Re-writing the rules on bond investing

Written By:

|

Raman Srivastava |

Raman Srivastava, co-deputy chief investment officer and managing director, Global Fixed Income For Standish, A BNY Mellon company, looks at opportunities for bond investors in a rising interest rate environment.

Until the financial crisis of 2008, bond markets generally offered investors relatively low volatility, a high degree of transparency, high correlations across global markets and the reassurance of AAA-rated sovereign issuance in times of uncertainty. As well as helping to manage portfolio volatility, investing in bonds tended to generate predictable cash flow and provide a degree of protection against inflation.

Today’s bond markets look very different – the fallout from the credit crunch, shifting dynamics across the global economy and unprecedented central bank intervention have seen a re-drawing of the landscape:

- In many major markets, zero-to- negative real yields are a reality, as record low interest rates can no longer compensate investors for the impact of growing inflationary pressures. Bond yields have been driven down by uncertainty over the health of the global economy in the wake of the financial crisis and concerted bond- buying programmes from the major central banks.

- The very concept of “risk-free” assets is being called into question with “safe” sovereign issuers the US, France and, most recently, the UK all downgraded since summer 2011. The pool of AAA-rated sovereign debt has shrunk as developed market governments struggle to balance the dual pressures of burgeoning fiscal deficits and ailing economies. Some estimates suggest that the pool of “nine-A-rated” sovereign debt (that is, rated AAA by Fitch, Moody’s and Standard & Poor’s) is now less than half what it was pre-crisis, having fallen from US$10.9 trillion at the start of 2007 to around US$4 trillion¹.

- Furthermore, investors have had to accept greater levels of both sector rotation and volatility as financial markets continue to take their cue from politicians and policymakers rather than fundamentals. Wrangling over the fiscal cliff in Washington, crisis after crisis in the Eurozone, and central banks striving to restore order have all played their part.

So what are the prospects for bond investors?

We expect that, at some point, developed market interest rates will rise from their current, very low levels. Once the likes of the Federal Reserve and the Bank of England feel their economies are turning a corner and pull back from quantitative easing, the artificially-low yields on government bonds are likely to rebound.

Many investors, already facing the challenges around yield generation and inflation risks, are now being forced to focus their attention on managing duration in portfolios. The marked fall in yields over recent years has left many bond holdings highly sensitive to even the smallest rise in interest rates. As at the end of 2012, the Barclays Global Aggregate Index was yielding just 1.7% with 6 years of duration risk². From these levels, there is very little upside and significant downside potential. Investors could be forgiven for looking at bond markets today and seeing only the risks associated with interest rates rising, but what we see are opportunities for taking advantage of this market dislocation.

Searching out global opportunities

Importantly, as well as becoming more volatile, returns from global bond markets have also diverged over the recent past. Before 2007, global bond market movements tended to be highly correlated, particularly during times of market uncertainty. Even the growing emerging debt markets tended to take their lead from US Treasuries – unless they were hit by external shocks, in which case they still tended to move as a bloc. This no longer holds true.

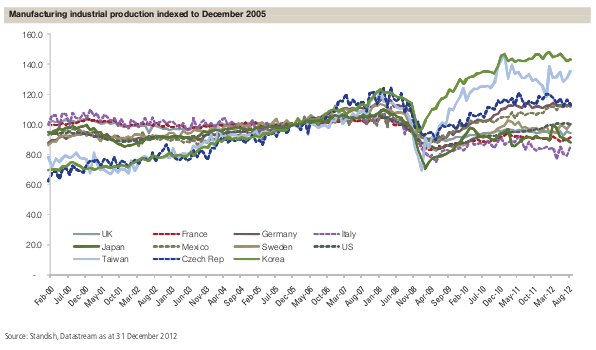

In part, this can be attributed to the shift in the global economy that was already taking hold prior to the financial crisis. A more complex, “multi-speed” global economy is evolving, no longer driven solely by US demand. Taking manufacturing industrial production as a proxy for economic activity, the range of growth rates across economies has widened considerably and this trend is expected to persist. These differentials are creating new opportunities and greater scope for those investors who can harness them.

Sectors that would traditionally have been seen as “off-benchmark” bets by investors are now moving into the mainstream. High yield credit, emerging market debt, peripheral Europe and high yield loans offer significant potential with a higher average yield and a lower duration than global government bonds. It is precisely these sorts of opportunities that investors need to capture going forward.

A generation of more nimble, unconstrained fixed income strategies offers investors a way of accessing greater potential returns, with a low correlation to any one sector or fixed income risk, and a focus on managing duration.

Standish has a history of managing these types of fixed income strategies and we have over US$3.5 billion under management in unconstrained mandates³. We have access to in-depth global research across countries, sectors and securities and we feel this gives us significant advantages relative to our competitors, given how pivotal active allocation is to driving returns. The aim of our Opportunistic Fixed Income strategy is to offer investors the ability to diversify away from the main risk in most fixed income portfolios – rising interest rates. We adopt what we would term a “benchmark-agnostic approach”, targeting an absolute return of 3% to 5% over domestic LIBOR through an investment cycle, with a tracking error range of 3% to 7%.

In addition to our go-anywhere mindset, we are also able to target duration neutral or net short positions in countries, sectors and specific corporate issuers. This is particularly useful when the risks in the bond market appear asymmetric, as now. The approach generates low correlations of returns relative to other asset classes, including stocks and US Treasuries. In these uncertain times, we also aim to maintain liquidity and deliver returns with less volatility than equities.

Unconstrained does not mean there is a lack of control, however. We do not employ leverage and we pay very close attention to all aspects of risk. Risk management and understanding sources of volatility are vital tools in managing the strategy – for example, we know the tracking error for each sector, bond by bond, expressed as basis points at risk on the upside and downside.

Overall, the strategy aims to manage duration in a way that protects investors from extreme market moves. The best investment ideas come in all shapes and sizes. Because our strategy uses such a broad global opportunity set – everything from Treasuries and other government instruments to emerging market and securitised debt – we are able to take advantage of the positive pockets of return that can be found no matter where we are in the economic cycle.

This is a financial promotion for Professional Clients and/or distributors only. This is not intended as investment advice. Past performance is not a guide to future performance. The value of investments and the income from them is not guaranteed and can fall as well as rise due to stock market and currency movements. When you sell your investment you may get back less than you originally invested. All information relating to Standish Mellon Asset Management Company LLC (Standish) and Standish Global Opportunistic Strategy has been prepared by Standish for presentation by BNY Mellon Asset Management International Limited (BNYMAMI). Any views and opinions contained in this document are those of Standish as at date of issue; are subject to change and should not be taken as investment advice. BNYMAMI and its affiliates are not responsible for any subsequent investment advice given based on the information supplied.. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries. This document should not be published in hard copy, electronic form, via the web or in any other medium accessible to the public, unless authorised by BNYMAMI to do so. No warranty is given as to the accuracy or completeness of this information and no liability is accepted for errors or omissions in such information. To help continually improve our service and in the interest of security, we may monitor and/or record your telephone calls with us. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. This document is issued in the UK [and in mainland Europe (excluding Germany)] by BNY Mellon Asset Management International Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. In Germany, this document is issued by Meriten Investment Management GmbH (formerly named WestLB Mellon Asset Management Kapitalanlagegesellschaft mbH) which is regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht. Meriten Investment Management GmbH is wholly owned by The Bank of New York Mellon Corporation. If Meriten Investment Management GmbH (MIM) receives any rebates on the management fee of investment funds or other assets, MIM undertakes to fully remit such payment to the investor, or the Fund, as the case may be. If MIM performs services for an investment product of a third party, MIM will be compensated by the relevant company. Typical services are investment management or sales activities for funds established by a different investment management company. Normally, such compensation is calculated as a percentage of the management fee of the respective fund, calculated on the basis of such product’s fund volume managed or distributed by MIM. The amount of the management fee is published in the prospectus of the respective fund. Any compensation paid to the MIM does not increase the management fee of the relevant fund. A direct charge to the investor is prohibited. The publication is intended as marketing instrument and does not satisfy the statutory requirements regarding the impartiality of a financial analysis, and the financial instruments concerned are not subject to any prohibition of trading in advance of the publication of this presentation. Authorised and regulated by the Financial Services Authority. BNY Mellon Asset Management International Limited, Standish Mellon Asset Management Company LLC and any other BNY Mellon entity mentioned are all ultimately owned by The Bank of New York Mellon Corporation. CP9974-09-07-2013 (3M).

1. Source: FT.com “Dearth of triple A alters investment map” March 26, 2013

2. Source: Barclays as at 31 December 2012

3. Source: Standish; assets under management as of December 31,2012. Includes assets managed by Standish personnel acting as dual officers of the Dreyfus Corporate of the Bank of New York Mellon, wholly owned subsidiaries of The Bank of New York Mellon Corporation.

More Related Content...

|

|

|