Investing in the UK’s private rented sector

Written By:

|

Julian Agnew |

|

Andrew Stanford |

Julian Agnew and Andrew Stanford of LaSalle Investment Management examine the investment potential of the private residential property sector arguing that it merits a place in a balanced and diversified pension fund property portfolio

At a time when English and Welsh Local Authority Pension Funds are contemplating life as part of a pool, potentially offering the opportunity to broaden their investment universe, we are making the case for investing in the UK private residential sector (PRS). Long considered alternative and “too difficult” by institutions in comparison to the established retail, office and industrial sectors of commercial property, we believe that there is a strong investment rationale for including a greater element of residential property in portfolios. That case extends beyond London where the opportunity for investing in a national strategy is compelling.

The investment opportunity

The sector has a place in a balanced diversified investment or a pooled portfolio, given its low historical correlation with other asset classes and the potential to deliver attractive risk-adjusted real returns.

At a time of heightened uncertainty as Brexit negotiations continue, PRS is backed by strong market and demographic fundamentals, a longstanding supply and demand imbalance and, more recently, broad government support to its development as a sector for institutional investors.

It is widely recognised that the UK has a long-term housing shortage, which has persisted for over 40 years. This lack of supply has caused house price growth to exceed general price inflation by 2.7% p.a. since 1970, in comparison with commercial property whose income yield is higher but whose capital value has on average undershot inflation by 1.6% p.a. It is also part of the reason why previous cyclical downturns have been short-lived, especially when compared to the commercial real estate market.

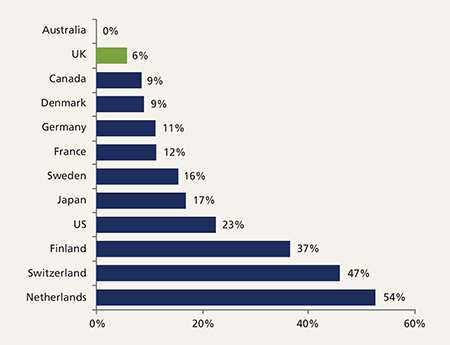

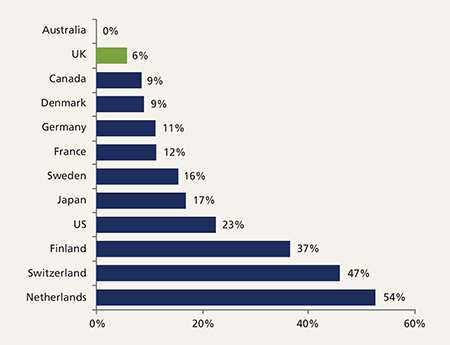

The UK is viewed by many international investors as having one of the most developed real estate markets globally. Given that the residential sector is a significant part of most developed countries’ institutional investment universe (see Figure 1) and given the momentum building within the UK’s PRS “build-to-rent” sector (as it has become known), there is potential for UK residential investment to form an increasing proportion of institutional real estate portfolios.

Figure 1: Residential as a % of institutional real estate portfolios

Source: LaSalle MSCI/IPD

That momentum has carried the build-to-rent sector beyond its nascent phase to the extent that the British Property Federation reports that there are now nearly 84,000 build-to-rent units either completed or planned across the UK, many of which have been specifically designed for long-term rent. There are also many build-to-rent schemes in the letting-up phase that have either achieved stabilisation or are rapidly approaching it.

Matching this momentum is the speed at which the property management sector is evolving to meet the needs of institutional build-to-rent investors. Before the sector gathered pace, property managers tended to focus their energies on the more abundant buy-to-let landlord whose needs were markedly different.

The sector has grown significantly since 1997 and now comprises 20% of the housing stock. The vast majority of this growth has come from private individuals deciding to become “buy-to-let” landlords often owning only one property. Landlords who own only a single property hold 40% of the PRS stock and just 8% describe themselves as full-time landlords. Thus, the market is highly fragmented.

The government is phasing out buy-to-let mortgage tax relief for higher rate taxpayers, and the Bank of England is increasing its regulation of the buy-to-let mortgage market. There is therefore the possibility of fewer buy-to-let landlords in the market. For example, the Council of Mortgage Lenders reported in June 2017 that the sector’s contribution to net mortgage lending had fallen considerably since 2016 and fewer buy-to-let landlords are releasing equity when they refinance.

Despite the lack of institutional investment, residential property has outperformed commercial property and the other main asset classes (except for equities) over the long term. These returns have been achieved with both lower volatility and low correlations versus other UK asset classes. As a result, residential can play a valuable role in a multi-asset portfolio (see Figure 2).

Figure 2: Residential property outperforming commercial property and other main asset classes (except equities)

*Unsmoothed, or 7.2% smoothed

UK Residential Returns based on Nationwide House Price Index plus long-run income return of 3.4% from MSCI IPD Residential

Sources: LaSalle, MSCI IPD, Thomson Reuters, Nationwide (2016)

Location, market and asset dynamics

Demographics, Technology, Urbanisation and Environmental Change (DTU+E) are themes that have the potential to drive performance over the long term. Consequently, they should form an integral part of the PRS asset selection and portfolio management process as they also help to drive strategy execution.

From a demographics perspective, a careful assessment should be made as to whether an asset will, or can be made to, appeal to the investment strategy’s target renter. It is therefore necessary to have a deep understanding of where millennials and other non-home owners wish to live, work and play to avoid acquiring an asset in a stagnant location, or building an asset which is not future-proofed in terms of unit size and amenities.

Environmental, social and governance factors should also be assessed. For example, reviewing how best to improve customer health, well-being and happiness and assessing potential adjustments to the design of the asset and management regime are critical to a PRS scheme’s success.

Technology provides great opportunity but it also presents challenges for a long-term investor. For example, the options for super connectivity technology to be woven into the asset’s fabric for the benefit of customers need to be reviewed and implemented with a view to future-proofing. Flexibility is also key to future-proofing; for example, there may be no need to construct drone-sized delivery balconies if 3D printing renders such drones redundant over the longer term.

When considering urbanisation, is there a chronic lack of supply of PRS accommodation in places where the target renter wants to live, namely in central locations? Or can the investor influence game-changing infrastructure in the local or wider vicinity to accelerate performance over the longer term? In further considering where best to build a PRS portfolio, the prospects for London’s economy and its PRS market are undeniably attractive. Key indicators from independent sources support this argument. However, focusing on London alone would be to the detriment of many regional hotspots which deserve equal scrutiny and have attractive characteristics of their own.

Examining the ratio of house prices in London versus the UK average shows how the spread between the two has been steadily rising over time. More relevant than the ratio itself, however, is how far the ratio currently deviates from its long-term trend as this will likely have more influence on growth rates over the next 10 years. This indicates the potential for a slowdown in London and/or a catch up in the regions as demand shifts from the capital and helps to support a national PRS investment strategy. That potential is supported by the July 2017 edition of the RICS residential survey which reported continuing price falls in London and the South East whilst house prices were reported to remain quite firmly on an upward trend in some areas led by the West Midlands and the South West.

Conclusion

In a post Brexit environment, the macro-fundamentals supporting UK PRS investment will continue and the opportunity for investing in a national strategy, which includes London, remains; any liquidity concerns at these early stages of the build-to-rent sector’s development should be negated by its rapid growth and strong interest from institutions. As a result, the sector has a place in a balanced diversified pension fund property portfolio or a large pooled property vehicle.

More Related Content...

|

|

|