Multi-Asset Credit – the future of credit investing

Written By:

|

Ross Pamphilon |

As investors continue to find it difficult to generate sufficient returns from the traditional approach to asset allocation, Ross Pamphilon of ECM outlines the advantages of a Multi-Asset Credit portfolio

There have been numerous innovations under the moniker of “The Mac”. The application of rubber technology to clothing heralded the Mackintosh raincoat in 1824. The Big Mac was introduced by McDonald’s in 1967. And 1984 saw the beginning of the cult of Apple with the launch of its first Mac computer. Not to be outdone, the asset management industry has developed an innovative Mac of its own.

So what is MAC? How can it be used? And how can it benefit investors?

What is Multi-Asset Credit?

MAC stands for Multi-Asset Credit. ECM has been running MAC portfolios since 1999. In the current market environment of low interest rates and falling bond yields, the MAC strategy deserves a closer look.

A MAC strategy might be considered a complement to typical fixed income allocations and is able to make investors’ fixed income bucket work harder for them. There are four key characteristics that define Multi-Asset Credit strategies.

1. Flexible and unconstrained

At the broadest level, a MAC strategy can allocate across the entire cash and derivative fixed income spectrum: from governments to corporates and financials, from high yield to emerging markets, and from asset-backed securities (ABS) to bank loans.

Even though MAC managers typically use reference indices for risk management purposes, the flexibility of MAC strategies comes from not being tied to a benchmark. The unconstrained nature of MAC strategies also extends to how they are managed. Although typically set up as total return funds – where fund returns generally rise and fall with the markets – they can also be established as absolute return funds – where fund returns have a low correlation and volatility compared with the market.

2. Three sources of value

MAC managers possess three main sources of value creation. All three are equally important but they tend to be relevant at different stages in a credit cycle.

Firstly, asset class allocation decisions are made based on the manager’s assessment of economic factors, the credit cycle, market valuations and technicals. Being able to identify the key themes influencing the market at an early stage is vital since it allows the portfolio manager to optimise top-down allocation.

Secondly, sector and security selection is driven by the analysis of individual bond or loan issuers and sectors. The manager’s research team’s expertise in the assessment of relative value as well as industry and thematic trends is key in making these decisions.

Finally, volatility calibration plays a key role in any MAC strategy: a corollary of the broad flexibility provided by MAC strategies is the responsibility for the manager to control risk carefully.

3. Interest rate risk management

MAC strategies typically provide flexibility for interest rate risk management. Unlike traditional fixed income and credit strategies where interest rate duration tends to be the dominant source of returns, MAC strategies have a more balanced approach between rates and credit risk. Given the low level of core interest rates, our preferred starting point for a MAC strategy is currently a duration-hedged position. From this duration hedged starting point, the manager can nevertheless use interest rate duration instruments as a tool to manage volatility and as a source of performance.

4. Currency hedged

MAC strategies aim to capture the excess return from credit management without the noise from currency markets distorting returns. As a result, unlike strategic bond funds, a MAC strategy hedges out currency risk. Currency strategies have their place in a diversified portfolio, but FX is a separate asset class that should be managed by overlay specialists.

Why the MAC concept makes sense

Despite recent increases, interest rates are still near their 60 year lows. Short term rates and real yields on some fixed income investments are close to zero. Investors are becoming increasingly concerned about how to generate attractive investment returns from fixed income.

As a result fixed income portfolios should have access to more tools to generate returns. MAC strategies allow the manager a wider remit to target those areas of the market which are expected to perform best and to identify the individual sectors and issues that can thrive.

This unconstrained approach is logical. An over-reliance on benchmarking contains risks. It can lead to “anchoring” – where a portfolio manager’s decisions are influenced by the weighting of a security in an index. An unconstrained approach removes this anomaly. Portfolio managers can approach an investment universe without preconceptions. Each eligible investment therefore has an equal opportunity of making it into the portfolio which leads to a purer portfolio of best ideas. A MAC portfolio can consider an investment on its absolute merits. This is true not just at the asset allocation level, but also at the sector and security selection level.

MAC’s three sources of value creation explained

Success over long periods requires skill in managing portfolios from both top-down and bottom-up perspective whilst keeping the risk budget tightly controlled. In this section we will review the three main techniques that our MAC investment process draws upon to achieve target returns.

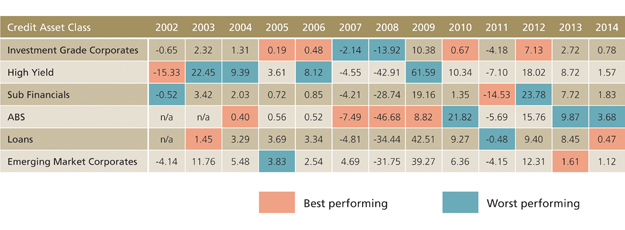

Figure 1: One credit class can’t deliver great returns all of the time

Source: ML Lynch Data (ER00, HEAD, EBSU, EMCB) 31/12/2013, S&P European Leveraged Loans Index and Barclays ABS (ABS Bond Index ex AAA) 31/03/2014. Merrill Lynch returns are excess returns over swaps (no duration). Floating rate Loans and ABS are total returns excluding Euribor.

1. Nimble asset allocation is vital

One asset class cannot deliver great returns all of the time. Active allocation through a MAC strategy gives investors the opportunity to benefit from attractive risk/return trade-offs across the credit spectrum. Therefore, selecting market betas for a fund is a key skill, and an important driver of MAC strategy returns. It has the potential to materially improve performance profiles from a risk and return perspective. To illustrate this, Figure 1 shows excess swap returns (i.e. interest rate duration hedged) across the various credit asset classes over the last twelve years. It shows the wide dispersion and variation between the best and worst performing asset classes each year.

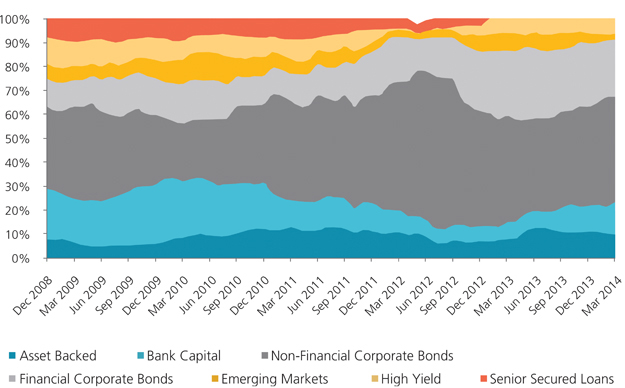

Figure 2 shows ECM’s dynamic asset allocation within the context of a live portfolio. In 2009, a year of recapitalisations, refinancings and restructurings, exposure to higher beta asset classes was increased significantly at the expense of corporates. This allowed portfolios to capture performance in lagging areas of the market in to 2010. During 2011 and 2012, exposure to the safe haven segment of non-financial corporate bonds was increased whilst senior unsecured bank exposure was reduced as ECM navigated the Eurozone sovereign crisis. When the recovery started to take hold in 2013, that exposure was reduced again in favour of high yield as well as bank capital, and from the middle of last year, emerging market risk was dialled down in response to concerns about the outflow of hot money following the Federal Reserve’s decision to reduce quantitative easing.

Figure 2: Asset allocation in action

Source: ECM November 2012

2. Sector and security selection requires a diverse and talented research team

In addition to adding value through asset allocation, MAC strategies aim to generate returns through strong security and sector selection. This requires a research team which combines breadth and depth of skills with industry specialisation and experience to deep dive into individual credits. The aim of this so-called “bottom up” component of the investment process should at all times be to avoid losers rather than picking winners in an effort to avoid the ultimate risk for a credit investor, that of default.

The ability to pick the correct sectors within an asset class is relevant given the continuous evolution of credit markets. For example, within the Financials asset class, the long-term deleveraging of the banking sector in combination with bank recapitalisation and reregulation, while potentially less attractive for return-on-equity-focused shareholders, will continue to be broadly supportive for credit investors and warrants an overweight position for the sector in our view.

Security selection is a multi-faceted skill. On the one hand, it means finding the most attractive obligors and then selecting the best place to invest in that issuer’s capital structure both in terms of subordination, maturity and currency. On the other hand, it implies selecting the right type of instrument to express a specific view. We have already mentioned that being invested in government bonds at this point in the cycle presents the investor with limited upside potential. In terms of security selection, this view explains our current preference for non rate-sensitive instruments which are likely to benefit from increasing popularity in an environment of rising interest rates. We like to invest in credit instruments pre-manufactured in floating rate format. Floating rate corporate bonds, bank loans and asset backed securities are all issued with coupons priced at a spread over floating rate benchmarks such as Libor.

3. Volatility calibration – how portfolio risks are managed

MAC strategies require a careful approach to risk management in the investment process. Firstly, the strategy’s risk limits need to be set in such a way that they are compatible with its target return, and compliance with these limits needs to be monitored closely to ensure that the portfolio retains appropriate fixed income-like risk characteristics.

Secondly, a combination of statistical analysis and “stress test” scenarios are required, because major market trends only filter through into statistical models over time. Scenario analysis for example, allows managers to predict how “tail risk” events could affect a portfolio’s risk and return characteristics.

Lastly, invaluable information can be derived from NAV calculations which are available to the manager on a daily basis for all but the most illiquid MAC strategies.

When the decision to adjust the fund’s volatility profile has been made, the portfolio manager disposes of a wide array of instruments to implement the adjustment, including credit and interest rate derivatives.

How a MAC strategy sits within an investor’s portfolio

How investors incorporate a MAC strategy into their portfolio is a function of how that particular portfolio is constructed. If the MAC portfolio is investment-grade focused, it may be used in addition to a core bond allocation. Despite MAC strategies having more tools at their disposal, they still aim to achieve traditional bond-like objectives, such as managing downside risk, minimising volatility and ensuring portfolio diversification.

MAC strategies that focus on higher-yielding credit strategies, however, may be kept separate from a traditional fixed income allocation. This is because of their higher risk/return and volatility characteristics, which stray far further away from a traditional bond allocation.

That said, investors should not be overly concerned with asking “where does a MAC strategy fit?” We believe that investors’ prime concerns are low yields, the potential for rising interest rates and the difficulty in finding attractive risk-adjusted returns. Therefore, now more than ever, investors are asking “how can I make my fixed income allocation do more?”

Conclusion

The prevailing environment in fixed income markets means that investors are finding it harder to generate sufficient returns from their siloed approach to asset allocation. A Multi-Asset Credit strategy gives portfolio managers more flexibility to deliver what clients expect – through a potent combination of a wider range of investable asset classes, managed duration and hedged currency, and an unconstrained approach – still with the bond-like portfolio characteristics that investors require.

Our clients tell us they value these important characteristics. In a world of low inflation, low interest rates and lower returns from mainstream fixed income asset classes, a flexible, unconstrained approach should become the future of credit investing.

More Related Content...

|

|

|