Is your portfolio insured?

Written By:

|

Ani Markova |

Ani Markova of AGF Investments looks at the current position of the equity market, arguing that the purchase of gold can be an effective way of achieving portfolio insurance at discount prices

As many investors know, the summer months are a seasonally weak period for the precious metals space and this year is no exception. Since January of this year, the gold price has been range bound between $1,200-$1,300, with a correction of 6% in June and July, respectively. The gold stocks represented by the S&P/TSX Global Gold Index were also down 15% during this same June-July period, drifting in a sideways pattern.

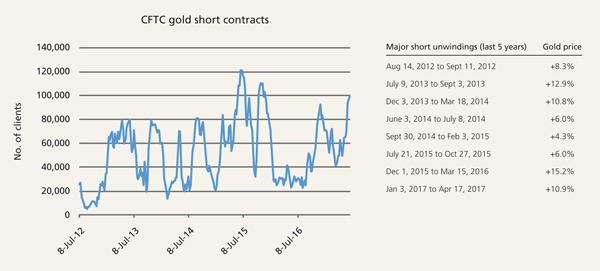

CFTC short positions are also approaching five-year highs, indicating a lack of investor conviction in the asset class. Historically, when short positions start to unwind, gold has rallied meaningfully (see Figure 1). It is our belief that in such periods of weakness it is important to take advantage of undervalued asset classes that can serve as portfolio insurance.

Figure 1: Gold performance when short positions begin to unwind

Source: Bloomberg, as of July 27, 2017

The constant turmoil and controversy at the White House and the inability of the Trump administration to attract political leadership and collaboration diminishes investors’ confidence of major fiscal policies being put forward at a time when central banks are starting to unwind stimulus and the global economy is showing signs of slowdown. Recently, the IMF revised its US growth rates down to 2.1% for 2017 (down 0.2%) and 2.1% for 2018 (down 0.4%), citing diminished fiscal policy expectations.1 In our view, equity markets are arguably stretched and without tax reform or nominal GDP growth to support earnings and valuations, we could potentially be faced with an equity market sell-off as a result of a business slowdown.

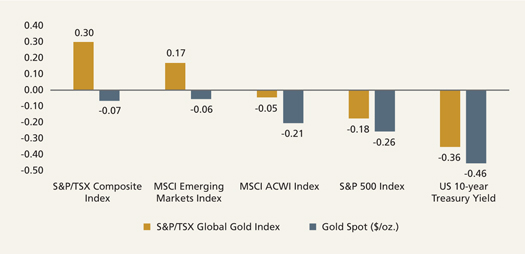

As the gold sector has effectively no correlation to the general equity market, investing in uncorrelated assets should bring better portfolio diversification. During such volatile times, it is our belief that gold and precious metals-related equities will be viewed as a safe-haven investment alternative.

Figure 2: 10-year monthly correlations, USD

Source: Bloomberg, for the 10-year period ending July 27, 2017

Gold sector valuation

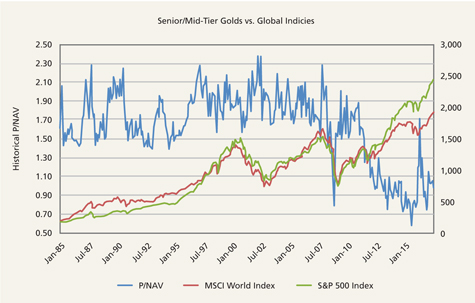

Gold companies have historically traded on a price-to-net asset value (P/NAV) basis. As seen in Figure 3, up until 2010, trading was within a range of 1.5x-2.5x P/NAV. Since then, there has been a compression in the valuations and it is now trading around or just below 1x P/NAV. Interestingly, the valuation compression occurred around the time when equity markets rallied and the central banks started expanding their balance sheets. If we were to witness a sustained drain of liquidity from the US Federal Reserve (Fed) and European Central Bank (ECB) balance sheet unwinding, that trade could unwind, and equity markets would likely enter a corrective phase. As a result, gold and precious metals could potentially see a rebound in valuations.

Figure 3: Price-to-NAV of gold companies vs. broader markets

Source: Scotia Capital, as of June 2017

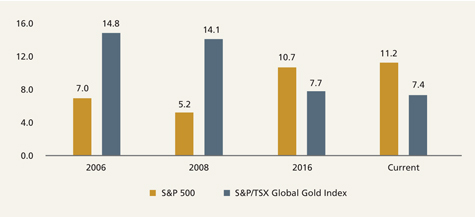

Comparing today’s valuation of the S&P 500 to the S&P/TSX Global Gold Index, the valuation of the equity market (11.2x P/EBITDA) is much higher than the gold sector (7.4x P/EBITDA).

Figure 4: Price-to-EBITDA ratios

Source: Bloomberg, as of July 27, 2017

How much gold should there be in a portfolio?

Historically, between 1-5% of investable assets have been allocated to gold. In an effort to illustrate gold’s risk reduction properties, the World Gold Council has suggested that a portfolio with an allocation of 5-6% to bullion outperformed a general portfolio by 735 basis points during tail-risk events such as Black Friday, the DotCom bubble, the terrorist attacks on September 11, 2001, the sovereign debt crisis, and others.2

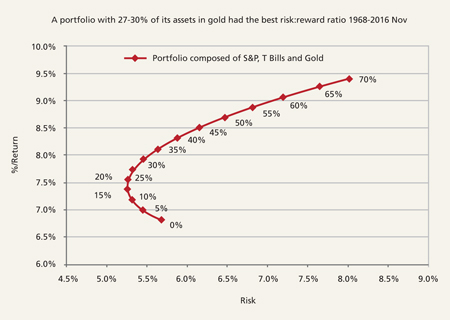

In a more recent study published by the CPI Group, a portfolio with 27-30% of its assets in gold had the best risk/reward characteristics over longer periods of time.3

Figure 5: Long-term efficient frontier of gold allocation

Source: CPI Group, as of December 2016

As this asset class is quite volatile, investors need to allocate an appropriate proportion to gold investments according to their investment horizons. However, having exposure to this asset class is warranted, as demand for the metal is expected to be driven mostly by its use as a safe haven asset, currency hedge and an alternative asset, with inflation hedge and wealth preservation characteristics.

What’s next

During its history, gold prices tend to be influenced by various factors. In the recent past, however, the bullion has been influenced by real rates (nominal interest rates minus some form of inflation). The biggest threat to the gold trade is rising long-term real rates, which is possible on the back of the unwinding of Fed and ECB balance sheets. The economic risk, however, is that rising cost of capital stalls the already fragile economic expansion, causing slowdowns or recessions.

Without strong signs of inflation such as we are witnessing today, we believe it is likely that the Fed could alter their tightening cycle if economic softness persists. If such action were to transpire, the gold price should react positively as the USD softens. Another consideration is that in 2018, the Fed will have new leadership and it is uncertain which direction the central bank will take.

Trade wars are another risk to the economic landscape. As we witness the lack of results from high-level economic talks between China and the US, there is a material risk that the Trump administration will feel pressure to switch to confrontation, rather than cooperation, to solve the US$347 billion trade deficit with China – raising geopolitical tensions around the world even further.

Conclusion

In our view, the summer doldrums are a good time for investors to purchase portfolio insurance at discount prices. We expect investors’ interest to return to the precious metals space in the autumn as we get closer to US debt ceiling negotiations and we gain a clearer picture of the Trump budget proposal. If the US GDP is unable to grow above 3% over the next 10 years, budget deficits will add to the overall US debt, which currently stands at US$19 trillion,4 eroding the value of the USD and the confidence of it being a reserve currency. In such an environment, gold is likely to shine again.

Important information

The commentaries contained herein are provided as a general source of information based on information available as of July 27, 2017 and should not be considered as personal investment advice or an offer or solicitation to buy and / or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), Highstreet Asset Management Inc. (Highstreet), AGF Asset Management (Asia) Limited (AGF AM Asia) and AGF International Advisors Company Limited (AGFIA).

AGFA is a registered advisor in the U.S. AGFI and Highstreet are registered as portfolio managers across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

Conflicts of Interest & Share Ownership Policy

AGF International Advisors Company Ltd., its employees, directors or related companies, may have a shareholding / be a director in the securities (or related investments/ derivatives) of certain companies covered in this report, or may provide/ solicit investment banking or other services to/ from them. It is noted that the Institutional Sales Representatives compensation is impacted upon by overall firm profitability and accordingly may be affected to some extent by revenues arising other AGF business units including AGF Investments Inc. and InstarAGF Asset Management Inc. Notwithstanding, AGF International Advisors Company Ltd. is satisfied that the objectivity of views and recommendations contained in this report has not been compromised.

AGF International Advisors Company Ltd. is authorized by the Central Bank of Ireland, in Ireland, and is regulated by the Central Bank of Ireland for conduct of business rules in Ireland, and regulated by the FCA for conduct of business rules in the U.K.

August 2, 2017. This document is for use by accredited investors only.

1. IMF World Economic Outlook Update, July 2017

2. World Gold Council – Gold Investor, Risk Management & Capital Preservation, March 2014

3. CPM Group, “Gold Yearbook 2017”, March 2017

4. U.S. Treasury Total Public Debt Outstanding. Source: Bloomberg, as of July 27, 2017

More Related Content...

|

|

|