Life after pooling

Written By:

|

Toby Nangle |

|

Moira Gorman |

Toby Nangle and Moira Gorman of Columbia Threadneedle Investments emphasise the importance of asset allocation in driving investor returns, and look at the different criteria for strategic asset allocation and dynamic allocation

Choosing a suitable asset allocation cannot be done passively. It is likely to be the biggest active decision any investor will make. It relies on actively determining three things:

i) The likely return of different asset classes

ii) The correlations of asset prices over the long term (for strategic asset allocation)

iii) The return and correlation of different asset classes over the shorter term (for dynamic asset allocation)

The importance of asset allocation in driving investor returns is well established. In 1986, Gary Brinson, Randolph Hood and Gilbert Beebower conducted a study to determine the effect of asset allocation on pension fund returns. Through reviewing the performance of 91 US pension funds between 1974 and 1983, they concluded that asset allocation was responsible for 93.6% of the variation in returns for these plans. Furthermore, in 2000, Ibbotson & Kaplan found that asset allocation accounted for close to 100% of the absolute level of returns. These statistics are important for local authorities to note; asset allocation decisions that remain with the authority will determine the success or otherwise of their fund.

When the 89 English and Welsh local authority pension funds implement their new “Super Pools”, economies of scale should reduce costs; larger pools of assets could also enable the use of more sophisticated strategies for hedging risks and managing liabilities. However, the asset allocation decisions will continue to be the responsibility of each individual administering authority, and they must be equipped to make these decisions.

Strategic asset allocation

In the 1950s, Harry Markowitz established “modern portfolio theory”, and with it the “efficient frontier” as a concept. An efficient frontier serves to show the highest expected return for a given level of risk, or the method of achieving the lowest level of risk for a specified return target. The construction of an expected efficient frontier is usually the first stage of strategic asset allocation.

Strategic asset allocation relies on the notion that asset price returns in different markets are not perfectly correlated, and that better risk-adjusted returns can therefore be achieved through investing in a combination of asset classes, rather than one asset class alone. By setting a given appetite for volatility associated with your funding target, you can choose a mix of assets that best places you to deliver returns. Alternatively, you can set a return target, and use strategic asset allocation to decide the least risky way to achieve that return.

In order to establish a strategic asset allocation you will need to forecast:

i) Long-run returns for assets

ii) The volatility of their returns

iii) The correlation of their returns

Typically this is done at a broad asset class level – with forecasts made for equity markets, bond markets, property, as well as commodities and other alternatives.

Forecasting market returns

Bonds

There is little mystery in forecasting bond market returns. Almost all of the return can (over the medium term) be calculated as a function of the starting yield. Further forecasting nuances associated with medium-term expectations regarding the appropriate “normal” rate of inflation and monetary policy can be added, which, when combined with a measure of interest rate sensitivity (duration), can lead to a forecast that has been more fine-tuned. Using the past performance of bonds to forecast future returns would be completely inappropriate. Following the 30-year bull run in bonds, yields today are low, and returns are therefore likely to be unspectacular in the future.

Equity

For equities, forecasting returns is more difficult. You need to estimate the future free cashflows and choose an appropriate method of valuation. Most models only work for distinct timeframes, but modelling is still worthwhile as it can provide an expected medium-term equity market return. Still, many opt to take a specific historic period and expect returns to repeat without any reference to current market valuations.

Other asset classes

Further forecasting is then required for any other asset classes in the prospective strategic asset allocation.

Constructing an efficient frontier

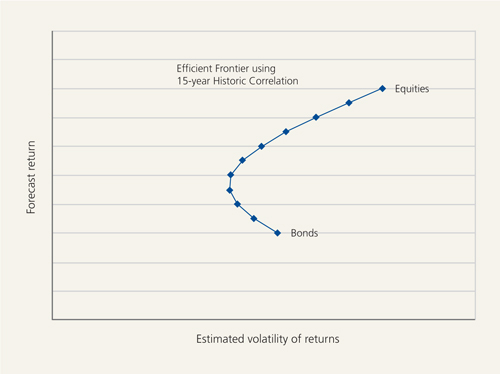

Along with forecasting total returns from fixed income and equities, strategic asset allocators typically then take historic trailing volatility and asset price correlation data to construct an efficient frontier, such as that in Figure 1 below.

Figure 1: Hypothetical efficient frontier for different mixtures of bonds and equities, using asset price correlations from 2000-2015

Source: Columbia Threadneedle Investments and Bank of America Merrill Lynch G5L0 index, February 2016

This efficient frontier shows the hypothetical potential returns attached to different combinations of bonds and equities on the vertical axis, with levels of volatility for these combinations shown on the x-axis, derived from historical asset volatility and asset correlations. The bend in the line is important as it illustrates the benefit of diversification: a portfolio consisting of both bonds and equities can be balanced to achieve a level of volatility equal to, or lower than, one consisting entirely of bonds, without compromising returns. This is because there has been a low or negative correlation between the two asset classes. In other words, their fluctuations cancel each other out to a degree.

Asset allocation in a changing world

Strategic asset allocation works best when volatility and correlations are stable. However, volatility itself is volatile. Pension funds seeking to maintain a given level of volatility could increase exposure to higher risk assets when volatility is low and reduce exposure when volatility increases. However, this could have the undesirable consequence that you buy when markets are high and sell when equity markets are depressed.

Asset price correlations also vary over time. During the global financial crisis for example, asset correlations converged as most of the perceived higher risk assets fell in value, reducing the benefits of diversification among risky assets. Certain investments did, however, provide protection, including government bonds, and commodities such as gold. More recently, quantitative easing has had an impact on correlations. Designed as it has been to influence financial conditions by directly targeting asset prices, it has had the effect of increasing asset prices across risky assets.

Labour markets can also affect market correlations, as they can lead to interest rate changes, which have an impact on the return from bonds. Labour markets look set to tighten again, driven by the world’s ageing population, the impact of China’s one-child policy and double digit wage growth in recent years. In such an environment, interest rates are likely to rise, putting further pressure on bonds. With yields already at supressed levels, bond market returns are likely to remain low over the next 20 years, and their correlation benefit is therefore likely to diminish – perhaps to post-war levels.

What this means for LGPS funds is that a set and forget strategy for their entire asset allocation, isn’t necessarily the optimal way to deliver appropriate risk-adjusted returns over the longer, or indeed medium to short term.

The options for implementing your asset allocation

Asset allocation is one of the most crucial decisions that local authorities pension funds will take, and the success or otherwise of the decision will largely determine the level and variability of returns enjoyed by each administering authority. For those authorities seeking to so do, active asset allocation can be deployed to target stronger risk-adjusted returns. There are three main options to incorporate active asset allocation within local authority funds under the new regime:

1. Manage the active asset allocation directly using in-house resources. This may suit schemes equipped with large internal resources of experienced investment personnel, but not all of the pools will have this type of resource.

2. Enter into a strategic relationship with professional active asset allocators to design and implement active asset allocation calls using units from the combined pool. This might involve agreeing to minimum exposure to certain asset classes and allocating percentages for managers to allocate actively. This may be difficult to implement in practice, as each participant in the pool retains individual risk and return target aspirations.

3. Allocate a portfolio of assets on a “go-anywhere” basis, as part of the strategic asset allocation. This approach recognises the individuality of each fund’s liability profile and plan for deficit reduction, while retaining the ability to seek strong risk-adjusted returns through dynamic asset allocation.

To re-iterate, there is no passive route around taking an active asset allocation decision for LGPS assets. Authorities can choose to take this active decision once every few years using strategic asset allocation as they currently do, however, they should not neglect the option of choosing to implement the decision dynamically and so respond to seismic developments in the global economy and the changing valuation of securities markets.

Dynamic asset allocation

In contrast to strategic asset allocation, dynamic allocation can be used to take advantage of shorter-term market movements. Exposure to different asset classes can be altered to take or avoid positions in attractive or unattractive markets, based on current economic conditions and market valuations.

The performance of different asset classes can vary significantly, even during years of muted overall returns. In 2015, for example, Japanese equities rose 16% while commodities declined 20%. To achieve strong risk-adjusted returns, you therefore need to have a dynamic asset allocation investment process in place to determine which asset classes will perform well, and which will perform poorly. Even those pools that retain in-house asset management capability may have to look elsewhere for the skill set required to successfully deliver dynamic asset allocation.

More Related Content...

|

|

|