Lifetime mortgages, a new opportunity

Written By:

|

Simon Betteley |

Simon Betteley of BlackRock looks at how lifetime mortgages can help reduce the cost of providing benefits as well as meeting liability payments as they fall due

With government bond yields having fallen to historic lows, pension fund liabilities have continued to grow and deficits increase. The latest Pension Protection Fund (PPF) 7800 index release, as of end January 2015, has indicated that funding levels have fallen to 78% on a PPF basis, equal to the previous low level recorded in 2012. In the pursuit of yield, investors are having to search more widely as government bonds and other traditional income-generating assets have become more and more expensive.

As a potential solution, lifetime mortgages offer a combination of factors that long-term investors may find attractive in the current environment, including duration, yield, a linkage to mortality and potential inflation protection. Through origination partnership agreements with established lifetime mortgage lenders, BlackRock is offering institutional investors, via segregated accounts, exposure to whole loan UK lifetime mortgages.

What is a lifetime mortgage?

Lifetime mortgages are a form of ‘equity release’ or ‘reverse’ mortgage for borrowers over 55 years old (average age 69 years). The mortgage is typically used by borrowers to meet their expenses in retirement and/or refinance traditional interest-only mortgages that are reaching maturity and have a lump sum payment due.

Unlike a traditional mortgage, lifetime mortgages typically have no monthly payment and no term. Interest payments ‘roll-up’ into the mortgage balance at an agreed interest rate (typically a fixed rate, but it can be linked to consumer or retail price inflation as well as LIBOR), with the loan payable on the borrower’s death or move into long-term care and the sale of the home. Borrowers cannot lose their home before one of these events occurs and recourse is solely to the property, not to the borrower’s estate or beneficiaries. Initial loan-to-values (LTVs) are lower than for standard mortgages, typically 30% or less, as the interest roll-up increases LTVs over time.

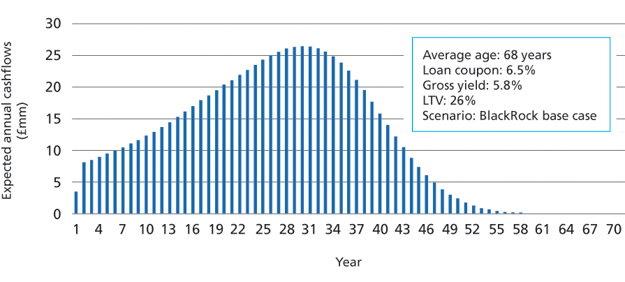

Figure 1: Expected net cashflows for lump sum fixed rate product

Source: BlackRock, December 2014

Note: Base case scenario assumes a 5% house price decline over 3 years at inception followed by annual growth at 2-3% thereafter

Importantly, while the portfolio itself is illiquid, it distributes cashflows over time as borrowers pass away or enter into long-term care. Some early repayments may also take place, reflecting other ‘life events’. The impact of changing house prices and inflation must also be considered in order to accurately value a portfolio, but the nature of the cashflows can be valuable when managing the payment of member benefits. Figure 1 below outlines an expected cashflow profile for a £250 million lifetime mortgage portfolio.

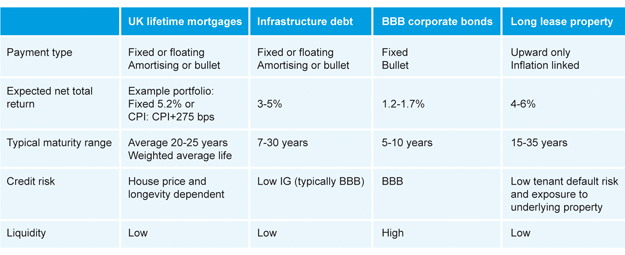

Traditionally, the finance for this type of product has been provided by insurance companies originating mortgages for their own portfolios. As such, the product has traditionally been viewed as relatively niche, while product characteristics have been tailored to the needs of insurance companies rather than the needs of borrowers. We believe there is a clear opportunity for new investors in this market to increase volumes significantly on the back of simplified products and a greater orientation towards consumer needs. A spread premium over government bond yields and swaps will however continue to exist in order to reflect the risks inherent in a product that is a small but growing part of the mortgage market. Figure 2 above gives a brief profile of lifetime mortgages compared with other income generating asset classes.

Overall, we believe these assets offer investors the opportunity to meet their liability cashflows at a significantly lower cost than traditional hedging assets such as inflation-linked government bonds, corporate bonds or swaps, and offer a secure and long-dated set of cashflows.

Figure 2: Income generating asset classes

Source: BlackRock, 2015

A review of the equity release market

The Financial Conduct Authority defines three categories of equity release mortgages:

- Shared appreciation

- Home reversion schemes

- Lifetime mortgages

After reviewing all three segments BlackRock will only be investing client money in lifetime mortgages as we believe the first two categories raise legitimate concerns about mis-selling and fairness.

Lifetime mortgages differ from the other two categories. They benefit from the fact that most lenders have adopted the Safe Home Income Plan code of conduct in 2000 (now the Equity Release Council code of conduct), as well as the introduction of mortgage regulation by the FSA in 2004. This code covers a number of areas, including a ‘no negative equity’ guarantee, meaning that in addition to being able to remain in their homes, the borrower’s estate will not be liable for any shortfall if the value of the house is below the rolled-up principal and interest amount. The regulations also ensure the use of a solicitor during the sales process and have inbuilt provisions regarding transparency and fairness.

It is important for all involved to ensure that lifetime mortgages are entered into with full knowledge of the implications. We believe lifetime mortgages have sufficient safeguards to ensure this. As of February 2015, there have been no reported decisions by English courts that have upheld misselling, an important consideration for those in the public eye. Moreover, instances of complaints with the Financial Ombudsman have been limited, with no decisions upheld in favour of the consumer vis-à-vis a lender. Lifetime mortgages therefore stand out when compared to other consumer financial products such as current accounts, pensions, insurance and investments.

The social benefits of lifetime mortgages

Lifetime mortgage loans bring a variety of social benefits as many older customers entering into these agreements have limited access to traditional loan markets. This can be either due to their age or because they have insufficient income despite having significant wealth tied up in their homes. These borrowers have varied needs and may look to release capital for a variety of reasons:

More pension income

Many pensioners face hardship from insufficient pension income and draw on external help to make ends meet. Lifetime mortgages may provide individuals access to the substantial wealth tied up in housing stock (64% of over 60 year olds in England own their home without a mortgage) and thereby reduce the burden on local and national support services.

A helping hand

Lifetime mortgage borrowers are not limited to pensioners. Research by Key Retirement Solutions indicates that 23% are using lifetime mortgages to help family and friends, for example providing children with a deposit to get on to the property ladder.

Avoiding mortgage defaults

There is currently a significant overhang (>£20 billion pa.) of interest-only mortgages held by older borrowers reaching maturity which need to be refinanced. Those without savings to cover principal repayment are at risk of losing their homes. Lifetime mortgages are a potential solution to prevent this worst case scenario.

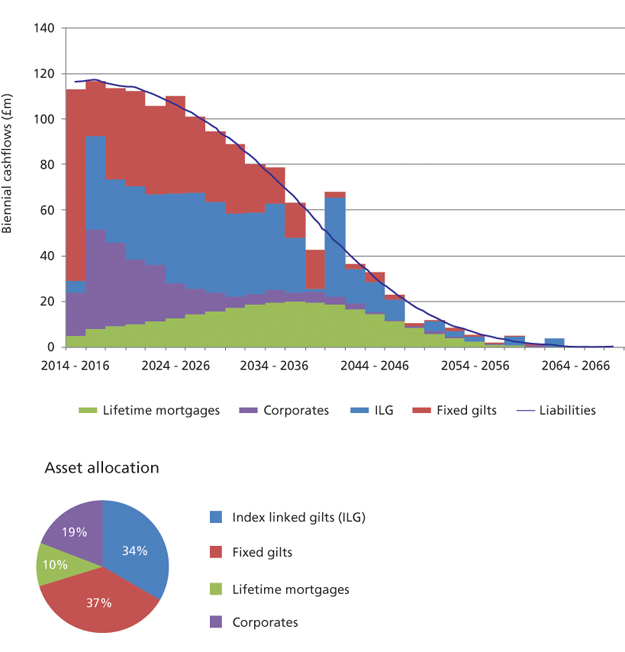

Figure 3: Cashflow profile of example scheme’s assets and liabilities

Source: BlackRock as at 31 October 2014. There is no guarantee that any forecasts made will come to pass.

Lifetime mortgages in a cashflow matching portfolio

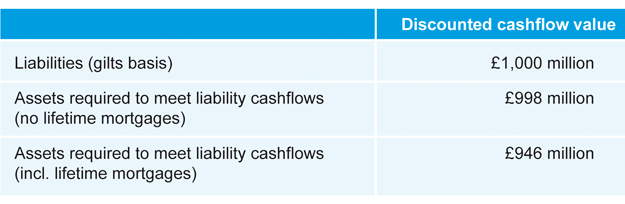

As discussed above, lifetime mortgages offer investors a secure and long-dated set of cashflows. The higher yield on these assets compared to traditional government bonds or swaps mean that they offer pension schemes an opportunity to meet their liability cashflows at significantly lower costs than investing in a portfolio of government bonds.

The precise mix of mortgages used to build the portfolio can be tilted to investor requirements, for example with respect to inflation exposure, interest rates, LTVs and the borrowers’ age, subject to market response. Due to their long duration, longevity linkage, secure clearly defined cashflows and diversification potential, we believe that lifetime mortgages are particularly appealing as an investment opportunity for pension schemes.

Above, Figure 3 shows the liability cashflow profile of a sample scheme. The scheme’s liability value is £1 billion on a UK government bond basis with a portion of the liabilities linked to inflation. The scheme has targeted matching the liability cashflow profile through a mixture of government bonds, corporate bonds and lifetime mortgages. It can be seen that by incorporating a 10% allocation to lifetime mortgages in the cashflow matching profile, the cost of meeting the liability cashflows falls by 4%.

Why consider lifetime mortgages as part of your long-term portfolio?

We believe lifetime mortgages offer long-term investors the ability to obtain exposure to a unique asset class that helps solve a number of asset-liability challenges. In return for accepting some illiquidity, an investor can receive long-dated secure cashflows, inflation protection and a substantial increase in yield compared to government bonds. Through partnerships with established residential mortgage lenders, BlackRock is at the forefront of building portfolios that meet the cashflow characteristics required by investors through newly-originated whole mortgage loans. An additional advantage for some investors may be the social benefits that these products offer, for example through helping to finance retirement or enabling older homeowners to stay in their homes while unlocking stored equity value.

With the ability to capture an illiquidity premium, pension schemes, particularly those open to future accrual such as local government pension schemes, are best placed to take advantage of these opportunities. An investment in lifetime mortgages could not only help reduce the cost of providing benefits, but also provide cashflows that can be used to meet liability payments as they fall due.

Disclaimer

This material is for distribution to Professional Clients (as defined by the FCA Rules) and should not be relied upon by any other persons. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: 020 7743 3000. Registered in England No. 2020394. For your protection telephone calls are usually recorded. BlackRock is a trading name of BlackRock Investment Management (UK) Limited.

Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2015 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK, SO WHAT DO I DO WITH MY MONEY and the stylized i logo are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

UNLESS OTHERWISE STATED, ALL DATA ARE ACCURATE AS AT 17th Feb 2015. Cars IMPEG 0057

More Related Content...

|

|

|