Multi-asset credit strategies – a credit smörgåsbord for pension funds

Written By:

|

Colin Fleury |

Colin Fleury of Janus Henderson looks at the pros and cons of mac strategies and identifies the factors which are key to success

Following the global financial crisis (GFC), central banks used monetary policy and quantitative easing measures to resuscitate their economies, creating an environment of low interest rates and falling bond yields. Further, deleveraging by banks (notably in Europe) led to dramatic changes in the nature of lending, creating new and attractive opportunities in credit markets. In the face of concerted efforts by central banks to drive down yields, investors sought strategies to enhance returns from allocations to alternative fixed income, which have the flexibility to navigate shifting market conditions.

With the potential for enhanced returns (while typically with a lower risk profile than equities), multi-asset credit (MAC) strategies began to find favour versus traditional benchmarked fixed income allocations that solely focused on government bonds or investment grade corporates. Unconstrained and with the ability to incorporate a variety of different credit asset classes into a portfolio, MAC offered the opportunity to harness “credit risk premium”1.

Defining multi-asset credit

Multi-asset credit can be a very broad church in terms of what it covers and will have different interpretations for different investors. At its heart, a MAC strategy can invest across the entire fixed income spectrum of cash and derivatives: from government and corporate bonds (investment grade, high yield and/or emerging market) to currencies, asset backed securities and secured loans, with some strategies also including direct lending, real estate, infrastructure and mezzanine or other more equity-like debt investments.

A typical MAC strategy however, looks to deliver returns mostly from the income from credit allocations, rather than relying on interest rate or currency views. Hence, it tends to have lower duration or interest rate sensitivity than other fixed income portfolios.

These strategies can also differ in terms of style: how actively they are managed, the degree to which asset allocation features, the emphasis on stock selection and how many asset classes are included, which can range from many to more of a focus on two to three.

The objective of a typical MAC strategy is to achieve a return above a cash benchmark, using an active and unconstrained approach. Most will target somewhere in the range of cash plus 3-5% over a market cycle. There are different approaches to managing volatility and mitigating the risk of significant downside in times of market stress. Some managers adopt a more defensive and disciplined process that focuses on liquid asset classes, which are secured and are higher in the capital structure. Others may adopt more active asset allocations and derivative usage.

The main advantage of a typical MAC strategy is that it is flexible and unconstrained by a benchmark. It offers three sources of return through asset allocation, sector/security selection and risk management with reduced volatility. Managing interest rate risk is an important component and since returns are to be primarily drawn from credit risk, these strategies typically hedge out the majority of currency exposure.

A typical MAC investment process

MAC strategies focused on credit tend to have fairly similar approaches, employing top-down and bottom-up perspectives. Broadly speaking, the investment process for a typical strategy begins with a macroeconomic evaluation of the environment followed by asset allocation decisions. Active management will be a key feature; exposure to the correct market/security is essential in avoiding losses while attractive risk/return trade-offs across the credit spectrum can be identified.

While asset allocation decisions can add value, MAC strategies aim to generate returns through strong security and sector selection. Credit is a resource intensive asset class, requiring a research platform. This can be the differentiating factor between different strategies. A successful strategy requires an extensive research platform that combines strong skills with industry specialisation and deep knowledge of individual credits. The objective is to identify losers, more than to pick winners, in an effort to avoid the ultimate risk – the default of an issuer.

MAC opportunities and risks

Asset allocation decisions in a MAC strategy are based on the manager’s macroeconomic assessments of economic factors, the credit cycle, market valuations and technicals.

Relative valuation opportunities in credit can be unearthed through skilled research but opportunities can also present themselves by exploiting portfolio flexibility to add risk at times of market disruption. Current opportunities will likely come from the ability to manage risk and protect the downside, given concerns for global growth and a long in the tooth credit cycle.

MAC strategies are not immune to risks; volatility risk (fluctuating returns), liquidity risk (the ability to sell a security quickly) and duration risk (interest rate sensitivity) are the main concerns. Loss of capital (through rising defaults) is yet another. Therefore, the degree to which the strategy is actively managed, e.g. to avoid or remove underperforming investments, can be influential.

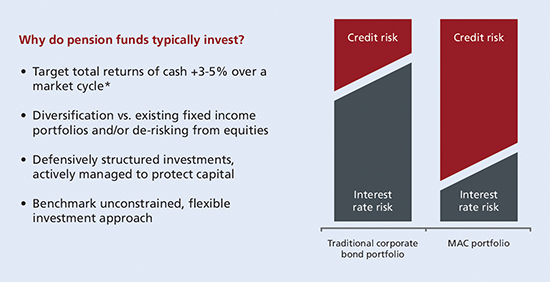

Figure 1: What a typical multi-asset credit strategy aims to do

For illustrative purposes only

*Representative figure only, funds will target different returns based on the specific risk/liquidity profile of the underlying portfolio

The fit into a pension scheme

The popularity of MAC strategies was driven by the need of many pension schemes to close their funding gaps, with the available options being low yielding investment grade corporates or volatile equities. A typical MAC strategy, focusing on long only credit can be included as growth assets within a scheme. Given that it will likely have little duration, it can also complement a liability driven investment (LDI) strategy, leaving decisions for interest rates and currency exposure to the LDI manager.

Choosing the right strategy is very much dependent on a pension fund trustees’ risk-adjusted return requirements and liquidity needs. Ideally, MAC strategies should have an active, transparent and bottom-up investment process incorporating macro views, be proven to have worked over economic cycles and be managed by well established teams with the required skills and resources to decipher today’s big shifts in the overall economy and business models.

The liquidity of the strategy is also very important. We do not believe this type of strategy should have daily dealing given the potential for a liquidity mismatch between the fund and the underlying assets. At Janus Henderson, we prefer a 3-5 year investment horizon offering monthly liquidity, and as such screen for tradeable and liquid securities in the asset classes that we invest in for our MAC strategy.

Why choose a MAC strategy now?

In today’s environment, global growth concerns and geopolitical tensions have led to a higher degree of volatility in the markets, which is likely to continue for some time and should warrant caution. Given that a typical MAC strategy will invest in sub investment grade assets, and that we are in the late stage of an elongated credit cycle, it would be reasonable to ask: why invest in a MAC strategy?

The answer lies in the benchmark-free, unconstrained nature of a MAC strategy, which allows it to navigate challenging markets – importantly, its flexibility to dial up, or dial down risk in the portfolio through active management. The skill of the manager in understanding the drivers of the markets (macroeconomic and fundamental) and in picking the right credits, are essential for the success of a MAC strategy. Further, for clients that are also prepared to invest for the longer term, it can help mitigate volatility.

Compared to a benchmarked approach, which is less nimble with more governance and more decisions to be made, a MAC strategy should be better able to deliver the required returns. It is also the case that many will invest in MAC strategies as an alternative to equities, which could have greater risk of drawdown in such an environment.

1. Credit risk premium: the additional return above risk free rates for bearing corporate default risk

These are the portfolio manager’s views at the time of writing and may differ from those of other Janus Henderson portfolio managers. The information should not be construed as investment advice. Before entering into an investment agreement please consult a professional investment adviser.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Disclaimer

Janus Henderson Investors is the name under which Janus Capital International Limited (reg no. 3594615), Henderson Global Investors Limited (reg. no. 906355), Henderson Investment Funds Limited (reg. no. 2678531), AlphaGen Capital Limited (reg. no. 962757), Henderson Equity Partners Limited (reg. no.2606646), (each incorporated and registered in England and Wales with registered office at 201 Bishopsgate, London EC2M 3AE) are authorised and regulated by the Financial Conduct Authority to provide investment products and services. Henderson Management S.A. (reg no. B22848) is incorporated and registered in Luxembourg with registered office at 2 Rue de Bitbourg, L-1273 Luxembourg and authorised by the Commission de Surveillance du Secteur Financier.

© 2018, Janus Henderson Investors. The name Janus Henderson Investors includes HGI Group Limited, Henderson Global Investors (Brand Management) Sarl and Janus International Holding LLC.

More Related Content...

|

|

|