Wind Energy Association, February 2015

3. Data refers to the published renewable energy action plan for each country sourced from European Environmental Agency publication, Renewable Energy Projections as published in the National Renewable Energy Action Plans of the European Member States (1 February 2011)

4. http://www.awea.org/MediaCenter/pressrelease.aspx?ItemNumber=7408

5. http://www.awea.org/MediaCenter/pressrelease.aspx?ItemNumber=7408

6. The Telegraph, EDF: Lower price “irrelevant” to Hinkley Point nuclear deal. 15 September 2015 as accessed 25/1/16

7. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. A policy framework for climate and energy in the period from 2020 to 2030 /* COM/2014/015 final */

More Related Content...

|

|

|