Long-term value to be found in emerging markets

Written By:

|

Matthew Vaight |

Matthew Vaight of M&G Investments explains why he believes investing in Emerging Markets can provide access to a vast universe of exciting companies that offer potential for long-term capital growth while helping to create a diversified investment portfolio

There is no single definition of what constitutes an “emerging market”. Most explanations cover a number of common themes: transformational economic development, and income per capita moving towards Western levels. The composition of the emerging markets universe has changed materially over time, reflecting the dramatic shifts that we have seen in the global economy. Back in 1988 when MSCI launched the Emerging Markets Index (MSCI EM Index), it consisted of just 10 countries, representing less than 1% of world market capitalisation. Malaysia was the largest market, accounting for almost a third of the MSCI EM index by market cap. There was no China or India in the index.

Today, the index consists of 23 countries representing around 10% of world market capitalisation. China has risen to be the dominant market within the index, while Malaysia now represents a mere 3% of the index. The asset class has evolved, matured, and is now arguably too important to ignore.

While the pace of economic transformation witnessed in many emerging markets over the past decade is likely to slow, these markets are destined to become ever more prominent and economically powerful.

Improving corporate culture

From an investment point of view, the potential opportunities available in these large and fast-changing markets are considerable. While the long-term structural trends taking place in emerging markets generate considerable excitement, we believe the real investment opportunity in emerging markets stems from what is happening at the company level. For us, the multi-decade improvement in corporate culture is the most exciting aspect of the emerging markets story.

Positive developments are under way. Firms are increasingly focused on capital efficiency and are implementing more shareholder-focused strategies. For example, in South Korea, which has a long-standing and well-founded reputation for ignoring the interests of minority investors, change is taking place. While the dividend pay-out ratio in Korea remains the lowest in the world, it is rising as a result of investor and government pressure. At the same time, we are seeing the arrival of innovative firms with cutting-edge products and technologies that are destined to become tomorrow’s global leaders.

In our view, the improvement in corporate culture and the emergence of world-class emerging market businesses is the compelling long-term reason to invest in emerging markets today.

Active approach to identify promising companies

Commentators tend to focus on the macro environment when it comes to emerging markets. As equity investors, we believe this is a distraction as investors don’t buy economies – they buy shares in companies. While the economic environment can influence how well a company performs operationally, in our view it does not determine share price growth over the long term.

To us three simple factors drive share prices – the profitability of a company (which we assess by the level of return on capital), the corporate governance practices of the management team and, perhaps most importantly of all, the valuation of the shares. When analysing potential investments, we focus on how well a company is operating. We want to know whether a business can earn a return in excess of the cost of the capital invested.

Another essential factor in our process is corporate governance: who are the company managers? How are they incentivised? Will they run the company to maximise shareholder returns? Corporate governance is particularly important in emerging markets given the large number of companies that have controlling shareholders, be they the government – as is frequently the case in China – or founding families, which is common in South Korea.

In many cases, state-owned enterprises (SOEs) are run for the benefit of the state, with the government dictating company strategy. Similarly, family-controlled firms often focus on the interests of the main shareholders and ignore those of minority shareholders.

Before investing in emerging market companies, it is essential to find out who controls the business and whether all investors will share in the success of the company. It is important to understand the motivations of the management teams – can they be trusted with investors’ capital? A bad management team can easily make a value stock a value trap. This information can only be discovered with a highly selective approach. In our view, going passive, for example by buying an index ETF, can result in taking positions in companies that, if you were to look at them fundamentally, are not suitable for investment.

Today’s valuations do not reflect potential

Emerging market equities have been out of favour for the past few years and have underperformed their developed market counterparts. The negative sentiment toward emerging market companies reflects myriad concerns, including slowing economic growth most notably in China, weak commodity prices and geopolitical risks. Corporate performance has also been disappointing as profits have declined. In many cases, companies have continued to invest despite slowing growth, putting margins under pressure. More optimistically now, however, we are seeing increasing signs that firms are responding to the slower growth environment and reducing their capital expenditure.

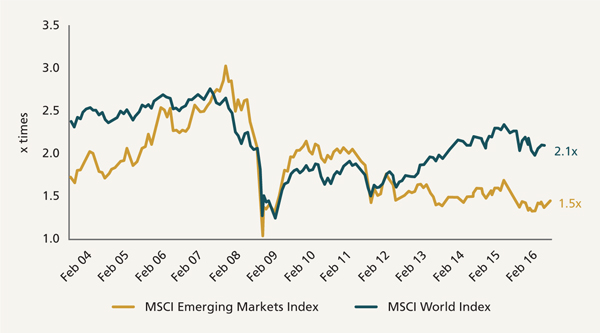

While there is still plenty of uncertainty about the outlook for emerging markets, we believe they offer opportunities for patient, long-term investors. The principal reason for our optimism is that valuations look attractive. After a painful period of underperformance, valuations of emerging market firms are trading close to crisis-era levels and at a significant discount to developed market companies (Figure 1).

Figure 1: Emerging markets trading at a large discount

Source: RIMES, MSCI, IBES, Morgan Stanley Research Data, 5 July 2016

Beyond valuations, we see encouraging signs of improvements at both the macro and the micro level that could support an upturn in emerging market performance. Across the emerging markets universe, there is a greater focus on reforms, be that at the political level or, more importantly for us, at the company level.

As contrarian, value-oriented investors, we see the most attractive opportunities in cyclical areas that have been overlooked by risk-averse investors. In our view, the general flight to safety has pushed valuations of defensive areas such as consumer staples to elevated levels and they are arguably now relatively risky. Similarly, at a country level, we favour markets like South Korea and Taiwan that have suffered lately from their close links to China.

We believe that investors are currently too pessimistic about emerging markets. There are undoubtedly challenges ahead but, in our view, the valuations do not appear to be pricing in any potential improvement in fundamentals, which could well be achieved through the developments currently taking place at both company and government levels.

For patient investors that focus on finding well-managed companies that are committed to creating value for their shareholders, we believe that there are currently opportunities to invest in firms whose long-term potential is under-appreciated.

For Investment Professionals only.

The distribution of this document does not constitute an offer or solicitation. Past performance is not a guide to future performance. The value of investments can fall as well as rise. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and you should ensure you understand the risk profile of the products or services you plan to purchase.

This document is issued by M&G Investment Management Limited. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents. M&G does not offer investment advice or make recommendations regarding investments. Opinions are subject to change without notice. Reference in this document to individual companies is included solely for the purpose of illustration and should not be construed as a recommendation to buy or sell the same.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|