New York, Paris, Hong Kong, Munich, everyone’s talking about… REITs

Written By:

|

Nick Roberts |

|

Guy Mountain |

Nick Roberts and Guy Mountain of Sarasin & Partners discuss whether now might be a good time to diversify UK property portfolios

Investors in UK property have seen strong returns recently – in 2013 the IPD All Properties Index returned 10.9% as capital values rose and yields fell. However, the underlying long-term driver of property returns, rental growth, has been more subdued; rents grew by just 0.9% last year and over the last five years have actually fallen by 1.3% pa. on average. Since 1980, UK commercial property rental growth has averaged 3.2% pa. below the average inflation rate of 4.2% pa. With economic growth across Europe stuck at low levels, the outlook for rental growth may stay subdued, and the time may be coming when the strong capital growth falters as the decline in yields comes to an end.

So is it time to cash in some of the good returns on UK property and reallocate elsewhere? The Bank of England is discussing raising interest rates in 2015. Property that can be very illiquid is currently quite easy to sell.

Go global

Just as UK pension funds have diversified their equity portfolios overseas in recent years, there is now a strong case to consider some diversification of UK property holdings. For example, rental growth in Singapore was 4% in 2013, Toronto 4.2%, Frankfurt 6.1% and San Francisco 9.2%. In markets with strong underlying demographics and rising incomes, property demand and rental growth can be sustained at attractive levels. But international diversification is easier said than done. The challenges of direct property investment overseas should not be understated. The expertise to own, maintain and administer property directly can be hard to come by, and local knowledge is crucial.

One compelling solution comes in the form of listed real estate, or Real Estate Investment Trusts (REITs). In essence, REITs enable access to a relatively illiquid asset class through a very liquid vehicle. By investing in a REIT – a company which itself owns and manages income generating property assets – investors also have a way into the market without the expense and scale of direct investment. In addition, while boasting tax efficient structures and competent management teams (generally aligned with investor interests), listed companies are some of the most experienced operators in the business and their assets are let to many of the world’s leading companies.

Buy the best

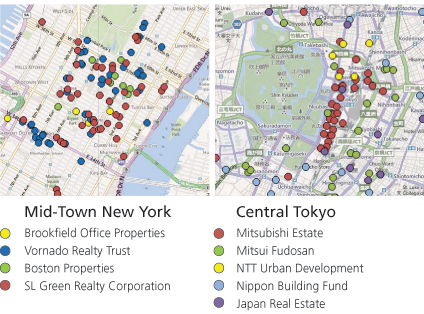

Perhaps most crucially, REITs are sometimes the only way to access prime real estate in a number of cities. Mitsubishi Estate is a great example of this, owning around 38% of the prime real estate in central Tokyo in front of the Imperial Palace (the Marunouchi District), as well as a number of high quality assets in other financial centres. Likewise, in mid-town New York, SL Green Realty Corp, Vornado Realty Trust and Boston Properties own a significant proportion of the prime real estate. In most regions, it is these coveted prime assets which have proved best for both capital preservation and rental growth.

Figure 1: Listed real estate can offer access to some of the world’s prime locations

Source: SNL Financial 2013

Certain regions and sectors are more affected than others by the dominance of REIT ownership. For example, over 80% of prime US malls are owned by REITs, so gaining access here through direct property channels would be difficult. To drive stock selection within a REIT portfolio, a longer-term thematic process can be used to pick high conviction stocks. For example in the retail space, Simon Property fits into our “evolution and modernisation of retail” opportunity set; in the developed world it is essential to stay ahead of changing consumer trends and Simon’s strong portfolio of assets enables it to do this. Simon Property is the largest US REIT: it has some of the best shopping malls that have higher-than-peer-group sales per ft2, and a large national footprint that makes them first choice for retailers looking to expand nationally. This essentially gives them “Franchise Power”, allowing them to push rents and keep the tenant mix fresh. Interestingly, their prime mall and outlet centre portfolio (similar to the UK’s Bicester Village) has proved more resilient in a downturn, as retailers would rather cut space in lower-performing malls, and consumers look for good value.

Diversification, liquidity and flexibility

The local nature of real estate means that it is affected by local economic factors and supply and demand dynamics which give a global portfolio significant diversification benefits;

90-95% of listed real estate companies are exposed to only one region, and over 75% of REITs and property companies specialise in one sector. There are material divergent returns on a regional basis, in fact over the last 13 years (2012 back) the average yearly spread between the best and worst regions has been 48%. These low correlations mean that a well-constructed global portfolio can be expected to deliver significant diversification.

The listed real estate sector is the only place you can cost effectively sell mid-town Manhattan (SL Green – US office REIT) and buy the central Hong Kong business district (Hongkong Land) in 24 hours. This makes listed real estate a highly liquid and cost-efficient way to gain global exposure for almost all investors. Put simply then, this asset class allows liquid, well-diversified exposure to the world’s best real estate in the best locations, providing access to locally driven markets, but with a global scope.

In the long term, volatility doesn’t matter

We recognise that, in the short term, REIT volatility is more in line with equities. However, while volatility can be unsettling, this also creates opportunities, enabling investors to potentially buy stocks at discounts to their net asset values, and sell them at premiums. The volatility itself can therefore offer investors a good entry point into an asset class with reasonable visibility of earnings (thanks to lease lengths) with the potential of rental growth. What’s more, although investors who own property directly often value the seemingly lower volatility they see in the price of their physical asset, this is in fact something of an illusion. The volatility in other asset classes simply reflects the way these are “priced” by the market on a daily basis. If directly-owned property was priced more frequently than semi-annually, its volatility would likely follow that of the listed real estate market. In this sense, the volatility of directly-owned property is not so much lower as unobserved.

It may not be appropriate to sell an entire UK property portfolio and immediately reinvest in REITs, but after a strong rise in capital values, and with the risk of continued subdued rental growth, now may be a good time to diversify part of a UK property portfolio into global REITs.

More Related Content...

|

|

|