Private credit in the US – where are the best opportunities?

Written By:

|

Nitish Sharma |

Performance across the private credit sector has shown strong yield relative to public market equivalents. Nitish Sharma of AllianceBernstein analyses where illiquidity premiums persist and key considerations to mitigate risk

Private credit has grown from being a relatively niche market to a fully-fledged global source of financing and is increasingly seen as a core portfolio component, valued for its return-seeking, diversifying and risk-mitigating characteristics across sectors, particularly by long-term investors such as Local Authority Pension Funds.

The global private debt market surpassed US$100 billion in aggregate capital raised by funds closed in 2017. North America saw the highest fundraising totals, reaching US$67 billion, almost double that of Europe-focused funds (US$36 billion). The US is the largest and most developed private market – approximately four to five times bigger than Europe.1

At AllianceBernstein, we believe that the best opportunities in the US are most in evidence across three key markets: core middle market corporate lending, commercial real estate lending, and securitised credit. In the US, each of these markets has delivered attractive, risk-adjusted returns relative to public market equivalents. In this context, US private credit remains a strong asset class that has the potential to outperform even in times of market stress.

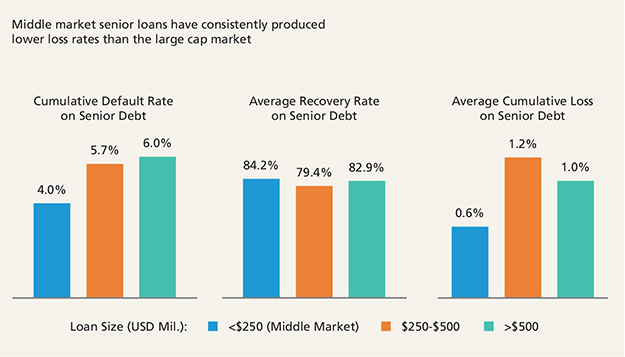

Figure 1: Middle market private credit: downside protection

Source: AllianceBernstein. As of 31 December 2018; represents data from 1995-2018. For illustrative purposes only.

Note: Past peformance is not necessarily indicative of future results. There can be no assurances that any investment objectives will be achieved.

US middle market corporate lending

The middle market is a vital sector of the US economy, responsible for approximately one third of private sector GDP, which equates to the third largest global economy on a stand-alone basis. The breadth and depth of this market offers substantial scope for the future. While there has been a decline in the number of publicly listed companies in the US every year since 1997 (there are now fewer than 4,000) there are around six million in the private sector – a rich source of lending potential for investors. This highly fragmented and scalable market generates robust transaction volumes that are typically not highly correlated to broader capital markets.2

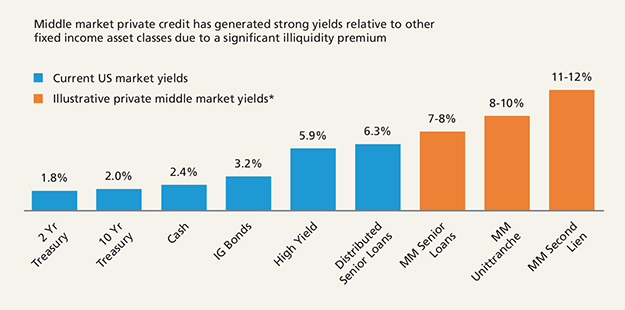

Figure 2: Middle market private credit: illustrative yield profiles

Source: AllianceBernstein. As of January 31, 2019. For illustrative purposes only.

Note: As of 30 June 2019. Past performance is not necessarily indicative of future results. There can be no assurances that any investment objectives will be achieved. Cash is represented by 1 Month USD LIBOR, 2 Year Treasury by the Bloomberg US Generic Government 2 Year Yield, 10 Year Treasury by the Bloomberg US Generic Government 10 Year Yield, Investment Grade (“IG”) Bonds by Bloomberg Barclays U.S Corporate Investment Grade Index. Distributed Senior Loans by S&P/LSTA US Leveraged Loan 100 Index, and High Yield by the Bloomberg Barclays U.S. Corporate HY 2% Issue Cap Index. 2 Year Treasury, 10 Year Treasury, and Distributed Senior Loans yields represented by Yield-to- Maturity. IG Bonds and High Yield yields represented by Yield-to-Worst. *Yieds are hypothetical and based upon historical data and forecasts. There can be no assurances that any target return objectives will be met. Source: St. Louise Federal Reserve (Cash), Bloomberg Barclays (IG and HY Bonds), Bloomberg (2 Yr and 10 Yr Treasuries), S&P/LSTA (Distributed Senior Loans), Thomson Reuters LPC, AB.

US commercial real estate debt

This asset class has long been recognised as playing an important role in an investor’s diversification strategy. US commercial real estate continues to represent a stable market compared to many countries around the world. In addition to diversification benefits, direct negotiated lending against real estate assets offers the potential for stable, current cash flow backed by strong collateral.

US securitised credit

This includes government-sponsored enterprise risk-sharing transactions, legacy and new issue non-agency residential mortgage-backed securities, commercial mortgage-backed securities, collateralised loan obligations, and consumer-backed credit. These securities provide broad exposure to the US housing and consumer markets, both of which we consider to be on a strong footing given the US’ tight labour market and relatively robust economy.

Strong prospects despite tougher times ahead

After a brief period when it appeared that interest rates were set to normalise, markets are experiencing a renewed rate-cutting phase and a resumption of shrinking yields. As a result, investors continue to face the challenge of securing high and stable income. An environment in which increased volatility and slow growth in the public markets may become the norm is likely to further increase the potential value of private credit strategies that offer a yield premium. We believe that allocating to this asset class should remain a priority for investors for several reasons:

Significant illiquidity premium

At this stage in the credit cycle, spreads are extremely tight and balance sheets look stretched. We believe that the liquidity premium in public markets has all but disappeared and expect future global rate rises to remain below historical averages for the foreseeable future. Private credit offers investors the opportunity to go beyond traditional fixed income solutions in order to meet long-term obligations.

Tougher downside protection

Private credit strategies offer access to a broad opportunity set spanning different market sectors, borrower types and geographic regions. Because investors have greater control at every stage of the process, from covenant negotiation through borrower oversight, many directly originated credit opportunities have experienced lower default rates and higher recovery rates than public credit asset classes.

Inter and intra asset class diversification

Directly-originated private credit opportunities have idiosyncratic exposures to sectors, types of borrowers and regional trends, which implies significant diversification benefits compared to traditional fixed income.

However, given competition in this sector, and the customised nature of the investments, a manager’s ability to source differentiated opportunities and due diligence are of particular importance. Investors must be careful to assess a manager’s approach, process, and track record.

Among the key capabilities to consider are: how loan opportunities are sourced and selected, how much they influence deal structuring and the negotiation of creditor documents, the way in which the volume of transactions is valued over credit selection, due diligence procedures, and the portfolio management approach.

In brief

After a long bull-market period, we believe it will take time to fix the disconnect between fundamental credit metrics and valuations in the public market given investors’ ongoing appetite for yield and income. Private credit has an important role to play at different stages in the credit cycle. Five years ago, investors were focused primarily on taking greater risk for greater reward. In the current climate, the illiquidity premium continues to be attractive but so too is the downside protection that such strategies afford through covenants and lower default rates. Allocations to private credit have more than tripled in the last 10 years. We expect this trend to continue. Given the size, stability and untapped potential of the US market, we believe that it remains an attractive destination.

1. Prequin 2018 Global Private Debt Report. http://docs.preqin.com/samples/2018-Preqin-Global-Private-Debt-Report- Sample-Pages.pdf; https://www.preqin.com/insights/blogs/alternatives-in-2019-private-debt-fundraising-sees-strategyshifts/25401

2. National Bureau of Economic Research, NBER Reporter 2018 Number 2. https://www.nber.org/reporter/2018number2/stulz.html

More Related Content...

|

|

|