Quantifying sustainability – making sense of ESG data

Written By:

|

Hamish Gowen |

Hamish Gowen of Quoniam Asset Management talks through the process of identifying asset managers who can help institutional investors interpret ESG-related data and adapt it to their individual preferences

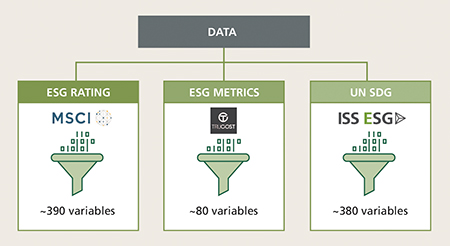

We have entered a phase of “ESG big data”. Data providers have flooded the market as awareness for ESG has grown. Both asset managers and asset owners are preparing their portfolios for increasing regulatory requirements. While data quality has improved, the new challenge is its quantity (see Figure 1). Data is often inconsistent across providers and can also be unstructured.

Figure 1: Multiple sources of data used in ESG integration

Source: Quoniam Asset Management

In the wake of these challenges, some asset managers are maintaining and expanding their in-house research teams, but will have to compete in quality with the rising number of data providers. These managers must also remain cost-efficient and continue to believe that they can add value in comparison to data providers. The remaining managers will choose to buy data and turn it into useful information for their investment process.

Institutional investors no longer have a narrow selection of ESG asset managers. They face not only an oversupply of data but a barrage of asset managers claiming expertise. To reduce the complexity of the task, they will need to identify the asset managers who will help them understand all the data and show them the way to best implement their regulatory requirements and stakeholder objectives.

Challenges of interpreting different ESG data

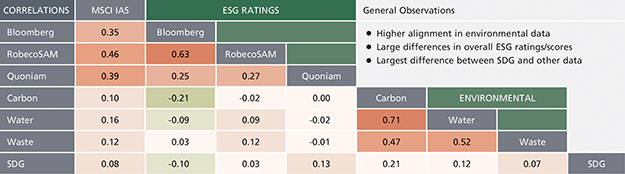

Terms like ESG roll off the tongue, but we have to remember that each letter stands for a highly complex, qualitative topic that needs to be first understood, interpreted and quantified. We have analysed different data providers including MSCI, ISS and Bloomberg and found that similar data sets have low correlations. For example, the MSCI ESG score has a 0.35 correlation with Bloomberg’s ESG score (see Figure 2).

Figure 2: ESG has many facets – correlations are low between factors and data providers

Source: Quoniam Asset Management

This poses a huge challenge for institutional investors because the data provider they choose will lead to different outcomes. For example, a hydropower plant can have good overall ESG ratings and SDG scores and, at the same time, a bad score for environment since its carbon footprint and water usage is high.

Context matters when evaluating a company’s ESG performance. ESG ratings and metrics can express opposing views for the same company. Each mandate’s guidelines can create an individual context, for example, investing with a specific focus on reducing water usage. From this angle, the hydropower plant would most likely be excluded despite its positive contribution to the SDGs.

These differences force asset owners to dive into the details. Institutional investors have to know which data providers will best express their preferences, and avoid reputational risk from misunderstanding. Investors need to be guided through differences in data to make the right choices from the outset.

Quantifying ESG information

In order to screen a global investment universe for controversies or calculate the environmental footprint of a portfolio, ESG information needs to be quantified. Data providers bridge the qualitative question “Does this company violate ethical labour practices?” to a binary output that can be filtered. In the case of the environmental footprint, the data provider must first define “water intensity” and answer that question with an absolute or relative number that an asset manager can use in the portfolio construction process. While environmental impacts can be easily quantified such as CO2 emissions or water usage, quantifying social impacts still remains a challenge.

ESG ratings are based on many facets, much like bond ratings, and draw on qualitative aspects, whereas ESG metrics are specific and one-dimensional, like CO2, water and waste intensity. Both ESG ratings and metrics show the current state of a company, while a focus on SDGs gives a future-oriented perspective.

In order to manage the shift towards more and complex data, vast amounts of information need to be analysed, interpreted and adapted to investors’ preferences.

Whereas in the past many believed that ESG and quant did not mix, quantitative asset managers today may even have an advantage when it comes to the integration of ESG into investment processes.

ESG integration – the quant way

In quantitative investment processes, ESG criteria are integrated during portfolio construction together with forecasts for alpha, risk and transaction costs. Rating or metric levels can be set as absolute or relative constraints, and the portfolio can be optimised with regards to:

- E, S, G factors and industry-adjusted score (IAS)

- ESG management score and ESG momentum

- Environmental footprints: carbon, water and waste

- Exposure to SDGs, e.g. revenue from SDGs

ESG research in quantitative asset management

What you include and exclude and how you integrate ESG into live portfolios affects portfolio performance. Therefore, it is important to ensure that the data can be integrated and processed before it is implemented into the investment processes or used for research. It makes sense to establish a specialised SRI committee within the investments team in order to monitor ESG data with respect to two essential objectives:

1. Ensuring the quality and coverage of all data sets, including ESG ratings, ESG metrics and UN SDGs (see Figure 1)

2. Re-evaluating criteria to ensure that the context has not changed with respect to ESG screening, integration and engagement

For example, at Quoniam we historically only excluded 1% of top CO2 emitters. This criterion will now change to include thermal coal (producers and distributors). These two criteria are to some extent overlapping, but they have shifted in context due to regulation and trends.

A challenge when dealing with large and complex amounts of data is quality assurance and the efficient extraction of relevant information. Our research has focused on broadening our knowledge of ESG data and understanding its interdependencies. We have analysed the correlations between various types of data sets and calculated our own Quoniam SRI composite. It combines different sustainability ratings and metrics to create a holistic representation of a company’s overall ESG performance. Research has shown that due to the complexity of ESG, it is necessary to include all aspects and perspectives. This ensures that significant divergences will not impact the ESG objectives of the portfolio.

Transparency in sustainable investing

If a large portfolio, for example, is transformed from no ESG consideration to becoming ESG-compliant, the asset owners must first set out an ESG policy that meets the requirements of stakeholders and regulators. Their policy should answer questions like: “What controversies do we exclude?”, “How do we define E, S and G?” or “What is our position on SDGs?”. After that, specialised asset managers can help them get as close as possible to their beliefs and requirements.

Another important aspect is transparent ESG reporting with multiple key performance indicators (KPIs). This ensures that investors can keep their own stakeholders and regulators informed on the fulfilment of the ESG policy.

Going forward we will see an increase in transparency on how companies consider sustainability risk in their investment processes, how their investment decision- making has an impact on ESG aspects and how financial products actually fulfil the classification to be sustainable. In addition, regulation will provide the financial sector and the real economy with clear goals on mitigating and adapting to climate change.

The transparency and decision- making capabilities that go along with regulation are highly dependent on the availability of data and know-how.

Conclusion

Overall, we will see an increase in ESG data covering various indicators and the necessity to comprehend its complexity. Institutional investors need asset managers who ensure the quality of the data and who analyse and classify it. Quantitative asset managers can add value in this area since they know how to turn vast amounts of data into useful information and adapt it to individual preferences.

Our research shows that the choice of data provider(s) leads to different outcomes and that ESG ratings and metrics can express opposing views for the same company. Differences in data need to be recognised to optimise portfolios for ESG criteria, alpha and risk forecasts simultaneously. Another important aspect will be the establishment of transparent ESG reporting in accordance with regulation.

More Related Content...

|

|

|