Moving the needle with liquid alternatives

Written By:

|

Ian Barrass |

|

James de Bunsen |

Alternatives have an important role to play in diversifying asset allocation, but how can this be achieved? Ian Barrass and James de Bunsen, Co-Managers of the Henderson Diversified Alternatives Fund, discuss the options

In recent years equity and bond markets have generally been characterised by strong real returns with low volatility, driven by unprecedented levels of central bank stimulus through quantitative easing (QE). As a result of this, investors may have overlooked the importance of a broad-based approach to strategic asset diversification as a contributor to the delivery of satisfactory investment performance.

The next few years may, however, prove more challenging. Global economic activity is gradually recovering following the financial crisis and, as this gathers momentum, the need for accommodative monetary policies will diminish. As this support is withdrawn the investment environment is likely to become more volatile, with consistently attractive returns being harder to achieve.

Investors with long time horizons can look beyond periods of increased volatility. Indeed, some may welcome a return to this more “normal” world, since higher volatility can offer greater opportunity. Most investors, however, are less comfortable with volatility, particularly when sharp falls in asset values can create strains elsewhere. This is the case for many local government pension schemes (LGPS). Higher volatility means a greater probability of a funding shortfall worsening at a key valuation point, which in turn may lead to increases in contribution rates for employers. The reality is that LGPS schemes need high investment returns to meet funding requirements, but with the least possible volatility along the way.

Bonds may not be enough

Historically, investors seeking to dampen equity volatility have relied on government bonds to provide the desired diversification. The logic was compelling. Returns from equities are uncertain and derived from economic activity. By contrast, returns from government bonds are more predictable and do not depend on economic activity, provided the government is able to pay. From a statistical perspective, equities and bonds have been mostly negatively correlated for the last 15 years.

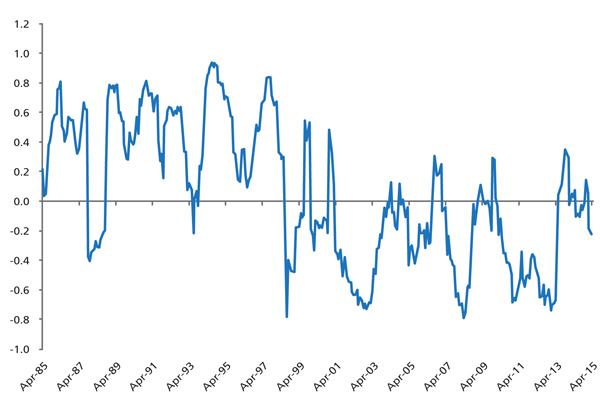

It is less clear, however, that bonds will continue to provide the diversification benefits that pension funds are seeking. During the financial crisis they served this purpose well, because they benefited from a flight to safety, with government bonds in particular rising in value while most other assets fell. Today’s very low yields, however, imply that bond values are high, which is a potential risk in itself. Add to that the possibility that rising interest rates could be the cause of a wider equity market setback and it is far from certain that negative correlations will persist. In the 15 years prior to 2000, bonds and equities were mostly positively correlated (Figure 1) and they could be again.

Figure 1: Rolling correlation, S&P 500 & US 10-year Treasuries

Source: Bloomberg. Rolling 12-month periods, monthly data points, annualised, local currency, April 1985 to April 2015

In addition, very low yields currently make diversification through bonds more dilutive to overall returns than in the past. At a time when investment returns need to do more of the ‘heavy lifting’ to close funding gaps, bonds represent an expensive insurance policy.

Effective diversification: characteristics

These observations raise some very pressing questions: if strategic diversification needs to look beyond bonds, what asset types should it encompass? What characteristics are needed to reduce volatility while still generating good long-term returns?

We believe that alternative asset classes can play a key role in addressing these problems. There is now a wide range of alternative asset classes that exhibit historically modest to low levels of correlation to the mainstream equity and bond markets. These include well-established areas such as property, private equity, hedge funds, commodities and infrastructure, but also perhaps less familiar asset classes such as renewable energy, specialist credit, reinsurance, and timber.

This modest to low correlation is derived from a number of characteristics observable within these asset classes: they are often illiquid, and sometimes long-term investments in nature. For example, private equity, property, and specialist credit offer significant illiquidity premia. The performance of certain types of infrastructure assets (eg, social infrastructure, such as hospitals, schools, universities, government buildings) and reinsurance funds are largely unaffected by global economic conditions or, in the case of renewable energy, are underpinned to some degree by guaranteed levels of government-backed cash flows. Then there are hedge funds, which rely on manager skill and their flexible investment mandates to deliver reduced correlation.

To be effective, diversification should embrace many or all of these alternative asset types with allocations that are sufficiently meaningful to “move the needle”. This, however, creates a governance challenge for most LGPS funds. How can funds be expected to have the resources to cover such a broad range of different alternative asset classes in sufficient depth, to judge when and how much to allocate to each one? The larger LGPS funds with well-resourced internal teams may be able to cope with this governance challenge, but most will be understandably wary of doing so. Effective diversification brings with it greater complexity.

DGFs – a partial answer

One possible solution to the alternative asset governance challenge is to outsource the problem to a fund manager by allocating to a fund that invests in a range of asset classes. Diversified growth funds (DGFs) have been increasing in popularity in recent years – LGPS funds now have an average 3% allocation – because they typically offer the prospect of attractive long-term returns with lower volatility than equities.

While some LGPS will be comfortable with the range of assets employed by a DGF, it is important to remember that most of these funds have daily dealing: their ability to exploit illiquid asset classes could be constrained. This is potentially limiting for diversification, because the assets most likely to have different return drivers from listed equities or government bonds are typically those that are less liquid. In some cases, such as hedge funds or credit market instruments, the dealing delays may be measured in days or weeks. In others, such as direct infrastructure and private equity, they could be measured in years.

Many LGPS funds are finding pensions in payment are starting to exceed contributions – they are becoming cash flow negative. This raises the question as to whether they should seek to invest in illiquid assets, particularly where the time horizon may be a decade or more. Ultimately, the answer depends on each fund’s situation, but in practice most LGPS funds are many years away from having to sell assets to meet pension payments – the investment income should more than cover any cash shortfall in the meantime. They therefore could commit to some form of long-term investment in illiquid assets.

Exploiting illiquidity sensibly

At the same time that the case for accessing a broader range of alternative assets has been building, the investment universe of alternative vehicles has continued to expand. Notably, Dexion Capital estimates that the closed-end listed alternative universe in the UK and Europe now contains over 130 companies with a combined market capitalisation of £63 billion.

Closed-end vehicles are an attractive proposition in that they are able to commit capital to genuinely long-term investment opportunities, but being listed they offer investors the ability to buy and sell more regularly. They can scale exposures up and down far more rapidly than would be the case with direct holdings. This extra flexibility may come at a cost of greater correlation with listed markets, but a basket of such vehicles should still demonstrate considerable diversification benefits.

Effective diversification is likely to be one of the key challenges for LGPS funds in a post-QE world where monetary policy is tightening. We believe that alternative assets will play an important role in providing investors with increased diversification given their modest to low correlation to traditional equity and bond markets and their potential for reduced volatility. We anticipate that the next few years could see asset managers with alternatives expertise come to market with funds more suitable for use by LGPS, as an individual allocation or in conjunction with a chosen DGF.

More Related Content...

|

|

|