Offsetting volatility with quality

Written By:

|

Matthew Benkendorf |

Matthew Benkendorf at Vontobel sees the return of quality growth companies with high margins, pricing power, low levels of debt and consistent earnings

2022 has been off to a volatile start with global inflation rising to record levels, particularly in developed markets, a spike in interest rates, the Russian invasion of Ukraine, supply chain bottlenecks, and Covid-induced lockdowns in China. These combined to put downward pressure on markets and upward pressure on oil and commodity prices.

Global growth forecasts are being cut as economists realise that their rosy scenarios of steady growth in 2022-23 have become much thornier. In April, the IMF reduced its 2022 global GDP forecast to 3.6%, 0.8% lower than just three months earlier and 1.3% lower than six months ago.

Pricing power can offset volatility and inflation

In the US, rising interest rates, declining fiscal stimulus, wage and price inflation, and lower consumer confidence increase the probability of potential monetary policy error and possible recession, which may become a reality towards the end of this year and into 2023. For the next few quarters, however, a normalisation from Covid with respect to supply chains, industrial activity and consumer behavior should be important drivers of economic growth.

Pricing power will be important amid rising commodity prices, wage inflation and supply chain issues. While consumer staples companies tend to be resilient, we are cognisant of price elasticity and to what extent companies can pass on commodity price increases without reducing demand. Industrial and technology companies that fill a mission-critical need, are leaders in their markets, and have strong brands can also have pricing power.

The Fed will need to tighten monetary policy aggressively this year. Investors should steer clear of high-multiple technology stocks, many of which are as yet unprofitable. Instead, investors can look to some tech companies benefiting from digitisation and data proliferation in fast-changing and highly competitive industries. Investors could see negative cash flows before real winners emerge but should seek out higher quality names with sticky, stable growth that are trading within reasonable expectations.

Corporate profit margins in America may have peaked and begun to decline somewhat. The chip shortage illustrates how interdependent markets are and how deglobalisation can have profound impacts that are difficult to fully foresee. Investors should be wary that record profit margins enjoyed by corporate America could revert to the mean.

Positioning for increased uncertainty

In Europe, sources of volatility are plain to see: the war and high inflation. Manufacturers may struggle to access energy at any price. Central banks have a tough job to manage inflation without causing a recession.

Europe is working on increasing access to alternative energy sources, but the shift will take time and there is talk of gas rationing in Germany. Even with a peaceful outcome to war in Ukraine, Europe will not want to be as reliant on Russian energy in the future.

War and the energy crisis have also hit consumer confidence in Europe. On the plus side, countries are spending more on green energy, the military, and responses for refugees, while some governments have announced support for energy bills. There is also increasing demand among consumers after Covid shutdowns, such as in strong summer travel bookings.

Unique exposure at reduced valuations

In a US tightening cycle, emerging market currencies tend to weaken, unless the governments in those countries also raise their rates, and higher commodity prices are positive for only some emerging market countries.

However, emerging market economies aren’t nearly as fragile as they used to be. Some emerging markets’ budget and current account balances are stronger than some developed markets. Emerging markets are trading at a valuation discount to developed markets, and increased pressure on emerging market stocks has created opportunities. Many emerging markets are earlier in their recovery from the effects of Covid. Additionally, emerging market stocks are currently trading at a discount of more than 30% versus developed markets, the largest discount since 2004.

Rising interest rates are generally positive for banks, although investors should be selective. In India and Indonesia, banks can benefit from higher net interest margins and lower credit costs. But with higher costs in Brazil and South Africa, rate rises can choke off growth.

It will pay to be selective in India as higher inflation impacts the lower income population. Exposure to market leaders focused on premium products, IT service businesses that benefit from a weaker rupee, quality banks with lower credit costs, and low-cost refiners should hold up well.

Regulation risk in China has not completely gone away. However, in sectors like e-commerce, investors are increasingly able to quantify the impact and help identify the potential winners. It is also possible to navigate the market with less exposure to companies and sectors in the government’s crosshairs.

How will this investment roller coaster play out for long-term equity investors?

Like the end of a long evening of revelry, this decline in the fortunes of both momentum growth and value companies leaves the quality growth investors, in our opinion, still standing. They are the ones invested in companies that can provide consistent earnings growth and earn high operating margins due to the economic moats around their businesses. They can own companies with the power to increase prices during inflationary periods. Their companies have relatively low debt levels and can withstand higher interest rates more easily. They should see relatively benign comments from their companies’ CEOs about current and future business prospects.

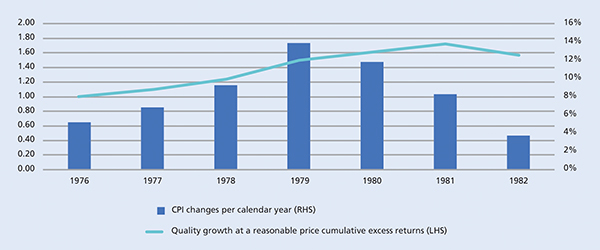

The consumer staples sector, a traditional source of high-quality, dependable growth names, began reporting quarterly results in April. Nestlé, Procter & Gamble, and Heineken announced they had increased prices by about 5% each. Quality companies can raise their prices to protect their profit margins. Investors reward such companies by buying their shares during inflationary times, as happened in the late-1970s when inflation raged through economies.

Figure 1: Quality growth outperformed in past periods of inflation

Past performance is not indicative of future results.

The Quality Growth at a Reasonable Price universe is defined by Credit Suisse HOLT as: The top 50% of companies measured by Quality and Growth scores, and the top 40% of companies measured by HOLT’s proprietary valuation score.

Source: Credit Suisse HOLT, Bloomberg, Axioma, St. Louis Fed. Data as of March 15, 2022.

With inflation rising sharply, and interest rates quickly increasing from very depressed levels, we have entered a new phase, one where the pendulum may swing back to quality growth, with its emphasis on companies with high margins, pricing power, low debt levels, and consistent earnings. We believe they are the slow but ultimately successful tortoises in the long foot race investors engage in to beat the overall market.

Disclaimer

Certain of the information contained in this viewpoint is based upon forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Adviser believes that such statements and information are based upon reasonable estimates and assumptions. However, forward-looking statements and information are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements and information.

More Related Content...

|

|

|