Managing market price risk – dynamic hedging of emerging market exposure

Written By:

|

Matthew Stemp |

|

Maria Heiden |

How can pension funds incorporate higher-risk assets into their investment portfolios while managing their risk budgets? Matthew Stemp and Maria Heiden of Berenberg outline an approach which could help

Local authority pension funds have provided local government employees with high quality and secure pensions for many years. They have been able to do so by remaining open to new investment thinking and embracing new investment opportunities whilst carefully managing the associated risk that comes with the search for higher returns. In doing so, one of the first significant steps they took some years ago was to reduce the natural “home bias” of investing in sterling-denominated assets, instead looking to foreign investment markets to both increase and diversify the investment returns available to them. Even though American and European investments still dominate their international allocation, emerging markets are playing a bigger role, as both legislative changes and the low interest rate environment in developed markets have taken their toll on funds, turning surpluses to deficits, and making ever more pressing the need to produce consistent investment returns. Unfortunately, increasing the allocation to higher return-generating asset classes brings with it higher risk, and risk budgets are generally already set. Thus, the management of risk in return-generating asset classes, such as equities and long-generating bonds, has become of paramount importance.

Increase weight to risky assets

The basis of risk management goes back to Markowitz theory about diversification: calculate your optimal portfolio weights by using the risk and return characteristics of the different asset classes. Not much maths is required to realise that this will always end up with small allocations to high-return asset classes as they also have the highest risk. Therefore, investors need to reduce the risk profile of the higher-return asset classes in order to allow higher weights into their portfolio. To do so, asymmetric overlay hedging strategies can be employed.

Use dynamic hedging

So-called “Protect” overlays are overlay strategies for the targeted management of specific market-price risk within an underlying base portfolio through the use of derivatives such as futures, forwards and options. The goal is the systematic reduction of the portfolio weight in falling markets, while incurring as little hedging cost as possible (in the form of option premiums, for example) in rising markets. Hedging strategies are implemented by means of a separate overlay portfolio, independently of the base portfolio. The Protect Overlay can be used to hedge both a passively-managed portfolio employing index tracking strategies and an actively-managed portfolio. Indeed, alpha management is clearly separated from beta management, and systematic Protect Overlay management reflects the progressive splitting of the value chain in asset management.

The simplest design of a Protect Overlay is continuous hedging with put options. Futures-short strategies represent a dynamic alternative to this approach. In times of rising markets, as few futures positions as possible should be taken, allowing the investor to participate in the positive performance of his risky assets to the greatest degree possible. When prices are falling however, a futures-short position is successively increased, thereby reducing the portfolio weight and protecting the investor from losses. This situational use of futures-short positions leads to an asymmetrical pay-out profile in a futures-based Protect Overlay, which corresponds to the characteristic of a plain-vanilla put option.

Currency Protect Overlay

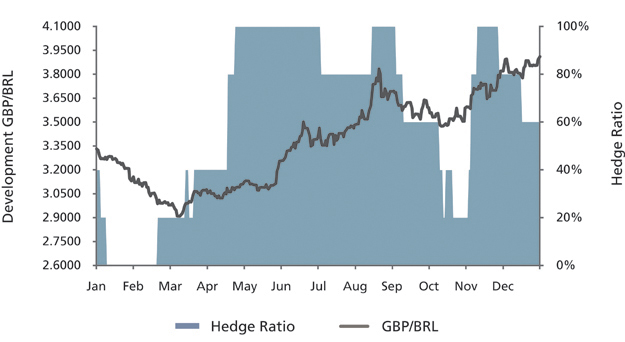

Protect Overlay strategies are well known for currency risk management, as currency risk is an unrewarded risk that comes with the benefit of diversifying outside the home market. It can be ignored, opening the possibility that any returns arising from a rise in prices of the underlying assets are negated, or even reversed, by a fall in the corresponding foreign currency. It can be removed by way of passive currency hedging within the Protect Overlay by selling the foreign currency into sterling as soon as the purchase of the asset is made. This has the disadvantage of requiring large liquidity to be available to feed the hedge positions if the hedge goes against you when the underlying currency appreciates against sterling. In practice many funds have chosen to adopt a middle way, and hedge 50% of their currency exposure on a static basis. By adopting a flexible approach in the Protect Overlay, and employing a trend-following model that automatically hedges when currencies depreciate (blue shading in Figure 1 for a USD long investment against GBP) but removes the hedge when they appreciate, funds can not only protect themselves against depreciation but also benefit from currency appreciation, and all with a much-reduced demand on the liquidity of the fund, as any currency-hedging strategy mirrors market price movements into cash flow movements at the maturity of the chosen derivative and the respective roll-over day. The cost of an FX-forward is the interest rate differential between the foreign currency that is sold and the home currency that is bought. It is positive if the foreign interest rate is lower than the interest rate of the investor’s home base (e.g. USD interest rates are currently lower than GBP interest rates), and it is negative if the foreign interest rate is higher than the interest rate of the investor’s home base (e.g. interest rates in emerging countries (e.g. BRL) are currently higher than GBP interest rates). Taking the interest rate differential into consideration, the FX-forward mirrors the market movement of the underlying currency adjusted by the interest rate differential. The hedging costs of choosing a passive strategy can therefore be substantial when it comes to emerging markets currency hedging, as there is a huge negative bias that needs to be financed by the underlying asset. Asymmetric hedging strategies can therefore also help to reduce these as they only hedge within depreciation periods.

Figure 1: 2013 Development GBP/BRL and hedge ratio of Protect Overlay

Source: Bloomberg, Berenberg

Equity Protect Overlay

Whilst pension managers have recognised the desirability of managing their currency risk, and are likely to do this more frequently as they move from static to dynamic hedging, the risk of owning equities more generally has not been so fully addressed. Historically, UK pension funds, including local authority funds, have had a high exposure to equities – typically more than 50% of their assets. Whilst this has fallen over recent years, equities remain a very significant component of the return-generating engine for most funds. This is particularly so at a time when alternatives, such as bonds, are sitting at historically low yields, along with the other “lower risk” assets. If deficits are to be reduced, investment returns must be generated, implying the acceptance of higher risk. To reduce the risk of owning equities further, and indeed allow for increased weightings, funds can seek to protect themselves from equity market falls by putting in place a hedging strategy against underlying equity indices. This has not been common practice in the UK, but, with funds already in deficit and requiring returns, and with very limited capacity to stomach even short-term falls in capital values, it is becoming of more interest. To put in place equity market hedges that protect funds from general market falls, a liquid derivative is required. Whilst this is easy for developed markets offering equity index futures and options, the availability within the emerging markets space is more limited but growing. To hedge Asian exposure, the Hang Seng Index is liquid, while for the South American market the Bovespa liquidity is steadily increasing. Options are still scarce and expensive. However, as liquid derivatives are available to employ a Protect Overlay, the market price risk of an allocation to emerging markets equities can be reduced substantially, thus allowing a higher allocation to the asset class within the portfolio for the same level of risk. The negative impact of big market falls is mitigated through efficient hedging, and thus returns from equity investment are also substantially increased, and dividend payments can be earned in any market period.

Duration Protect Overlay

The same techniques are also employed to hedge duration risk in bond portfolios – of particular significance at a time of historically-low bond yields and interest rates, although of course a rise in bond yields would have the impact of reducing actuarial deficits. However, a dynamic hedge on a fixed income portfolio would also reduce the financial deficit of a fall in capital values in bond markets as interest rates rise. When it comes to emerging market bonds, only hard currency bonds can be hedged using treasury options or futures. However, employing an asymmetric hedging strategy to actively manage the duration risk can enable the fund to invest in longer-term bonds with higher duration, as it is gradually reduced when interest rates rise, and losses of the bonds’ value can be covered. By doing so, the risk profile of the asset class is reduced and its allocation can be increased to boost returns.

Increase your return

Summing up, a risk-adjusted investment strategy with a limited risk budget only lends itself to the investment of small volumes in the risky asset classes that are interesting for pension funds because of their high return expectations. The considerably-improved risk indicators such as volatility and maximum drawdown achieved through the use of a Protect Overlay allow for a higher allocation, as a means of offsetting the lack of interest income amid a low interest-rate environment.

More Related Content...

|

|

|