Making sense of multi-asset/diversified growth funds

Written By:

|

Craig Nowrie |

Craig Nowrie of Columbia Threadneedle Investments offers some guidelines for investors looking at diversified growth strategies

Multi-asset or diversified growth funds (DGFs) tend to have similar return characteristics over the longer term, whether that be CPI or cash plus objectives (in that over the longer term these have traditionally been equivalent to the long run return of equities). Moreover, they generally share a secondary objective: to reduce absolute volatility compared to that of an equity only portfolio, typically by between a third and a half.

This has generally led to a multitude of multi-asset funds being classified as a distinct asset class. This asset class has blossomed since the mid-2000s into one that is now worth almost £120 billion¹ in assets under management.

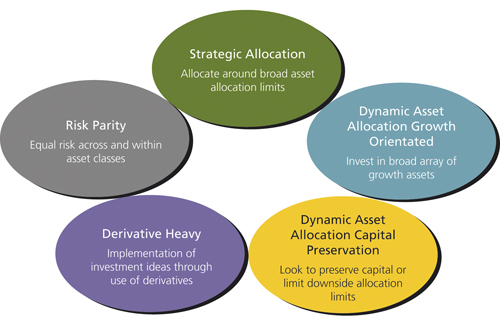

While this blossoming asset class has been treated as one universe, we firmly believe that not all DGFs are created equal. In fact, we identify five distinct strategies, as shown in Figure 1.

Figure 1: DGF strategies

Source: Columbia Threadneedle Investments

When considering an investment in a multi-asset/DGF fund, the characteristics and potential behavioural pattern of the strategies being reviewed need to be fully understood. There is no one correct answer when investing in these strategies. Only by understanding how DGF strategies fit with their other investments can investors arrive at the solution that’s correct for them.

So let us consider these strategies in more detail. Firstly by giving a more detailed description, and secondly, looking at a representative fund to illustrate the characteristics of each strategy.

DGF strategies in detail

Strategic Allocation, where the fund allocates around broad asset allocation limits, with some having broader limits than others. The key benefit of this strategy is that diversification is hard wired into the product.

Dynamic Asset Allocation Growth Orientated, where the fund invests in a broad array of growth assets, and as such will typically not invest in developed government bonds. This will result in these strategies typically having a higher beta and correlation to equities than some of the other strategies.

Dynamic Asset Allocation Capital Preservation, where the fund seeks to preserve capital or limit downside. As with the more growth-orientated managers, these funds are dynamically managed. However, managers also have the ability to invest significantly in cash or fixed income if they believe there are significant issues ahead.

Derivative Heavy, where the fund implements investment ideas through the use of derivatives. These funds will employ a degree of leverage in constructing the portfolio, by selling assets that they don’t own in the hope that they can buy them back for less.

Risk Parity, where the fund allocates equal risk across and within asset classes. To do this, and achieve a similar return to the other strategies, the fixed income allocation is levered. There is also a new breed of Risk Parity funds which take account of valuations to alter the asset allocation.

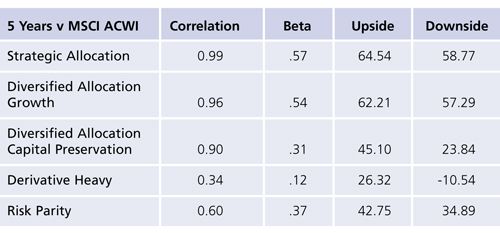

Although each strategy would be expected to reach the same end point, the respective journeys are expected to be different. Figure 2 illustrates this point, using a specific strategy that we believe is managed in a manner consistent with its respective strategy definition.

Figure 2: Characteristic behaviour of DGF strategies

Source: eVestment as at 31 March 2015

The first of these columns look at the correlations to equity markets over a five year period to the end of March 2015 (i.e. do they have a similar return pattern to the equity market?). As expected, the Derivative Heavy and Risk Parity strategies show little correlation to equity markets. The remaining three show a higher degree of correlations to equity markets.

Given the last three years of equity market returns that is not unexpected. However, the difference is in the beta (i.e. the extent to which they move in accordance with global equity markets). Again, the story that the numbers tell is what we would expect, with the Diversified Allocation Growth and Strategic Allocation strategies having a higher beta to equities over the longer term.

This is further represented in market upside and market downside capture, where the Diversified Allocation Growth and Strategic Allocation strategies have a higher participation in both the up and down markets. Interestingly though on the downside participation, the Derivative Heavy manager is negative, implying that the strategy produced positive returns when equity markets were negative.

Taking this further, a particular Diversified Allocation Growth DGF, with a high historic correlation and relatively high historic beta with global equities, has captured just over 60% of the upside of global equities but has succumbed to around 60% of the downside.

By contrast, a naturally defensive Diversified Capital Preservation DGF has historically captured around 45% of the upside of global equity markets but has generally delivered 25% of the downside. Given these different approaches, it is perhaps unsurprising that investors are increasingly blending DGF strategies.

Only by being aware of these characteristics can investors fully understand how these strategies can play a part in their overall investment strategy and fit with their other investments.

1. Source: eVestment as at 31 March 2015.

More Related Content...

|

|

|