Real estate debt is bouncing back

Written By:

|

Mohamed Ali |

Nuveen Real Estate’s Mohamed Ali explains why the commercial real estate debt market has emerged as a compelling opportunity for institutional investors following the sector’s 20-25% valuation correction since mid-2022

The commercial real estate (CRE) landscape has profoundly transformed since mid-2022, creating compelling investment opportunities for institutional investors. Rising interest rates and macroeconomic uncertainty have driven capital values down by approximately 20-25% across Europe and other developed markets, according to the CBRE Prime Capital Value Index.

One consequence of this is real estate debt is becoming an increasingly attractive proposition for sophisticated investors seeking stable, risk-adjusted returns with meaningful downside protection.

The current environment presents a combination of factors that make real estate debt particularly compelling: attractive entry valuations, conservative lending structures, superior recovery characteristics and meaningful portfolio diversification benefits.

Foundation for growth

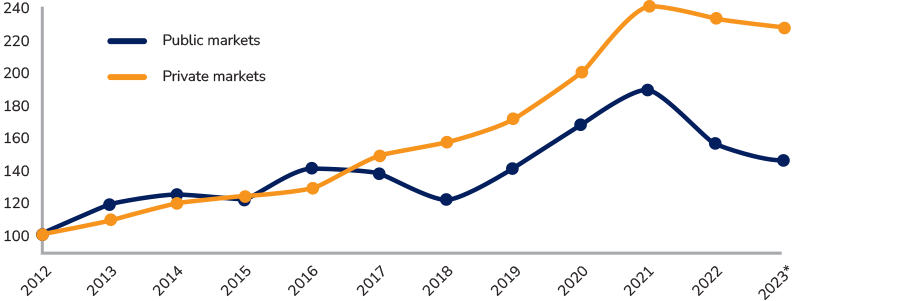

Private markets have demonstrated remarkable resilience and growth, expanding approximately 7.8% annually since 2012, more than double the 3.5% growth rate of public markets over the same period, according to EY.

This sustained expansion reflects institutional investors’ ongoing search for yield enhancement and portfolio diversification, particularly during the prolonged low-interest-rate environment that characterised the decade leading up to 2022’s rate hikes.

Current projections from Preqin suggest global private debt assets under management will reach $2.64 trillion by 2029, reflecting continued institutional appetite for these strategies.

Figure 1: Growth in private markets has proved stronger and also less volatile than that of public markets

Source: EY 2023

Despite the elevated inflation and interest rate environment since mid-2022, investor intentions toward real estate debt have strengthened.

Recent INREV surveys indicate that 62% of investors plan to increase their allocation to real estate debt, with public and private pension funds showing the largest increases in planned allocations.

This interest reflects investors’ recognition of the defensive characteristics real estate debt can provide, particularly the risk mitigation physical assets offer.

The appeal of backing bricks and mortar becomes particularly relevant when macroeconomic uncertainty is affecting investors.

Unlike corporate credit, where recovery depends on often intangible business assets, real estate debt provides lenders with the ability to either force asset sales or take direct control of underlying properties, holding until market conditions improve.

Optimal entry point

The commercial real estate market correction has created what appears to be an optimal entry point for new real estate debt investments. MSCI data shows most repricing appears to have already occurred, with early signs of stabilisation and even recovery emerging in some market segments.

The current correction of 20-25% in European prime capital values, while significant, remains moderate compared to historical downturns such as the early 1990s recession (-36%) or the GFC (-34%).

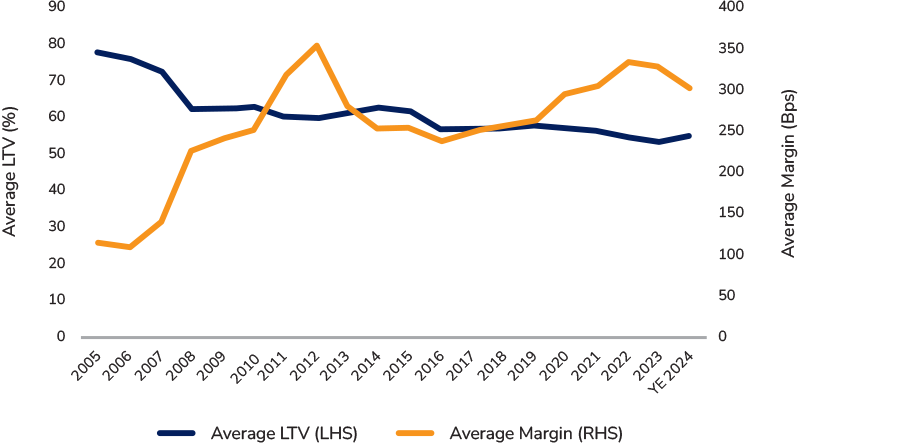

This valuation reset has coincided with significantly more conservative lending practices compared to pre-crisis standard, according to Bayes UK Lending Survey data.

Average senior loan-to-value ratios tightened from approximately 80% before the GFC to around 55% by the end of 2024, providing lenders with substantial equity cushions.

Figure 2: Average LTV Rates vs Margins

Source: CBRE

While risk-free rates have risen since 2022, credit spreads in real estate debt have remained elevated, unlike liquid corporate credit markets where spreads have tightened.

Senior real estate lending now offers yields comparable to, or even exceeding, high-yield corporate bonds, but with superior collateral backing and recovery prospects.

Interest coverage ratios, which faced downward pressure during the initial phase of interest rate increases, appear to have stabilised during 2024, according to results from the Bayes UK Lending Survey.

This stabilisation, supported by recent interest rate cuts and clearer monetary policy direction, suggests that borrowers maintain adequate cash flow coverage to service their debt obligations, reducing the likelihood of defaults driven by cash flow stress.

Structural evolution

The European commercial real estate lending landscape has undergone significant structural evolution since the GFC, creating opportunities for alternative lenders and more diverse financing markets.

Regulatory reforms including Basel III/IV and Solvency II have increased capital requirements for banks and insurers, curtailing their appetite for higher-leverage and non-core commercial real estate lending.

This regulatory-driven retreat has created space for alternative lenders to establish a meaningful market presence.

Current estimates suggest that alternative lenders now provide approximately 40% of UK commercial real estate lending, with growing market shares in France, Spain and Germany. Further growth is expected as Basel III Endgame implementation continues across European markets.

While banks still account for 84% of European commercial real estate lending overall, their declining market share is creating a more diverse, competitive and resilient lending ecosystem.

This transition provides borrowers with a wider array of funding solutions across the capital stack while creating opportunities for institutional investors to access attractive risk-adjusted returns through direct lending strategies.

Diverging markets

The comparison between real estate debt and private corporate credit reveals stark differences. Private corporate credit, which grew rapidly to nearly $2 trillion by 2024, is now showing signs of stress as we shift away from the low-interest-rate backdrop that fuelled its expansion.

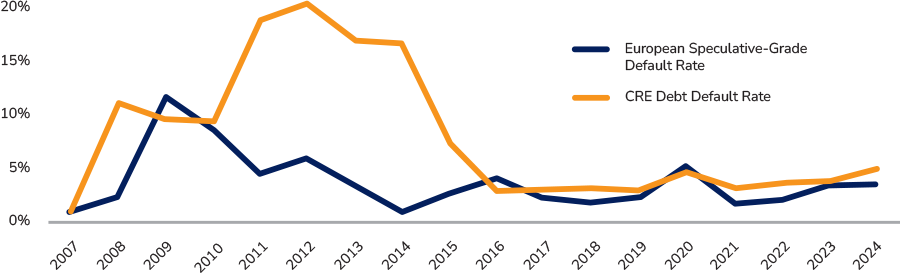

Default rates in private corporate credit have increased. Fitch reports that US private corporate credit default rates rose from almost zero percent in 2022 to 5.7% at the start of 2025, while S&P data shows European speculative-grade corporate default rates reaching 4.1% by March 2025.

These levels are typically associated with recessionary periods, and any further market shocks or extended weakness are likely to disproportionately impact corporate credit performance compared to the already-rebased real estate market.

Figure 3: Corporate and CRE Debt Default Rates

Source: S&P Global

The vulnerability of corporate credit has been significantly compounded by the growth in covenant-lite lending over the past decade.

Driven by fierce competition among lenders during the capital-abundant, low-rate era, covenant-lite loans now represent approximately 90% of total leveraged loan issuance in both the US and Europe, according to data from the Association for Financial Markets in Europe.

In contrast, real estate debt maintains stronger structural protections.

The physical nature of the underlying collateral, combined with conservative lending practices developed in response to post-global financial crisis (GFC) regulations, creates a more defensive investment proposition. Recovery rates consistently demonstrate this advantage, as data from GCD Bank shows.

Portfolio benefits

Real estate debt’s risk-return characteristics position it well for institutional portfolios, offering returns potentially similar to higher-risk asset classes while maintaining significantly lower volatility.

This favourable risk-return profile stems from several structural factors. The senior position within the capital stack provides cushioning against defaults, while contractual income obligations built into loan structures deliver steady cash flows.

The typically shorter duration of CRE loans compared to traditional fixed income investments can help mitigate exposure to inflation and interest rate changes.

From a portfolio construction perspective, CRE debt’s low correlation with traditional fixed income provides strong diversification benefits.

Portfolio optimisation analysis from Nuveen Real Estate suggests allocating just 10% of a diversified portfolio to CRE debt can potentially reduce overall portfolio volatility while maintaining or improving expected returns.

This diversification advantage becomes particularly valuable during periods of market stress, when correlations between traditional asset classes often increase.

The income stability provided by real estate debt also offers portfolio cash flow predictability that can be useful for institutional investors with defined liability streams, such as pension funds and insurance companies.

The contractual nature of loan payments, backed by physical collateral, provides a more predictable income stream compared to equity-based real estate investments or many other alternative asset classes.

Time to return

The convergence of factors supporting real estate debt investment appears particularly compelling from a timing perspective.

The regulatory environment continues to evolve in favour of alternative lenders, with Basel III likely to further constrain traditional bank lending capacity. This ongoing structural shift should continue creating opportunities to capture attractive risk-adjusted returns through private credit.

The broader macroeconomic environment, while still uncertain, appears to be moving toward greater clarity regarding monetary policy direction.

Central bank communications suggest that the aggressive rate hiking cycle may be behind us, potentially providing more stable operating conditions for real estate borrowers and reducing refinancing stress.

Seizing opportunities

Current market conditions present a compelling case for increased allocation to real estate debt.

Attractive entry valuations following market corrections, conservative lending structures providing substantial downside protection, superior recovery characteristics compared to corporate credit and meaningful portfolio diversification benefits represent a strong real estate environment.

Institutional investors have the opportunity to capitalise on these market conditions.

Real estate debt offers the rare combination of defensive characteristics during uncertain times and upside potential as markets stabilise, all while providing the portfolio diversification benefits that sophisticated institutional investors increasingly value.

Disclaimer

All investments carry a certain degree of risk, including possible loss of principal, and there is no assurance that an investment will provide positive performance over any period of time. Past performance does not guarantee future results.

Nuveen, LLC provides investment solutions through its investment specialists.

4908914

More Related Content...

|

|

|