Potential emerges

Written By:

|

Federico Garcia Zamora |

A challenging global investment environment is driving significant interest in emerging market (EM) sovereign and corporate debt. Federico Garcia Zamora of Standish explores the latest developments in the EM debt universe

This year has seen renewed investment interest in emerging market sovereign and corporate bond markets as doubts resurface about the global economic outlook and the search for returns extends beyond traditional, mainstream assets. In July, emerging market debt (EMD) yields hit record lows¹, with the sector lifted by recovering commodity prices, improving prospects in some EM geographies, and amid fresh concerns about likely growth in markets such as the Eurozone.

EMD issuance has been intermittent throughout much of 2016 with a reported dip in bond sales in the second quarter of 2016.² However, Brazil and Turkey released new debt tranches³ in February, and in April the release of US$16.5 billion issuance package marked Argentina’s return to bond markets for the first time in 15 years.⁴

By July 2016 EM sovereign and local debt issuance had hit its highest level on record, according to industry data provider Dealogic.⁵ Market fortunes have improved significantly since last year and there are now some encouraging signs of recovery in the market.

There are many positives in the market, and traditional drivers for the asset class appear more supportive than they were in the past three years. Low yields and low global interest rates seem to be here to stay in Europe, Japan and the US which is a factor that will support the EM asset class.

Commodity prices, including oil, have at least partially rebounded from recent lows and seem on a more stable footing; the demand/supply dynamics projected into the future also look more positive.

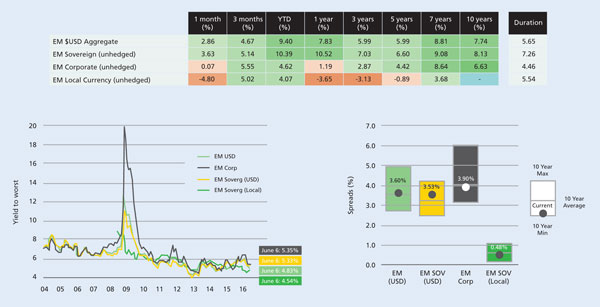

Figure 1: Emerging Market Debt: performance and spreads

Source: ISSG, Brclays Capital and Bloomberg. As at 30 June 2016

Market optimism

Despite ongoing political uncertainty in a number of developing countries, there are reasons to remain optimistic. While the return picture is rarely predictable and uniform there are a range of markets we feel could offer good prospects. Within central and eastern Europe we like Russia, Kazakhstan and Georgia, while in Latin America, Brazil, Colombia and Argentina look attractive. In Asia, Indonesia currently stands out as one of the richest prospects in the region. In recent months, cyclical factors have been very supportive of Indonesia. The growth picture has improved and the government has been fairly stable and has been pushing for structural reform. Flows have been very supportive as well because it is, essentially, the main high yielding market in Asia.

Risk can be seen as a key feature of emerging markets and a tendency for unpredictable events to drive volatility means investment in EM sovereign and corporate debt sometimes requires both patience and strong nerves.

EMD investors should always think long-term while also keeping a close watch on international events, this year’s failed coup attempt in Turkey is a prime example of events that can damage short-term confidence in specific markets. Within our universe there is always the risk something unexpected could happen which might spook markets. But despite the often short-term blips in the market, the fundamental need for returns remains and emerging markets currently offer some of the highest available. That technical backdrop has been with us for some time now and will most likely continue to be with us for the foreseeable future.

Risk profile

While the situation in emerging markets such as Brazil and South Africa (which is facing an uncertain political future after recent local elections⁶) do carry an element of risk, such political risks are not confined to developing markets. We have just seen the UK vote to leave the EU and we now face upcoming French and Italian votes which could also influence the future direction of Europe. In developed markets there are clearly a range of events that could upset global investment markets – not least further activity by the US Federal Reserve (Fed) – and the outcome of the US election.

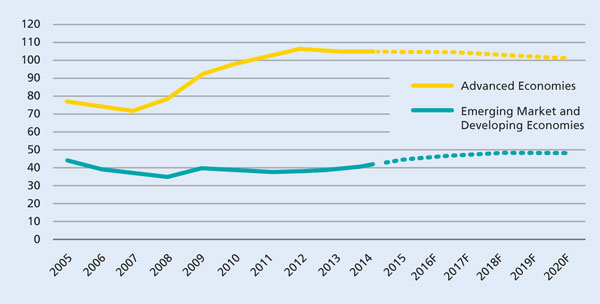

One important decision facing EM investors is whether to gain exposure to the sovereign market, look at corporate debt or a mixture of both. While on average, emerging markets economies are less indebted than developed ones – according to the IMF – the sovereign debt sector is not immune to default or the threat of it. EMD has had a number of sovereign debt downgrades in recent years.⁷ Corporate debt can offer potentially higher risks than sovereign bonds but can also provide compensatory, attractive returns. Either way, good local knowledge of individual markets and geographies and specialist investment expertise are crucial in order to maximise opportunities while keeping risk to a minimum.

Beyond sovereign versus corporate, another key consideration facing EMD investors is whether to gain exposure via US dollar-denominated (hard currency) securities or local currency. Traditional hard currency issuance has increasingly given way to local currency. This has helped to improve both the stability and scale of capital markets in developing markets, but investors should always think carefully about the currency risks associated with their investments.

Figure 2: EM Indebtedness (Gross Government Debt/GDP %)

Source: International Monetary Fund, World Economic Outlook Database. As at 6 October 2015

Going local

While issuance in local currency denominated debt has grown significantly in recent years⁸, many investors show a preference for US dollar issues as a way to guard against local currency fluctuations that may impinge on returns. Many asset allocators are still cautious on local currency EMD given the volatility local markets have seen over the past three or four years. They generally feel more comfortable with hard currency EMD, where they understand the currency volatility much better than on the local side. That said, local currency denominated debt can be used as a positive tactical vehicle. If a major fall in the dollar, say, was anticipated then it could perform well.

Positive factors

Looking ahead, a number of factors look set to boost growth in the EMD sector. The low yield environment currently holding back many developed markets shows no sign of reversal and while prospects remain weak, the comparatively high returns offered by emerging markets investment will continue to attract investor interest.

From an investment standpoint, EM sovereign and corporate debt can provide both portfolio diversification and income generation. Governments in a number of emerging markets, such as India, are also taking steps to improve governance and boost their economies in order to attract new investment. At a macroeconomic level emerging markets are becoming increasingly sophisticated and the development of pensions systems across many developing nations⁹ is expected to foster continued growth of assets, including both sovereign and corporate debt that can help them match their longer-term liabilities. Our belief that economic growth in emerging markets is set to continue to outpace growth in developed countries is key to the potential long-term advantages of investment in emerging markets.

1. FT. Emerging market debt yields hit record lows. 28 July 2016

2. Reuters. Sovereign emerging bond sales up 50 pct yr/yr in 2016. 29 June 2016

3. FT. Bond markets reopen for EM borrowers. 13 March 2016

4. Reuters. Sovereign emerging bond sales up 50 pct yr/yr in 2016. 29 June 2016

5. FT. Emerging markets party as lower for longer morphs into forever

6. Newsweek. South Africa left in limbo by landmark election results. 08 September 2016

7. FT. EM debt rally soars to new heights. 27 July 2016

8. Teachers Insurance and Annuity Association (TIAA) Global Asset Management. Investing in EM local currency debt markets. 01 March 2016

9. lbid.

More Related Content...

|

|

|